LN Markets Alpha #8

Don’t succumb to the FOMO. As François Rabelais, a leading literary figure in XVI century France, wisely said: "All good things come to those who wait".

Published on the 7th of March 2024, at Block 833604, Bitcoin Price is $67,400

ATH special edition

As the market anticipated a consolidation at the $52K level, we shifted into a turbo-bullish mode, predicting another upward movement. In our last edition, we stated:

“ […] we're approaching a phase where turning off your brain could prove to be a highly profitable tactic. During Bitcoin bull runs, seasoned traders often miss out on gains due to excessive caution. They lock in profits at high RSI levels, or when market euphoria peaks, and then wait for a re-entry point that never materializes”

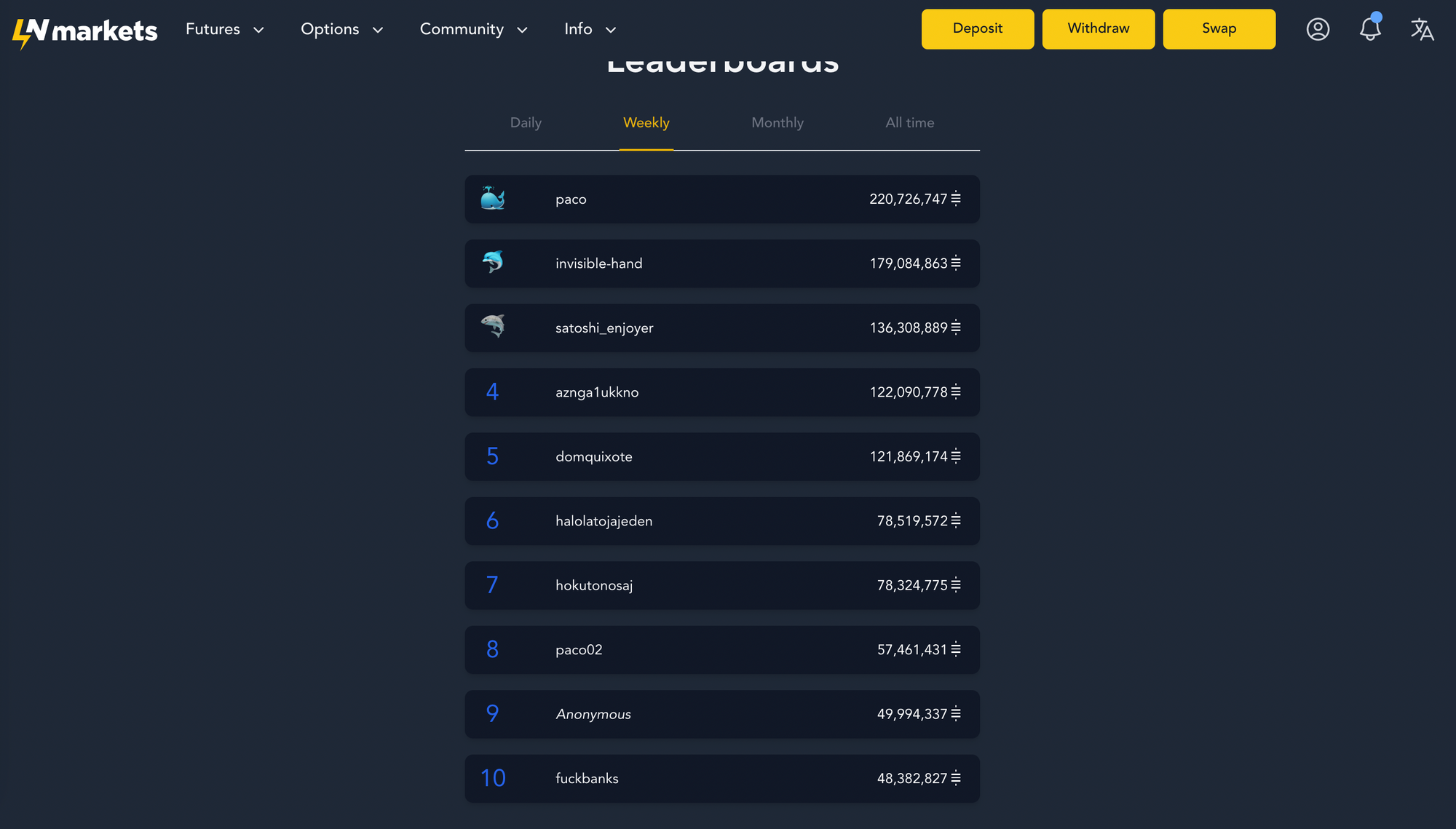

Following this commentary, Bitcoin surged by almost 30% in a single week, retesting its previous all-time high (ATH) from November 2021, at $69K. The LN Market's weekly leaderboard, highlighted below, shows that many of you took advantage of this opportunity and succeeded.

Congrats Kings!

On Monday, March 4, the bears defended the $69K level for the first time, pushing the price back to the $65-67K range. The following day witnessed another test of the previous ATH, briefly reclaiming it for about 10 milliseconds before experiencing the first $10K daily candle in Bitcoin's history, albeit a red one, plummeting the price to as low as $59K - see below.

So, shall we reclaim this long-awaited ATH, or do we think the bears will be able to shift momentum?

