LN Markets Alpha #1

Overview

• In the short-term, our outlook on the market remains neutral, with $40K-42K as our bullish target, and $32K as the bearish one.

• Utilizing options presents an effective strategy to maintain exposure to significant events, like an ETF approval, without overly committing to a Bitcoin market that appears somewhat overbought.

• Over the medium to long term, an array of elements aligns to create a decidedly bullish scenario for Bitcoin.

• On-chain metrics suggest an impending supply squeeze, potentially triggering further upward movement in price.

Short-Term Analysis

According to the Fear & Greed Index, sentiment towards Bitcoin is predominantly bullish. At the close of September and into Uptober, Bitcoin experienced a formidable 48% surge from a local trough of approximately $25,000 to crest at around $37,000, all without any significant retracements.

It's noteworthy that Bitcoin initially eclipsed the performance of other major cryptocurrencies during this surge, a sign typically indicative of a young upward trend. Of late, we've observed 'altcoins' beginning to accumulate momentum. This shift can often be ascribed to traders reallocating profits from Bitcoin into these altcoins or attempting to recoup from missing the earlier rally. Momentum traders chasing the price and FOMOing into shitcoins could be indicative of a temporary overheated market.

In shorter timeframes, Bitcoin broke the ascending parallel channel to the upside while the Relative Strength Index (RSI) is normalizing. This pattern suggests that for the moment any drops are met with considerable buying interest.

