#57 - The art of investing with Preston Pysh and much more!

🎙️ The art of investing with Preston Pysh

Preston Pysh is an entrepreneur, engineer, financial expert, podcaster, former military man, bestselling author, and has been awarded the bronze star in combat while commanding an attack helicopter company with the 101st Airborne Division.

Preston hosts one of the top-ranked investing podcasts on Apple Podcasts, We Study Billionaires, with more than 95 million downloads. He's written numerous books on investing and leadership and also provides independent research of the stock market and central banking policy.

As the Founder and President of the Pylon Holding Company, he specializes in the acquisition of private and public companies. He has a B.S. in Aerospace Engineering from West Point and is a Postgraduate Candidate at the Johns Hopkins Carey Business School in Baltimore, Maryland.

Last but not least, Preston is a man of taste 🥰

Has anyone played around with this? Looks crazy… https://t.co/HysQ0cfQvv

— Preston Pysh (@PrestonPysh) December 3, 2021

Preston's presence in this humble newsletter is an honor, and we warmly thank him for his time.

What does your military experience bring to your investing skills?

Preston Pysh: Patience. In the military there’s a saying that everything is “hurry-up and wait.”

When it comes to investing, I’ve found that the best strategy is to find something of tremendous value, continue to buy more proportional ownership over time, and then let the market do the rest.

I know Charlie Munger isn’t really popular in the Bitcoin space, but he has a funny and pertinent quote here. He says, “Don’t just do something, stand there”. The fallacy that a lot of beginners have in investing is they feel like if they aren’t doing something (trading-wise), then they’ll be left behind. So they over-trade, and as a result, realize an enormous frictional burden called capital gains tax.

I would argue great investors really do the opposite, they focus on the big trends, study the hell out of who/what is going to dominate that space, they don’t take their eye off the ball, and then they just keep accumulating a bigger position.

You could be described as a "macro guy". How do you feel about the world's current events?

Preston Pysh: That’s funny because if you would have said that to me ten years ago I would have told you I was a micro guy. One of the reasons I’ve become a macro guy is because I was forced to.

As a value investor, it was becoming more evident that the methods for calculating intrinsic value weren’t working or weren’t reliable while using a unit of account that was so manipulated. At the core of value investing is a fundamental assumption (that no one ever talks about), and that assumption is you’re doing calculations with sound money.

Without sound money you have no basis for risk free rates.

About 8 years ago it became evident to me that the risk free rates in sovereign bonds were manipulated, thus making my ability to conduct internal rate of return calculations for equities less reliable - especially if intending to hold the equities for a long period of time (10+ years). When I look at the macro trends in late 2022, it’s absurdly worse than 2015.

Today, you literally have a global sovereign bond market, for most developed nations, that’s on the cusp of failure.

I don't say that to capture a salacious headline, it’s just math. At the most basic level, bonds need to provide a yield premium above inflation (and equities a premium above those bonds), and when I look at the hundreds of trillions in bonds around the world, none of them are currently providing a positive spread above inflation.

So when I look at the current events around the world: Grossly misaligned energy independence in Europe and Japan, BRICs countries unwilling to accept Western Nation fiat in exchange for raw commodities, US & China chip manufacturing concerns, etc. it demonstrates an erosion of trust. When trust and cooperation decline, prices go up. This is something the global credit markets were not priced for. This battle of net producers delivering raw materials to net consumers that demand settlement in THEIR fake paper fiat is the crux of the global macro situation.

How should an investor position himself in such a situation?

Preston Pysh: It’s really straightforward. Start with the last sentence from the previous answer: “this battle of net producers delivering raw materials to net consumers that demand settlement in THEIR fake paper fiat is the crux of the global macro situation”. If this is true, then a new settlement layer is needed - and needed for the entire planet.

