LN Markets Alpha #3

In the near term, we anticipate Bitcoin entering a cooling phase, oscillating between $32K and $42K, but remain bullish in the long-term on the back of increasing global USD liquidity.

Short-Term Outlook

Our latest prediction of Bitcoin surpassing the $38K resistance and swiftly ascending to the $40-42K range came true soon after our last edition was published. However, it turns out we were not bullish enough!

We suggested taking profits at this level, yet Bitcoin's price continued its ascent, approaching $45K. Our analysis of the market structure was largely accurate, though, as evidenced by the sharp drop from $44K to the lower $40K range on Sunday night, triggering numerous liquidations among traders who were riding the price wave upwards.

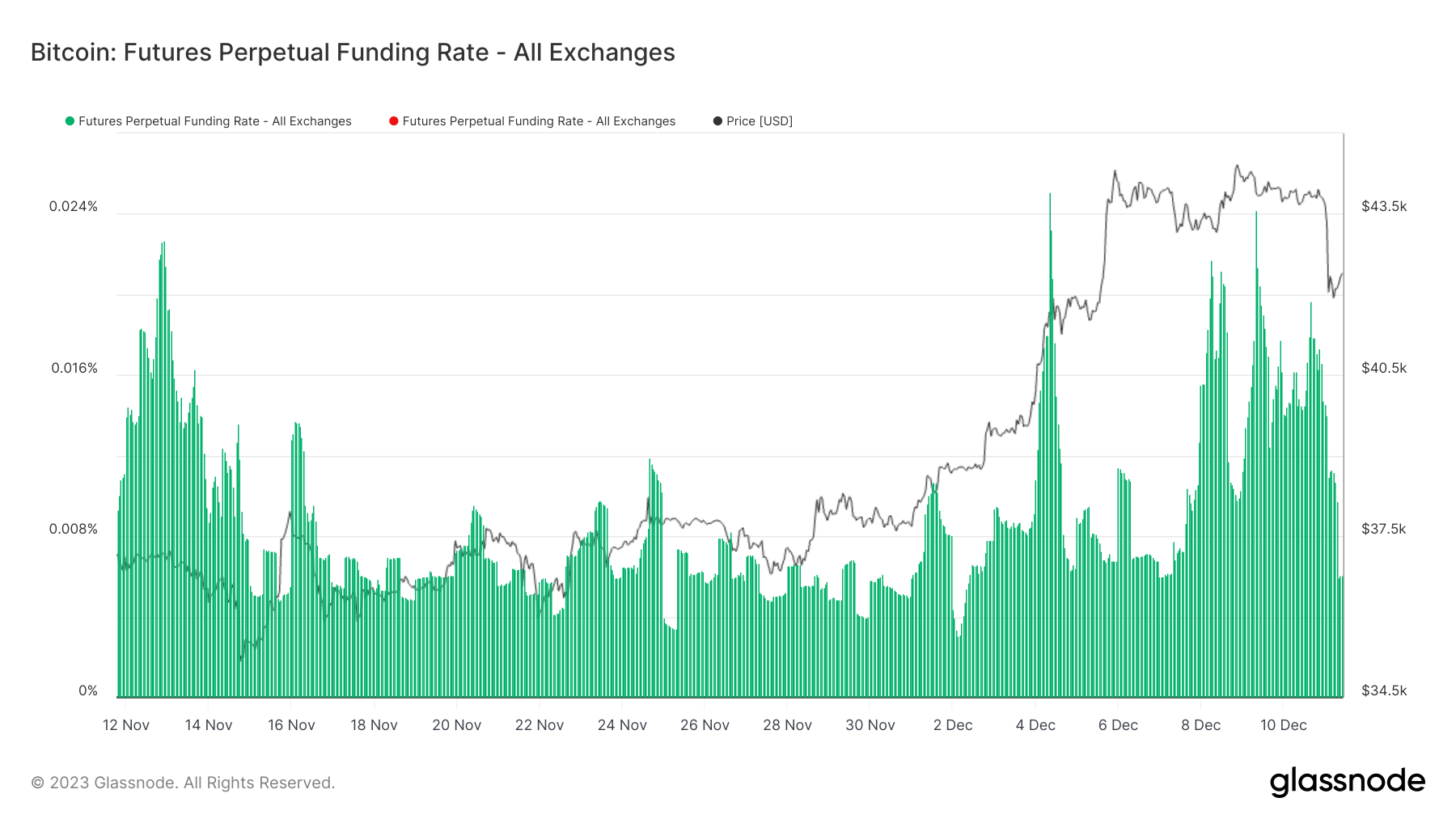

In the days leading up to this, there was a gradual increase in the funding rate while the price remained relatively flat. This divergence between leverage and price momentum often sets the stage for sudden and steep liquidation events.