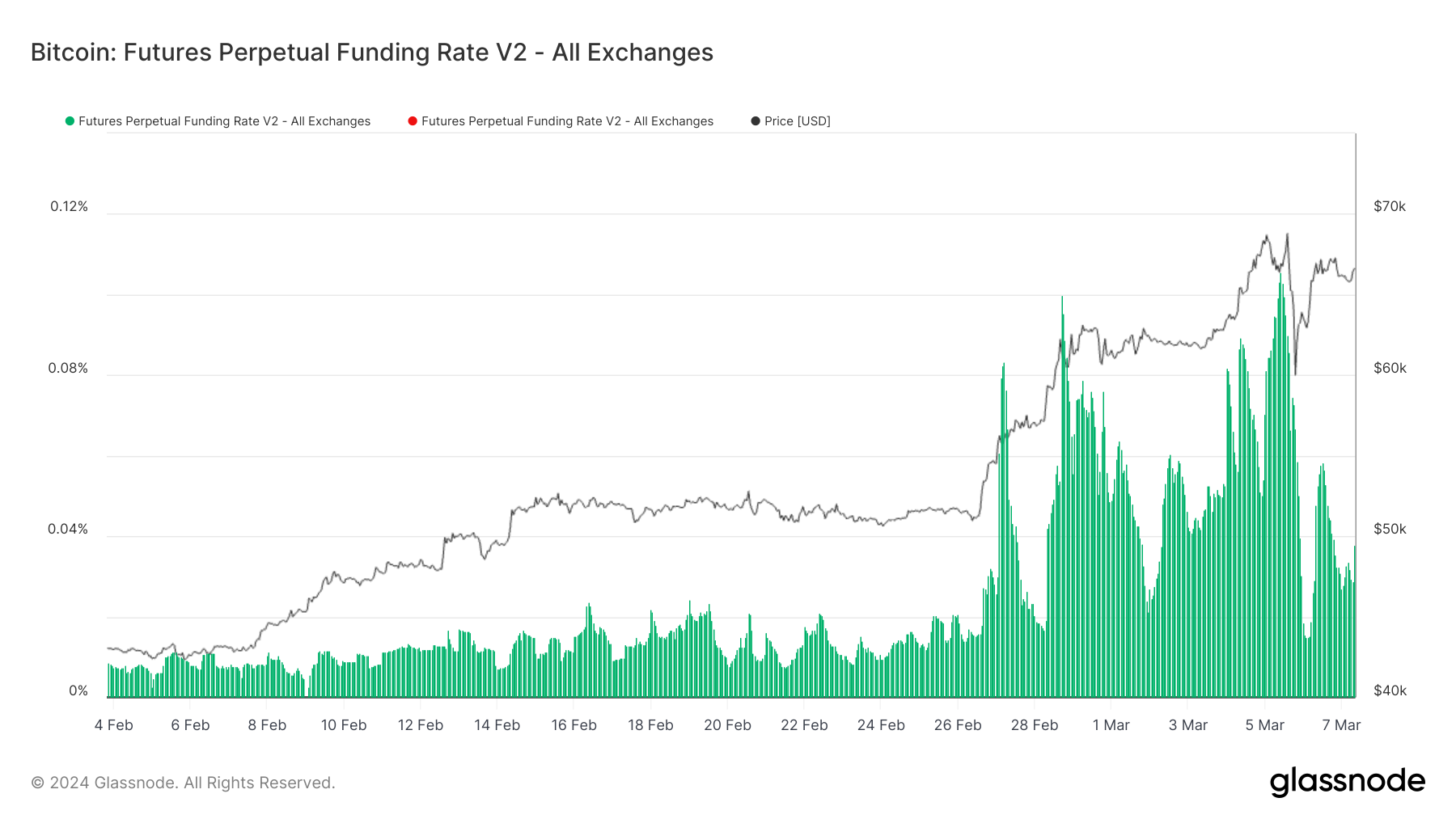

As usual, we will first look at the current leverage structure. The funding rate increased meaningfully on the run toward $69K as late comers piled up to catch the rally and short-sellers got liquidated/stopped en masse at the $53-55K levels. Then, Tuesday’s massive drawdown liquidated the bulk of short-term long leveraged position.

Yet, speculative appetite seems still elevated in the bull camps. As shown below, the rebound was accompanied by a rapid surge in funding rates. At this juncture, the market seems less fragile than at the beginning of the week, with funding rates nowhere near the danger zone, but the trend is far from healthy and could indicate a longer wait until a cleanly break of the ATH.

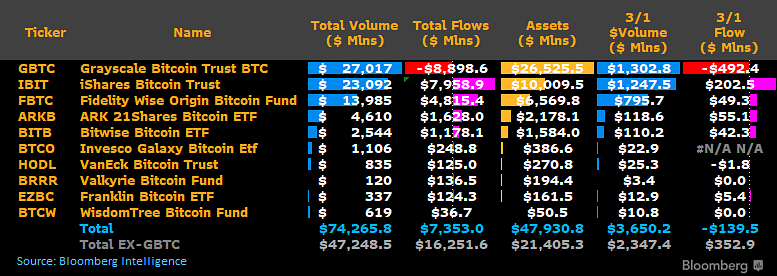

Looking at ETF flows, both the trend and absolute numbers appear bullish. By the close of market last Friday, ETFs boasted an impressive $21 billion in assets under management (AUM) (excluding GBTC), with almost $75 billion traded in just 7 weeks. Net inflows have since continued in line with the previous trend.

In our recent editions, we also highlighted the potential sale of GBTC shares worth approximately $1 billion by Gemini, likely carried out last Thursday and Friday. This was offset by inflows into IBIT, totaling $1 billion over the same period. Given the recent flows and considering most asset managers settle transactions on a T+2 basis - see LN Markets Alpha #5, we anticipate no bearish price movements in the immediate future.