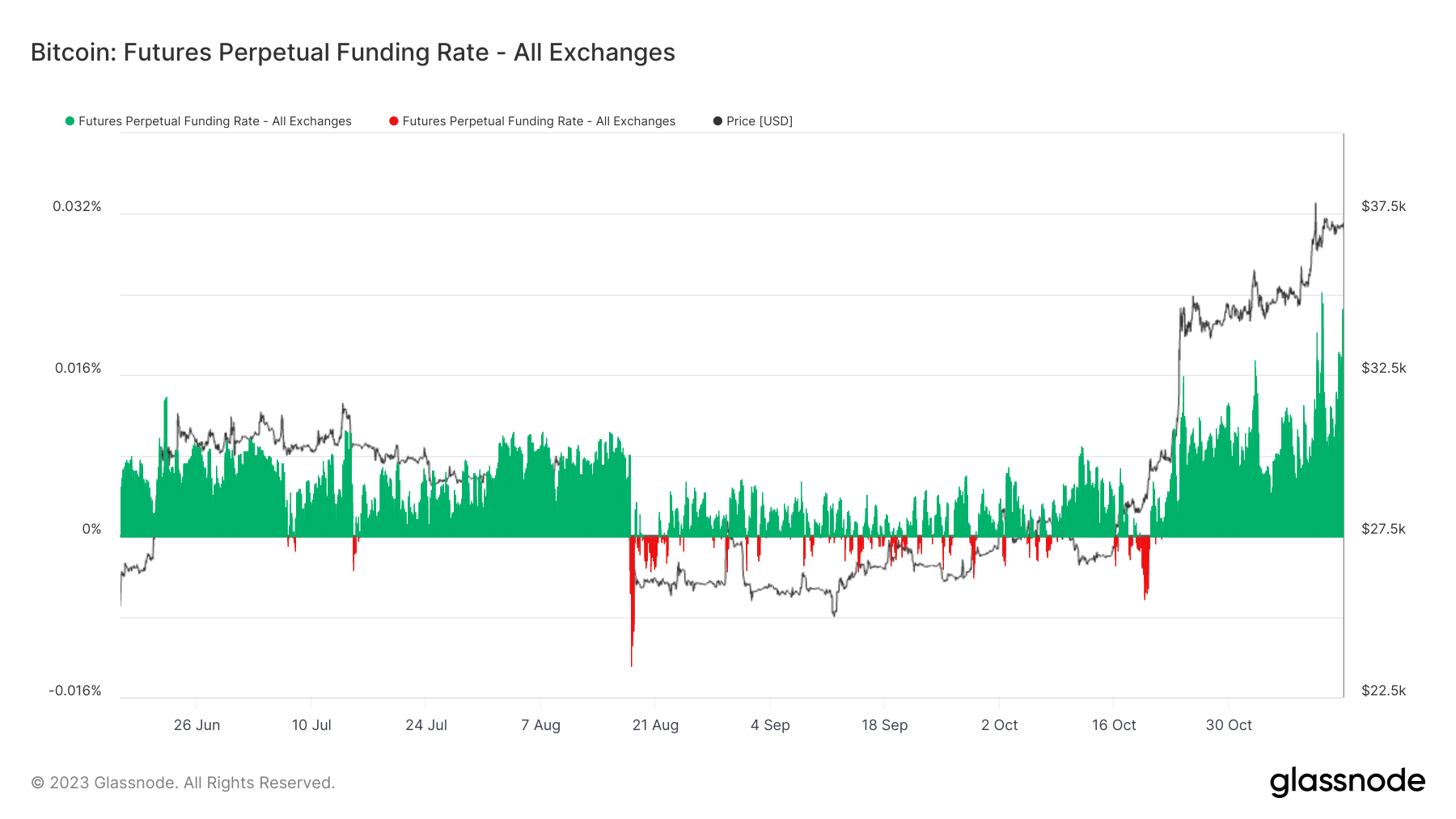

Nonetheless, given the heightened market sentiment, the accumulation of leveraged long positions (see funding rate chart below), and the daily RSI hovering at overbought territory, prudence is advised.

We currently sit at the 0.618 fib retracement level from the preceding bull market, eyeing the $40-42K zone. The price range of $31.8K to $33.4K has seen little activity since the summer of 2021, and the $30-31.8K bracket has served as a resistance band over the past three months. From a technical analysis standpoint alone, it is difficult to develop strong conviction: Bitcoin may retest the pivotal $32K mark (red line) to establish support before potentially climbing towards the $40K-$42K range (green line), or do the reverse.