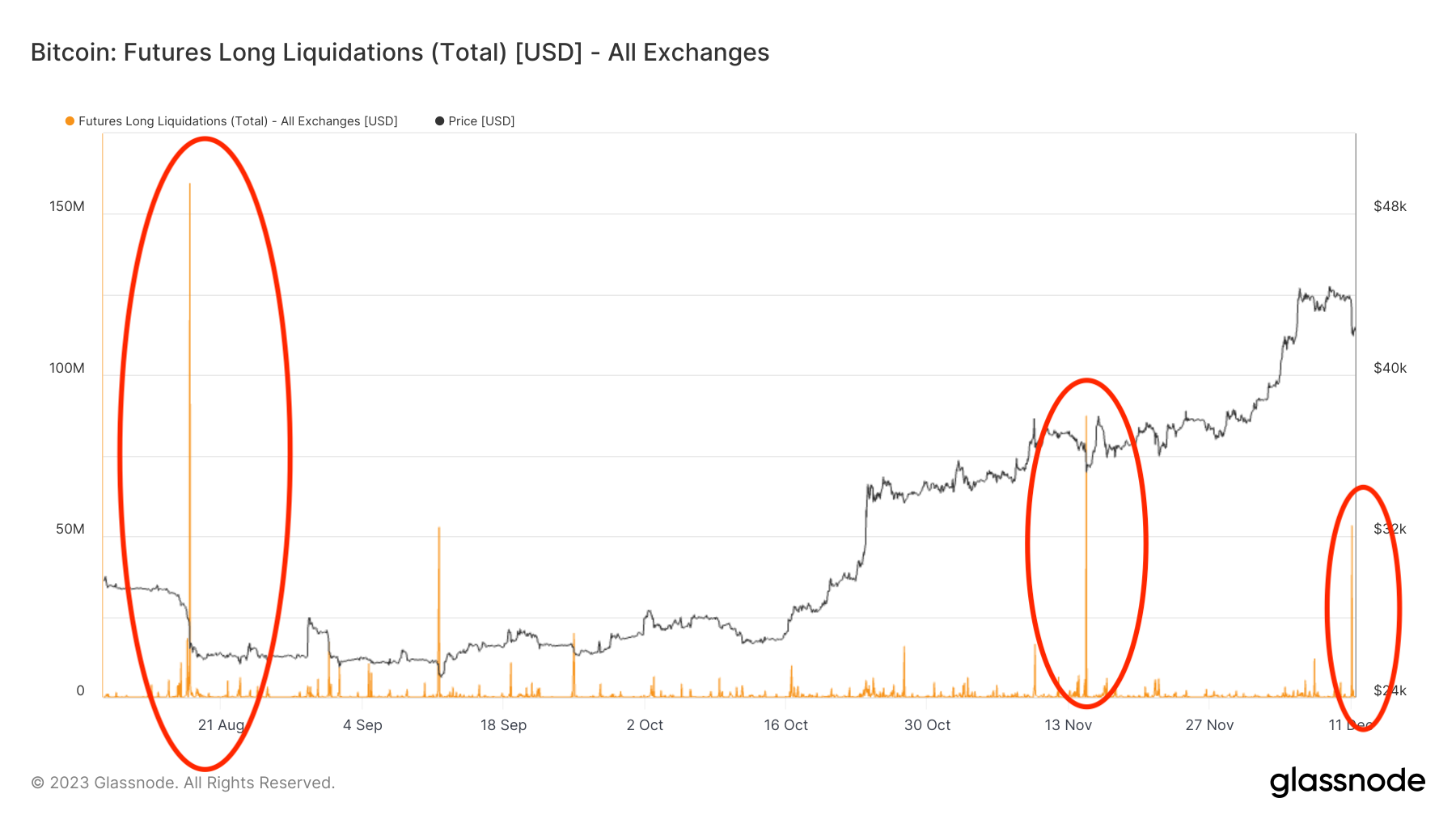

The downturn on Sunday resulted in about $53M in long position liquidations. While significant, this figure falls short of the approximately $150M liquidation seen on August 17th, or the $87M liquidation on November 14th, which effectively cleared the market of excess leverage and paved the way for a breakout from the previous range.