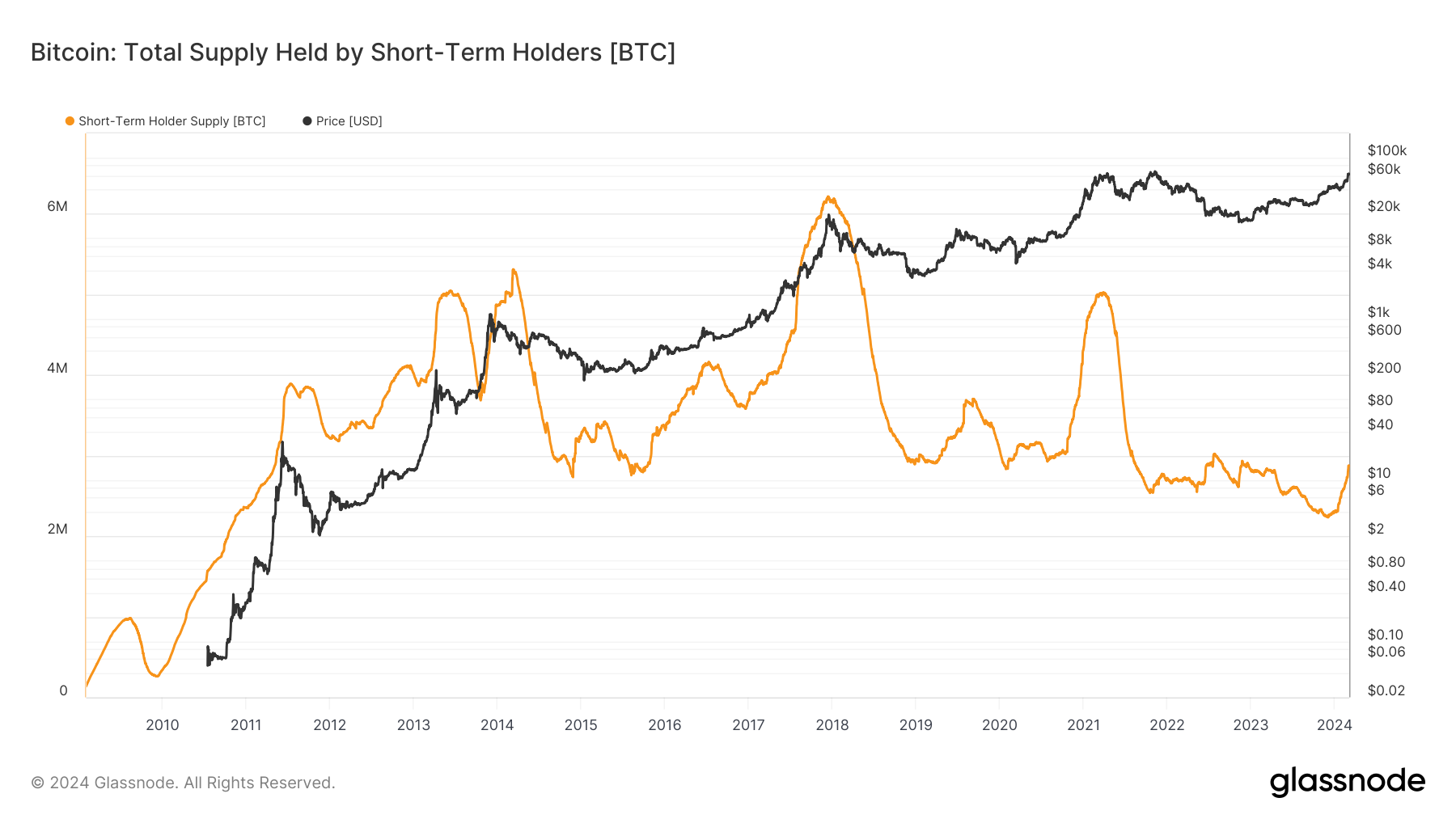

So, the boomer frenzy doesn’t seem over yet and the degen hodlers aren’t selling: Glassnode’s Short-Term Holder supply is still currently lower than at the latest bottom after the FTX’s debacle, representing a mere 15% of coins ever issued.

However, we remind newcomers that a similar rejection occurred when Bitcoin tested the top of the 2017 bull run, leading to a ~20% drop before resuming its upward trajectory, surprising many by propelling the orange coin to $40K within months. While the past is not a predictor of future movements, and conditions have changed significantly, the current scenario could still unfold similarly.