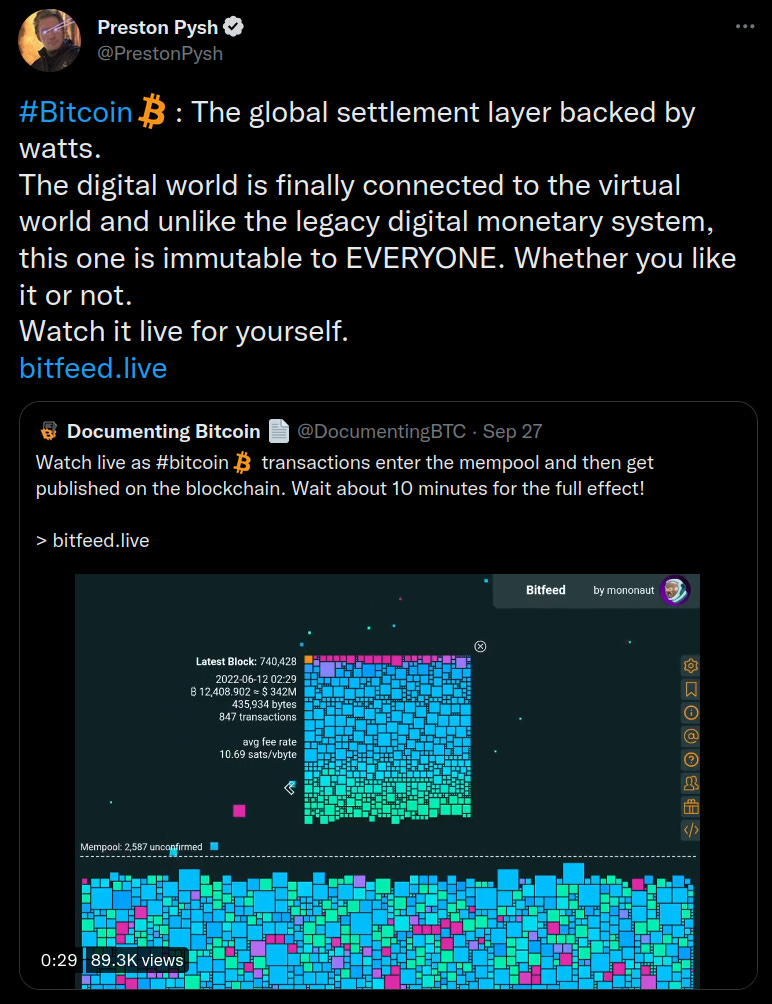

If that settlement layer is decentralized, unmanipulatable, scarce, tethered to energy, instantly salable, near zero cost to store and transfer, then it provides tremendous value to global participants. So, obviously, that’s Bitcoin.

What else will perform? Well, I would suggest that equity that retains its competitive advantage through such a global currency reset would perform, um, ok.

The real challenge in identifying other assets to own is that when a currency fails, the credit markets that are denominated in the failing currency are antithetical prior to the unwind. This is because they are capitalized at extremely high multiples relative to their expected coupons versus the systemic risk that’s inherent in the system for imminent debasement. This in turn, also causes the equity market to also be capitalized at extreme levels that don’t account for the systemic risk in the overall system. As a result, owning equity can help preserve the loss of buying power, but in comparison to the new currency units, it’ll be difficult to outperform.

Always remember, price is what you pay, but value is what you get.

That saying is especially true if you’re valuing equity with a unit of account that’s about to be extinct - it’s warping your ability to conduct economic calculation sanely. This will be wildly unpopular for most individuals because it will over-concentrate their portfolio, and for many, they’ll lack conviction in knowing “what exactly is coming next.”

You speak with the foremost experts in business and Bitcoin. What are the key things you learned?

Preston Pysh: a) Question everything. Just because someones an expert, doesn’t mean there can’t be mistakes in their logic. To get to the crux of their critical thinking ask why five times and drill into the fundamentals.

b) Never stop learning. You’ve got to read as much as you can get your hands-on and try to consume content and ideas that are contrary to your own preconceived beliefs or models.

c) Humility is vital. You can’t think clearly and make sound efficient decisions if you’re clouded by hubris. When you find a person that lacks humility, it’s almost always rooted in some deep seated insecurity that’s not evident on the surface. Some of the greatest thinkers and investors that I’ve interviewed are extremely humble individuals that listen way more than they pontificate.

Which Bitcoin features intrigue you the most?

Preston Pysh: Security. Security. Security. At the end of the day, the money protocol that will win is the one that can absorb hundreds of trillions in buying power without being compromised. At the base layer of global settlement is buying power that doesn’t need to move at a high frequency, it’s money that needs to be secured from government debasement and manipulation.

This is a must listen show w/ @JasonPLowery. He does an amazing job at first principles thinking when it comes to the security ramifications of Proof of Work (#Bitcoin) versus Proof of Stake protocols. Be sure to share with your friends and let us know what you think. https://t.co/zchNPGLn1W

— Preston Pysh (@PrestonPysh) October 5, 2022

People suggesting it needs to move fast or do twenty different swoopty things are probably letting their myopic personal views of how they wish the world worked, cloud their understanding of how the world actually works.

What’s your view on tokens on Lighting?

Preston Pysh: I think the tokenization of equity and other non-fungible coupons is an interesting idea that can potentially democratize equity and credit ownership around the world.

The problem that many in the VC space fail to discuss when pumping the marketing around this topic is securities on a blockchain still have ties to government intervention and abstract power hierarchies.

For example, let’s say Apple stock could be tokenized and put on the lightning network so a person in the country of Turkmenistan could procure it, instantly, and without an intermediary to clear the certificate/token. That stock certificate, which I would describe as having real world value (unlike most tokens we’ve seen to date), has ties to abstract power like the SEC, security councils that might not like equity ownership of said company in certain jurisdictions, the company board deciding to stop making dividend payments, etc. So a person needs to ask themselves, if abstract power is still involved, what’s the actual value-add of having the token on lightning (or any blockchain for that matter)?