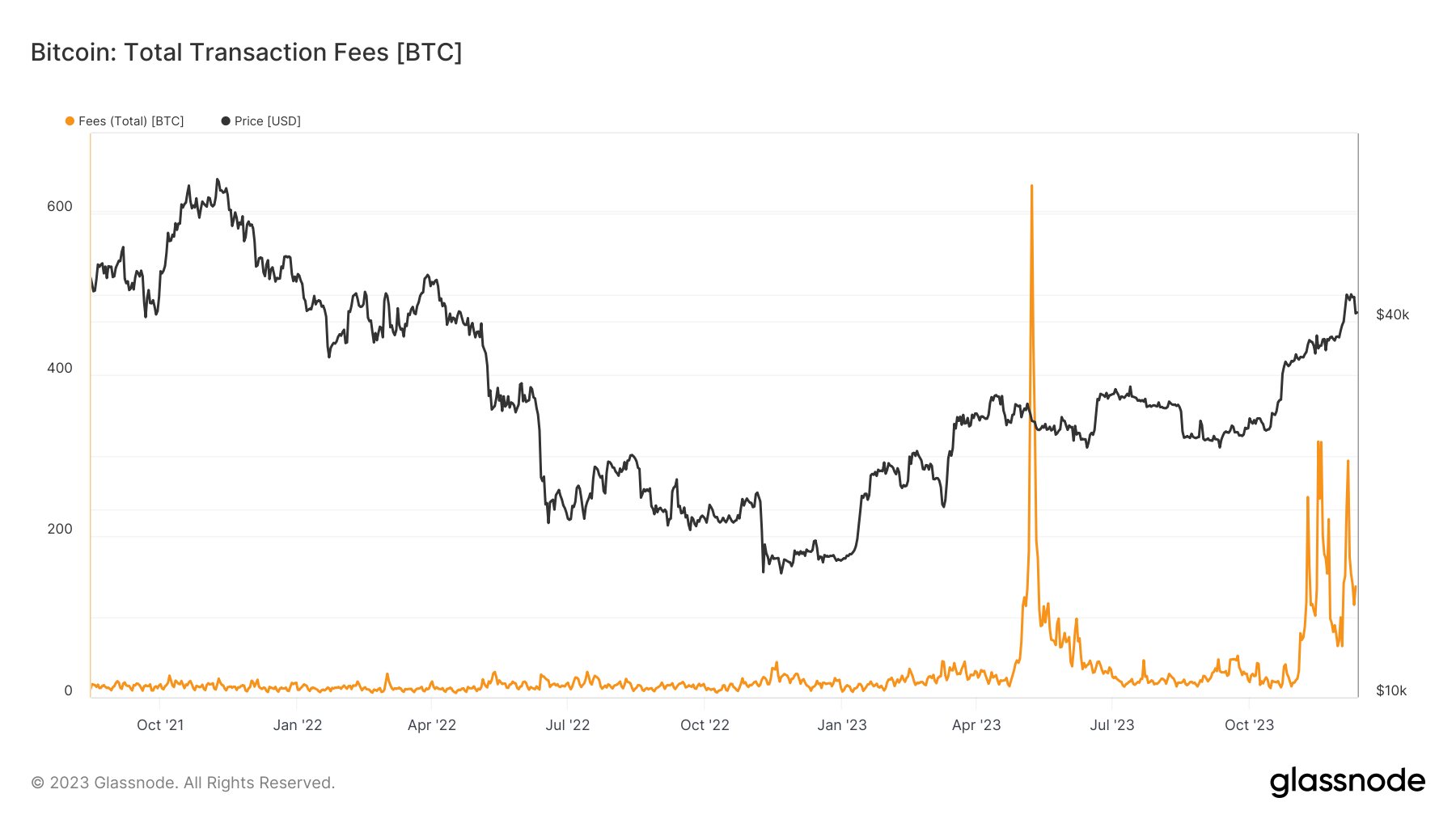

At this point, a correction seems more probable than a continuation of the upward trend. Since the uptrend began in mid-October, there hasn't been a major correction, and Sunday’s liquidation event likely wasn't sufficient to eliminate all the excesses in the market. Moreover, as previously noted, the increased transaction fees (see below) driven by renewed speculation among the BRC-20 crowd are a bearish indicator: heightened greed is often a precursor to a market downturn.