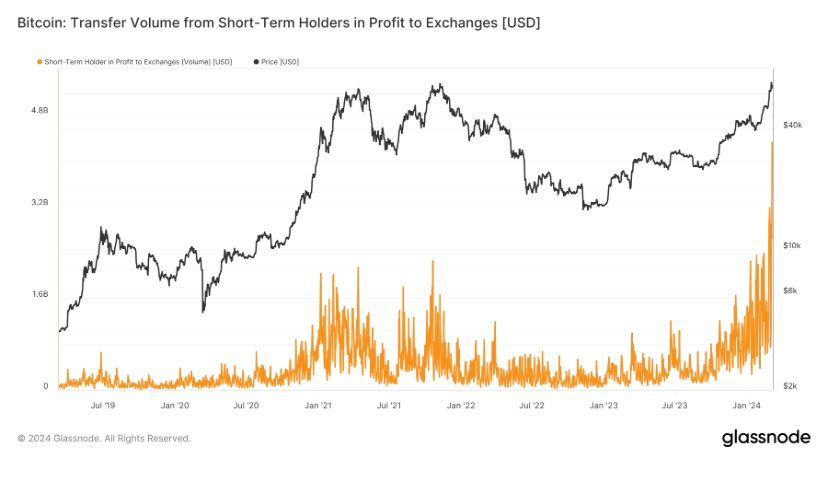

With bears now having a level to defend, and without any significant correction before reaching the ATH, it's plausible to expect short-term holders to take profits, aiding bears in defending the $69K level. The volume of coins sent to exchanges by short-term holders in profit reached a new high recently, indicating potential selling pressure that could disrupt the current momentum. As shown below, the number of coins sent to exchanges by short-term holders in profit, broke its ATH a couple of times these last days, with close to 65k BTC sent yesterday. You can’t know if these coins will be sent to be sold, but it is reasonable to assume that a large part of it has been deposited for such purposes.

In this scenario, bears would pile up and create the condition for a squeeze leading to another big and swift leg up. Therefore, we would not advise opening long at this point: if we break the ATH, it won’t be too late to hop on the bandwagon, but another failure to do so would most likely send Bitcoin much lower to the $52-55K zone. In other words: the risk-reward ratio is far from being attractive.

That said, we don’t believe for a second this bull market is over yet. Factoring in the halving kicking in about 7000 blocks, the fact that Bitcoin already reached a new All Time High in most fiat-currencies – see LN Alpha Markets #3, that we have a mysterious whale who has been silently scooping up 100 coins a day for the past 18 months[i] - see below, and that ETFs inflows doesn’t seem decelerate at all, we would reiterate our bullish stance.