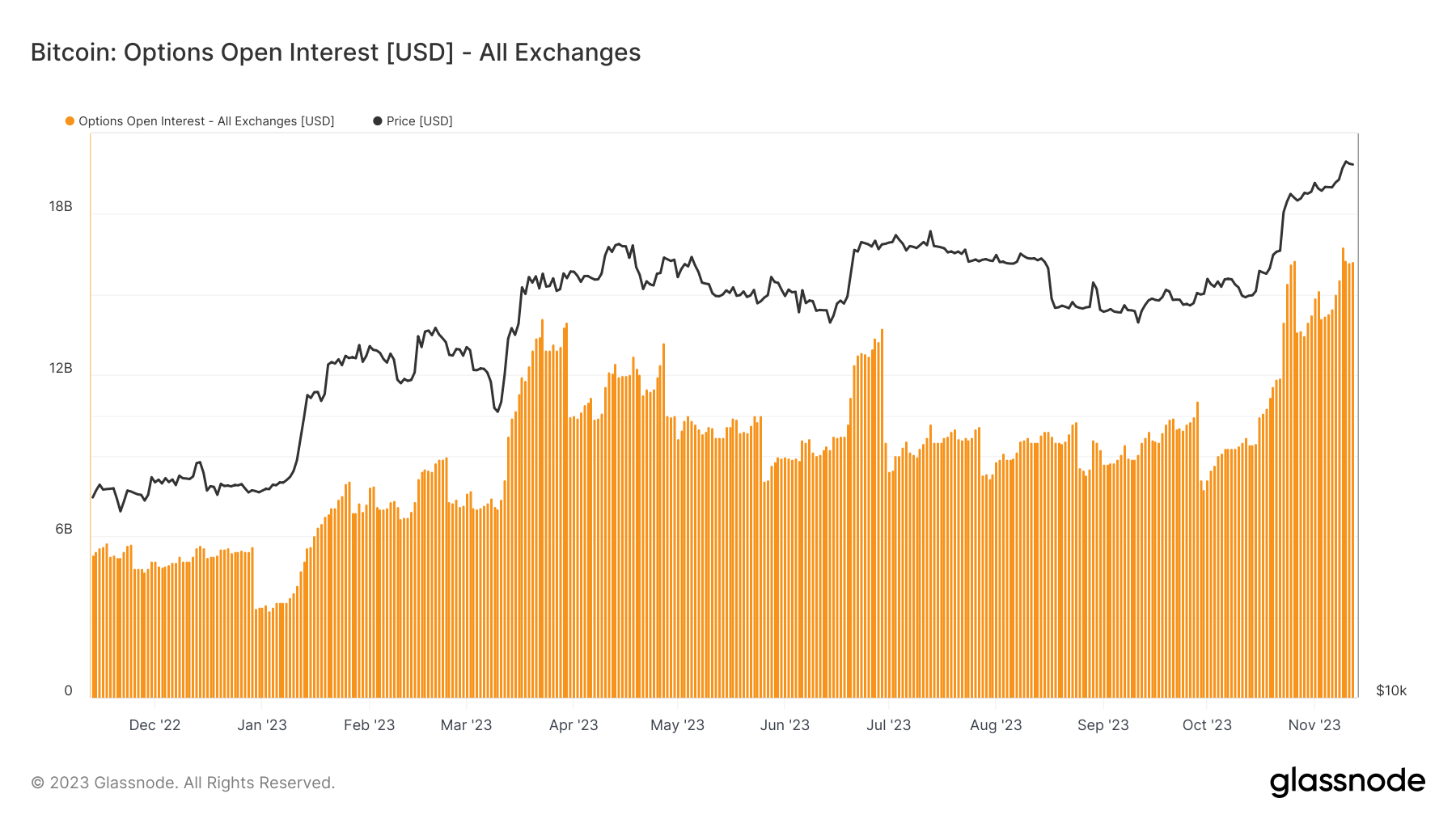

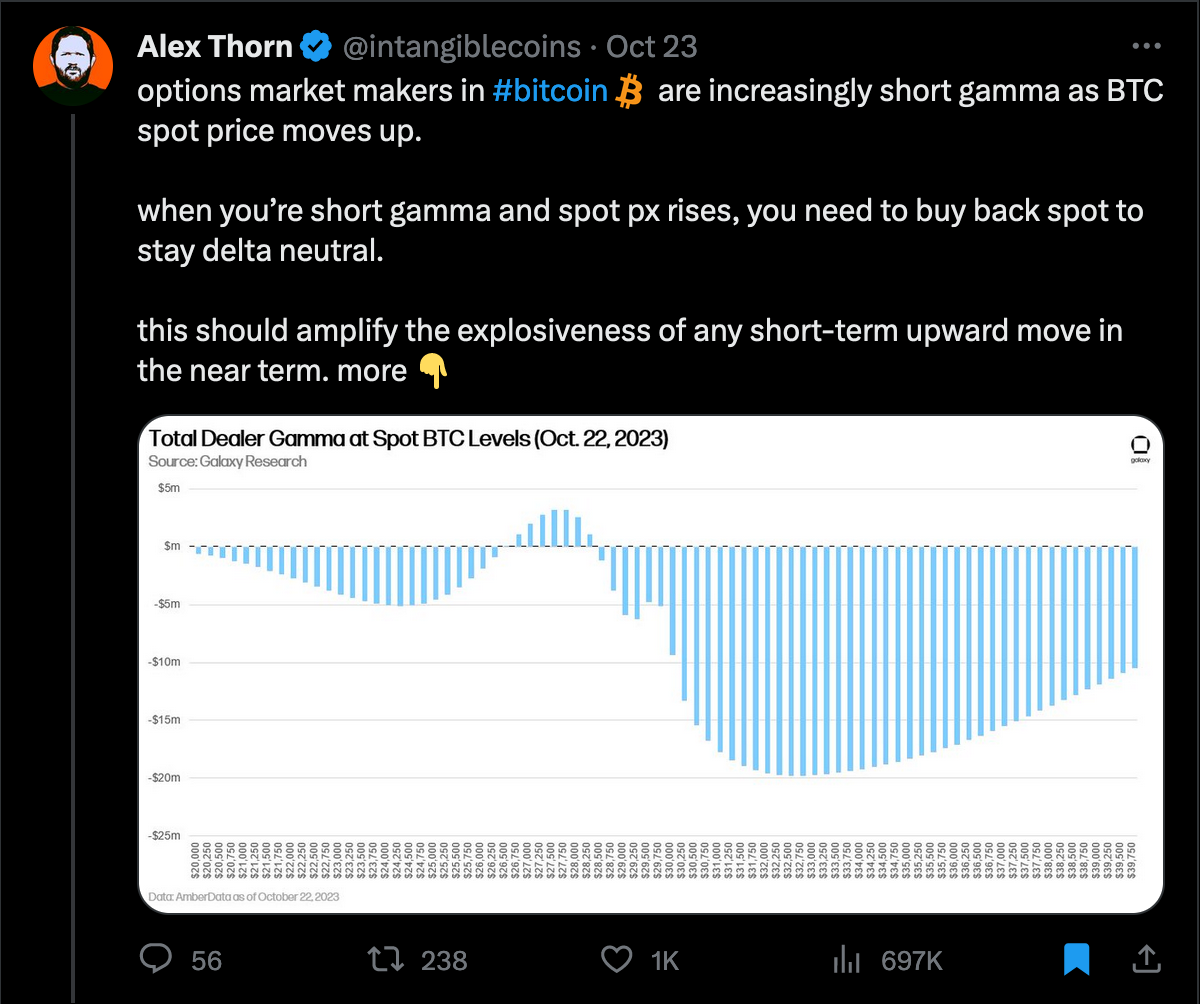

Bitcoin next trend could well boil down to option dealers' positioning. Options volume and Open Interest have skyrocketed since beginning of 2023 and now affect bitcoin price dynamics more than ever before.

At the beginning of October, Alex Thorn from Galaxy Digital pointed out that option dealers were increasingly short gamma, i.e. would need to buy bitcoin spot as price move higher to remain hedged. Shortly after Thorn's tweet, bitcoin smashed the $32K resistance and climbed seamlessly to the $34K zone.

Medium/Long-Term Analysis

Despite the ambiguous short-term price activity, our conviction in a long-term upward trend remains firm.

There are 3 principal indicators that bolster our prediction for sustained growth:

1) A robust belief in the likelihood of spot ETFs receiving approval by the end of January 2024.

2) The heightened volatility across other asset classes amidst the current geopolitical and macroeconomic turmoil.

3) On-chain data reveals a dearth of short-term sellers.

1. Spot ETF Approval

The optimism among analysts for a SEC-approved Bitcoin spot ETF before the end of January reaches a new ATH. This confidence is partially rooted in the regulator's recent legal setback against Grayscale in front of the D.C. Circuit Court of Appeals, where their rationale for denying such ETFs was deemed "insufficient"[i]. To further delay approval, the SEC would have to come up with fresh arguments, which could prove almost impossible as they already vetted similar products in the past (e.g. GLD) and shakier similar products such as Bitcoin future ETFs.