To this, I would suggest it provides a couple advantages. First, it potentially prevents the rehypothecation of stock certificates (assuming it wouldn’t use multiple forms of stock issuance across legacy system and blockchain based systems - which may take a long time to ever establish). Second, it opens-up ownership to a much wider global audience (pending any abstract power objections). Third, it could turn the securities market into a 24 hour 365 a day place to more seamless price risk and return for all participants.

By tokenizing securities, they can potentially be used for all sorts of activities in cyberspace, but, and this is a huge but, people must never forget they are only as secure as the abstract power structure that can always influence and control it.

This is an important consideration because it’s very different from Bitcoin in what it potentially could provide as a value proposition.

You are an avid reader. What are the top five books you would recommend?

Preston Pysh:

Superforecasting by Philip Tetlock and Dan Gardner

Basic Economics by Thomas Sowell

This Time is Different by Carmen Reinhard and Kenneth Rogoff

Shoe Dog by Phil Knight

- Hedge Fund Market Wizards by Jack Schwager

How do you see Bitcoin in 10 years?

Preston Pysh: I see it as the global settlement layer in which all tangible and intangible goods are valued (akin to how the US dollar is used today, but with exceedingly better implementation). It will also naturally incentivize global cooperation and the optimization of natural resources to deserving consumers (which may take more than 10 years from 2022).

⚽ The FIFA World Cup 2022 is approaching quickly (20 November – 18 December). We are pleased to support a betting competition for the World Cup with 6 million Sat rewards that was started by the top German-language Bitcoin podcast Einundzwanzig.

Each participant must pay a 50,000 sats invoice to register and all these sats will be sent to Bitcoin Ekasi. The more players, the more sats they get! More than a hundred people have already signed up

Join us and have fun while helping establish a Bitcoin-based economy in a South African township! How can you join us?

Visit https://www.kicktipp.co.uk/lnmarketsworldcup/ to sign up.

The platform is available in 8 languages, you may select your preferred one here. Select: "Become a member". You will receive an e-mail back from the organisers asking you to pay a Lightning Invoice of 50,000 sats. As soon as payment is received, your account will be activated for making your bets. Please don't be alarmed if it takes a few hours.

The prize's breakdown, which is 6 million sats, is as follows:

🥇 1st place: 3 million sats

🥈 2nd place: 1.5 million sats

🥉 3rd place: 0.5 million sats

🏅 4-13th place: 0.1 million sats

🌱 Latest Strikes

A brief recap of what’s new in the Lightning world (full version here).

Ecosystem

Developer Grants

This week we saw two new grants going to Lightning builders!

- Superlunar issued a grant to Dusty Daemin to support his work on Lightning, and notably splicing.

- Okcoin is now sponsoring Johns Beharry’s work of promoting Lightning projects and experiments through BoltFun.

Legends Of Lightning Update

Speaking of BoltFun, I thought it would be interesting to see how the LegendsOfLightning tournament has evolved since we last took a look. There are now 25 different projects competing, and each of them is sharing their story along the way! Go take a look!

TabConf 2022

Seems like TabConf was lit! 🔥

yep, @tabconf was *def* the best #bitcoin dev conf I've been to in years 😭

— Olaoluwa Osuntokun (@roasbeef) October 18, 2022

if you develop any sort of Bitcoin software n didn't go, you should be feeling a tremendous amount of FOMO, self-doubt, and inadequacy

but ofc, don't be too hard on yourself, there's always next year!

André Neves gave the keynote, detailing how Bitcoin can thrive through developer education, mainstream adoption and open source software, and what they’re doing at Zebedee and NBD.

There was also a cool presentation on where we’re at with Eltoo.

⚡ Bonus

👀 Probably nothing

You can now receive #bitcoin instantly via the Lightning Network in @CashApp! ⚡

— Michael Rihani⚡️ (@MichaelRihani) October 25, 2022

- Open Cash App

- Money tab -> Bitcoin

- Share QR code or link

What do you think?

Try it by sharing your link below 👇 pic.twitter.com/rg1BbzyLMB

Introducing Wolf: The first startup accelerator focused exclusively on lightning ⚡️. Learn more or apply at https://t.co/MC9fJATOt4 #Bitcoin #Lightning pic.twitter.com/2vQ7SoMheI

— 🐺 Wolf ⚡ (@_WolfNYC) October 26, 2022

😏 Makes sense

CBDCs are a solution to a problem

— Joe Weisenthal (@TheStalwart) October 26, 2022

(The problem being technocrats at central banks wanting to get invited to panels about the future of finance) https://t.co/SZmWyf3uwV

🤯 Pure alpha

Here's a lookback at how Bitcoin has reacted to McDonald's McRib launches. They just announced it again yesterday.

— Zack Voell (@zackvoell) October 25, 2022

And you're bearish? pic.twitter.com/nZNwLyuCuv

🤝 Reach out on Twitter, Telegram and Discord to build together the future of finance on Bitcoin!

💡 Any suggestion to improve LN Markets? Please share it here.