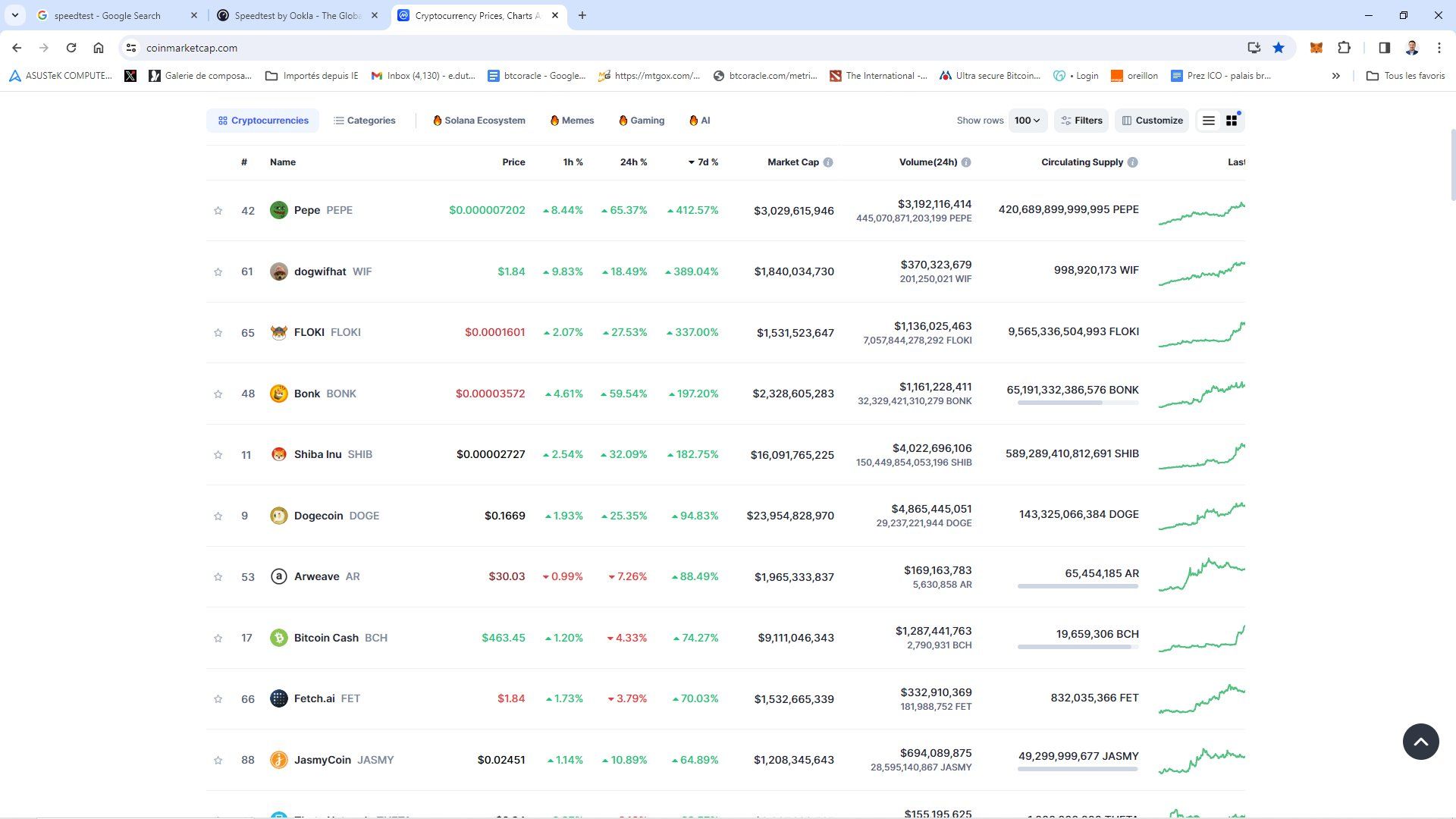

Another argument in favor of a temporary cooldown is the heightened speculation & greed sentiment that has developed in the market over the past weeks. For instance, the best performing crypto last week were all BRC-20 and meme coins – see below, with some of them even featured on CNN…