With powerful financial institutions, such as BlackRock, Fidelity, WisdomTree, or ARK, lobbying for these ETFs, approval seems not just probable but also potentially close at hand.

Forecasts for the inflow of capital that could be catalyzed by the approval of a spot Bitcoin ETF vary considerably, ranging from a conservative $14 billion[ii] to an ambitious $150-$200 billion over three years for BlackRock’s product only[iii]. In the context of Bitcoin spot market, even the pessimistic estimate would represent spot demand equivalent to 4-5 Michael Saylor!

Such capital inflows would not only be significant in absolute terms but also in their timing, arriving shortly before the Bitcoin halving, where the rate of new Bitcoin creation halves, further constraining supply. The likely scenario is a substantial bullish impact on Bitcoin’s price due to the entry of fresh capital into a market characterized by inelastic supply and a holder base with little interest in selling.

2. The Sovereign Debt Crisis

The U.S. is currently facing a precarious balancing act with its monetary and fiscal policies - or what macro analyst Luke Gromen calls “riding two horses with one ass”. On one hand, rapid interest rate hikes have been implemented to control inflation, but this has precipitated unintended consequences, such as banking sector stress and a debt service dilemma for sovereign issuers. Besides, banks are in the business of borrowing short-term to lend long-term, so an inverted yield curve erodes their operational margin.

In response to these financial pressures, the U.S. Federal Reserve has introduced the Bank Term Funding Program (BTFP), which allows banks to borrow against the nominal value of their treasury holdings, even if the market value of these securities has significantly declined – “BTFD” would have been a more appropriate name. This policy effectively prints money to maintain bank liquidity, contrasting starkly with the Fed's tightening measures.

Another side effect of the rate hikes is that the market value of the long-dated debt instruments these banks hold in size cratered. Over the past decade, we have been told repeatedly that Treasuries are the safest asset and Bitcoin is too volatile to be considered a serious investment option. Yet, top to bottom, TLT, the ETF tracking the performance of long-dated US treasuries, is down slightly more than Bitcoin.

For investors in fixed-income securities, this scenario poses a double-bind: they face potential nominal losses if interest rates continue to rise or erosion in real value if inflation persists.

3. On-Chain Data

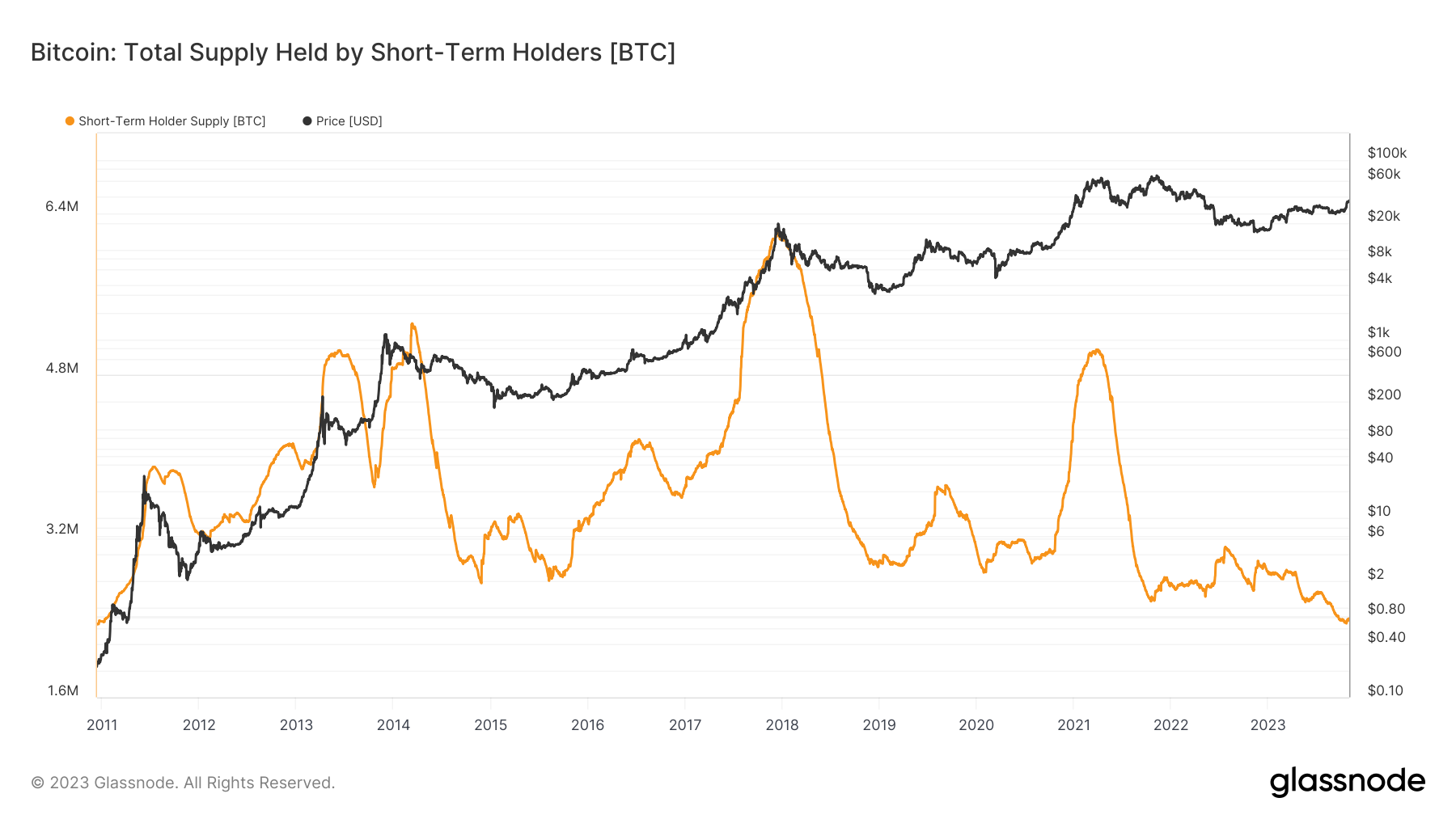

The on-chain data provide compelling evidence that the stage is set for a Bitcoin supply crunch.