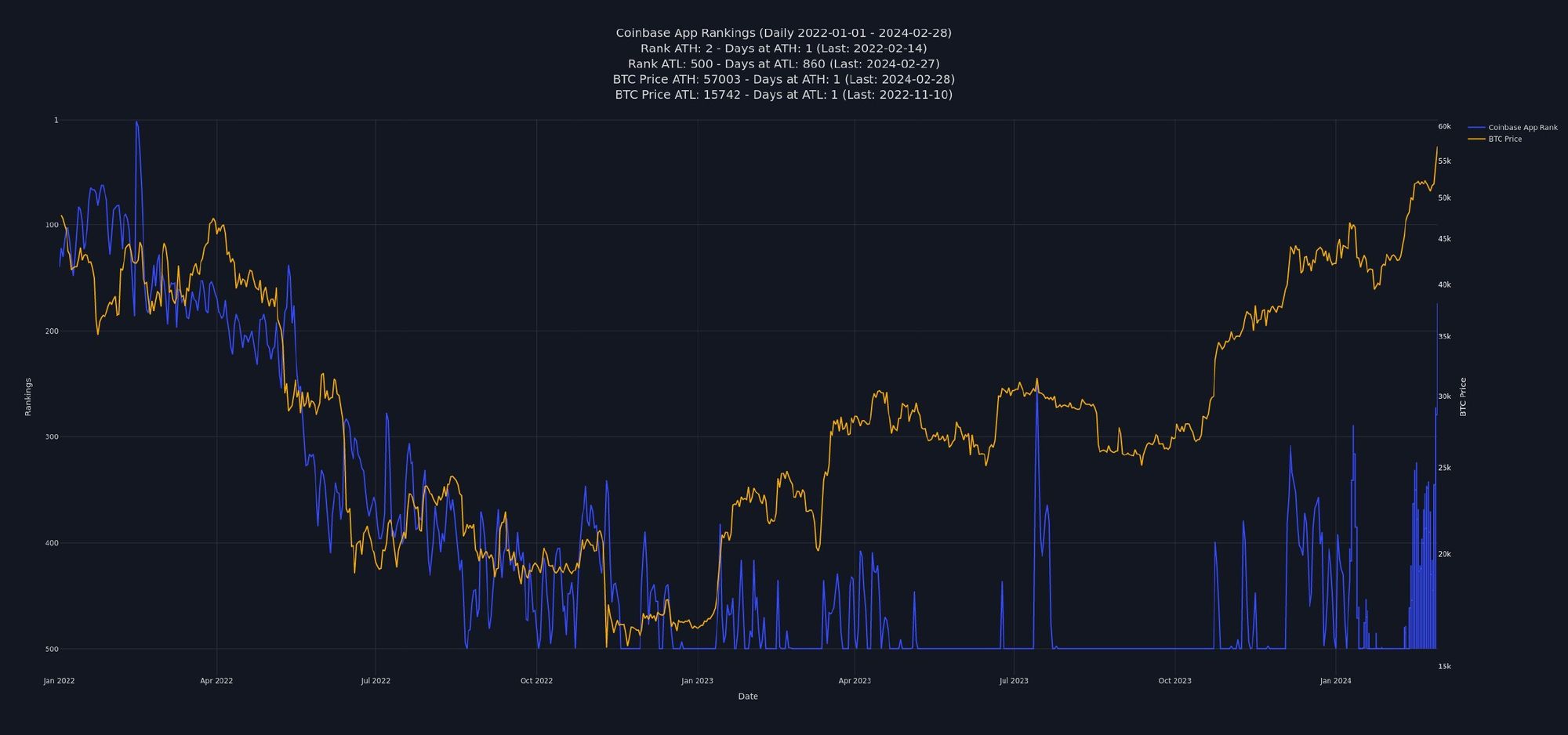

Also, Coinbase ranking on the app store, which has been an excellent market top indicator during past cycles, is steadily rising – see below, and fake news of BTC shortages at OTC desks are proliferating, thus indicating elevated speculative sentiment.

Therefore, we remain bullish in the long-term, but we would also advise against opening long positions just now. Instead, one should keep an eye on the metrics presented above looking for tale signs of a rebound.

The ideal scenario would be an increase in futures and options OI, without a correlative surge in funding rates and IVs, therefore indicating that bears are doubling down while leveraged long traders remain spooked by the downtrend. Comparing the ratio between coins sent to exchanges by ST holders and the net inflows into spot ETFs would also constitute a good indicator of the spot dynamics: once the selling diminishes meaningfully, provided ETF inflows maintain their current pace, Bitcoin will surely find a local bottom and resume its ascent, obliterating the previous All Time High.

Conclusion

Markets don’t rise in a straight line. Too much price appreciation fragilizes the potential for trend continuation as it incentivizes short-term traders to discard risk-management and indulge in frenetic speculation, as much as it gives good reasons to USD maxi to take profits while they still can. With Bitcoin climbing almost uninterruptedly since January 2023 and delivering a ~250% return over the past quarter, caution is advised.

In your Master’s or MBA finance courses, you might have been taught that markets react to new information – the famous Efficient Market Hypothesis. Although markets are essential institutions conveying pertinent economic information necessary for economic coordination, financial markets can’t be reduced to linear functions outputting prices from information alone. The EMH is again another product of the economic neoclassical framework entertaining little affinity with reality. We would advise you to look at market from a different view, grounded in the idea that they are complex systems in constant reorganization through the effect of participants changing their positioning and exposure. They can react to new information, new prices, latent profits, their peers behaving in a certain way, their daughter getting married, and what not.

This is what makes short-term financial forecasting a guessing game. The long-term behaviour of markets though is more connected to human action, fundamentals, and macro. Bitcoin is no exception: it is extremely difficult to forecast in the short-term, but monotonically going up and right in the long-run. Therefore, in time like these it might be wise to focus on the long-term, especially so since there are so many bullish factors on the horizon (ETF flows, the halving, the return of the printer, increasing deficits, etc.).

Don’t succumb to the FOMO. As François Rabelais, a leading literary figure in XVI century France, wisely said: « Tout vient à point à qui sait attendre » (All good things come to those who wait).