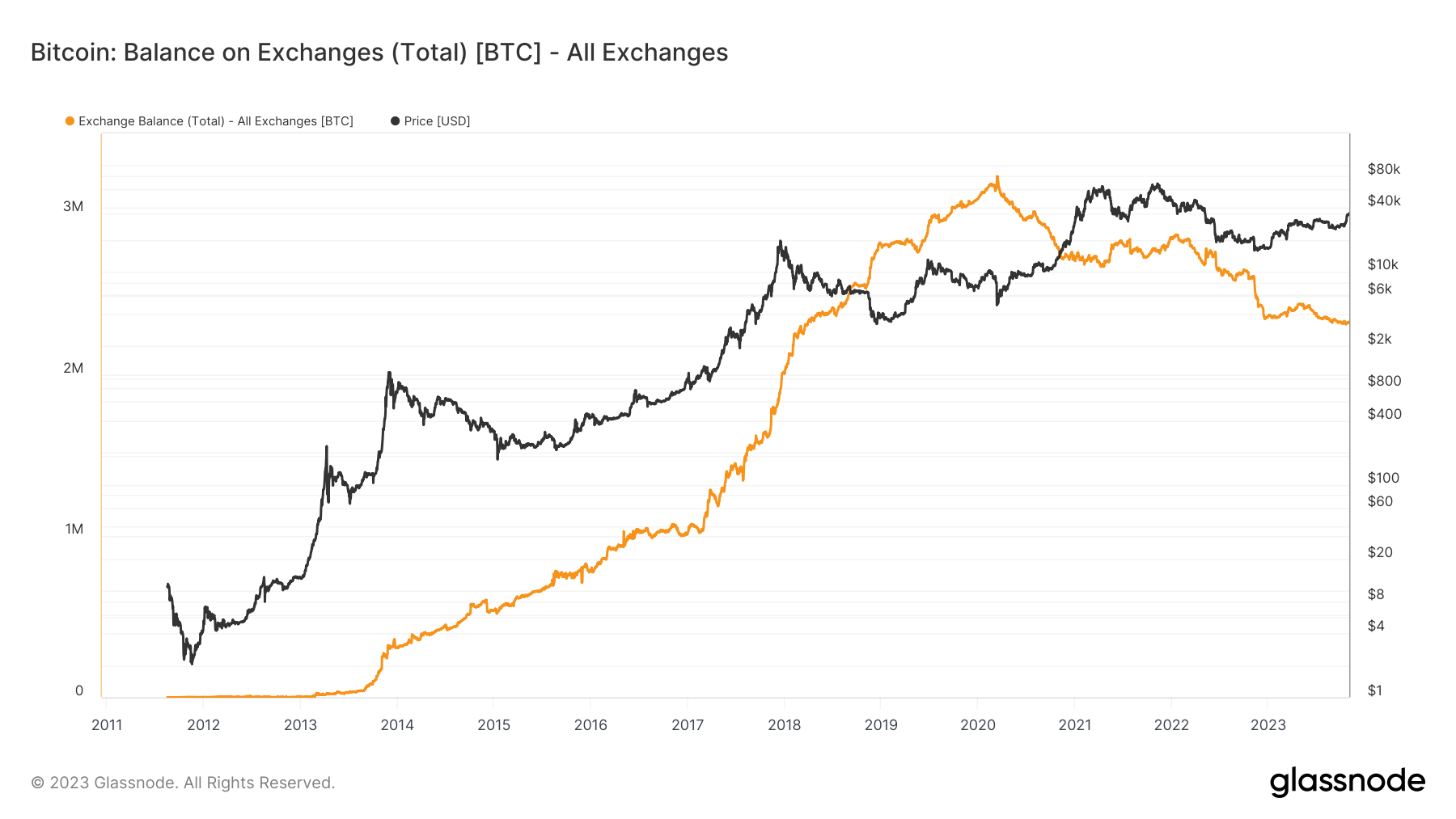

Not only have short-term holder supplies dwindled to historically low levels, but Bitcoin reserves on exchanges have also been decreasing steadily, hitting a five-year low.

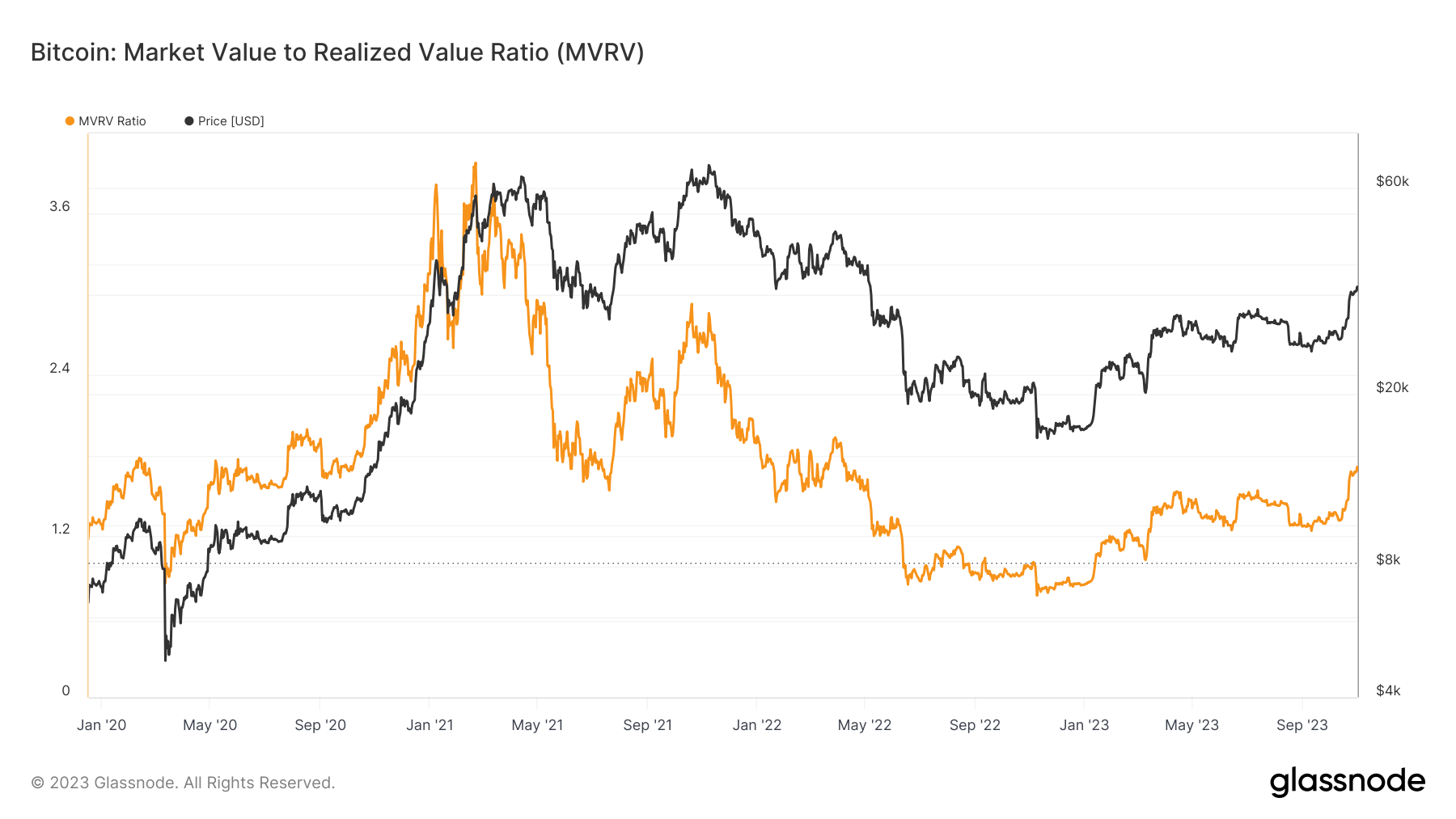

The Market Value to Realized Value (MVRV) ratio provides further evidence that most current holders have not moved their coins at current price levels, suggesting that the market will need to adjust upwards to motivate these holders to sell. It’s important to recognize that liquidity is the linchpin here: the scarcity of sellers at current price levels could result in pronounced price escalations, especially if a spot ETF were to be approved, leading to a sharp increase in demand.

Conclusion

In the short term, our stance is neutral. While bearish indicators seem to be prevailing in the current climate, Bitcoin's pattern in the lead-up to bull markets and options dealer positioning suggests a strong chance of upward movement, and the downside appears to be somewhat limited. A drop to the $32,000 zone with a consolidation could present an appealing entry point for a long position.

Technical analysis, however, has its limitations. Given the anticipation around a potential ETF approval, maintaining exposure to possible upward movements is prudent. A calculated method to achieve this is to periodically invest in soon-to-expire, out-of-the-money call options. Despite a rise in Bitcoin's implied volatility, the rates remain at a moderate historical level, making these options reasonably priced. Should an ETF be greenlighted, I anticipate a swift and substantial price surge, potentially towards the $40,000 mark, given the lack of resistance between the current level and that range.

Currently, on LN Markets, a $37,000 call option expiring in 10 days is valued at 230 basis points and could result in significant gains under these circumstances.It's a low-expenditure tactic, costing about 2.3% of one’s position value every 10 days, with a chance for returns of 150 to 400% in the event of a trend continuation toward the $40K-$42K range. However, if Bitcoin's price remains stagnant or dips in the short term, loss is limited to the 2.3% paid for the options. This kind of asymmetric risk-reward is appealing in a market that's hard to predict, but susceptible to wild moves.

Looking at the medium and long term, our outlook is highly bullish. Between the macroeconomic upheaval and on-chain indicators, all signs point towards a significant move for Bitcoin on the horizon. Currently, the market is hyper-focused on the ETF narrative, possibly overlooking other bullish factors.

First, the potential victory of Milei in Argentina's elections could ignite a chain reaction of nation-state Bitcoin adoption. Milei's advocacy for Bitcoin over traditional central banking[iv] could be groundbreaking, especially if Argentina adopts Bitcoin in everyday transactions. Such a move might inspire neighboring countries to follow suit.

Second, shifting geopolitical dynamics indicate that the current U.S.-led world order may be nearing its end. BRICS nations are working on alternatives to the U.S. dollar, and conflicts in Palestine and Ukraine could reshape alliances in resource-rich regions. Europe's unresolved energy needs may force it to reevaluate its alliances, potentially leading to new alignments based on pragmatic energy needs.

Third, the macroeconomic landscape paints a grim picture for most traditional investments, with seemingly everything but Bitcoin appearing overvalued. Government debt levels, a shaky banking sector, a bursting commercial real estate bubble, and an equity market propped up by a handful of companies, should deter many investors.

Our fiat money regime lifted everything up, and as the tide turns, investors could warm up to the idea of selling their overvalued asset to buy themselves a seat on the Bitcoin life raft.

Links & References

[i] https://uk.practicallaw.thomsonreuters.com/w-040-5871?originationContext=document&transitionType=DocumentItem&contextData=(sc.Default)&ppcid=0ccb0513ad114c7996256138e6d0da23&firstPage=true

[ii] https://www.coindesk.com/tv/unchained/how-much-money-will-flow-into-bitcoin-etfs-heres-one-projection/

[iii] https://decrypt.co/200129/ex-blackrock-director-says-sec-will-approve-bitcoin-etf-3-6-months

[iv] https://bitcoinmagazine.com/culture/argentina-bitcoin-president-javier-milei-run-off-election