We are closely monitoring the $38K and $32K levels for potential targets. In the absence of significant bearish factors, a plunge below these levels seems unlikely. Both have served as crucial resistance points during the rally and may now provide support during the correction. Additionally, a retest of the $32K level would align with a 0.618 Fibonacci retracement, a critical level in such market movements.

This doesn’t mean one should immediately short Bitcoin. Markets can correct either in terms of time or price, and we might see a prolonged, albeit gradual, correction which could be challenging to endure, especially for those bullish on Bitcoin in the long term. However, from a trading perspective, this scenario presents an ideal short opportunity. As always, use leverage cautiously, as we might experience sharp upward movements along the way.

We'll likely provide another update before Bitcoin hits $32K, but should this scenario unfold, we would view that level as an optimal entry point for a long position. As we'll discuss in more detail in the following, our medium to long-term outlook on Bitcoin remains strongly bullish.

Medium/Long-Term Outlook

The recent surge in Bitcoin's price isn't solely attributable to increased liquidity; rather, liquidity serves as the fuel that powers its growth. Over the long term, Bitcoin's value is shaped by its adoption and investment levels, but its medium-term fluctuations are heavily influenced by the state of liquidity. Even in a market with limited liquidity, Bitcoin can still appreciate relative to other assets if investors persistently accumulate it. However, its performance against the USD in such conditions is less assured – which is why Bitcoin reaching all-time highs in currencies like the Turkish Lira (TRY) or Argentine Peso (ARS) shouldn't be surprising.

Understanding and predicting the future liquidity of the USD is crucial, especially since it plays a significant role in our medium-term outlook for Bitcoin's price. We identify three primary drivers of USD liquidity over the medium term (6 to 18 months):

- US Fiscal Policy

- China and Japan Monetary Policies

- FED's Policy

US Fiscal Policy

The fiscal situation in the US significantly impacts both inflation and liquidity. Fundamentally, fiscal deficits move USD from the private sector to the government, typically leading to less efficient spending and bolstering inflation. However, this also results in an increase in US government bonds, which act as collateral in the credit system. In our fractional reserve lending system, the more Treasuries in circulation, the more collateral available to support credit creation. That said, the supply of bonds alone doesn’t guarantee liquidity; there must also be a demand for borrowing. Yet, given the private sector's current indebtedness and the state of risk assets, there's likely a continual demand for leverage and loans, especially for refinancing existing debts.

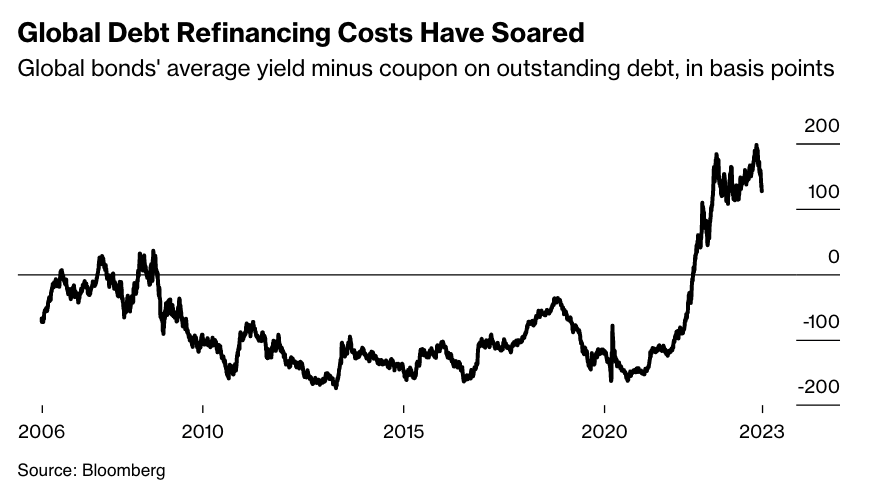

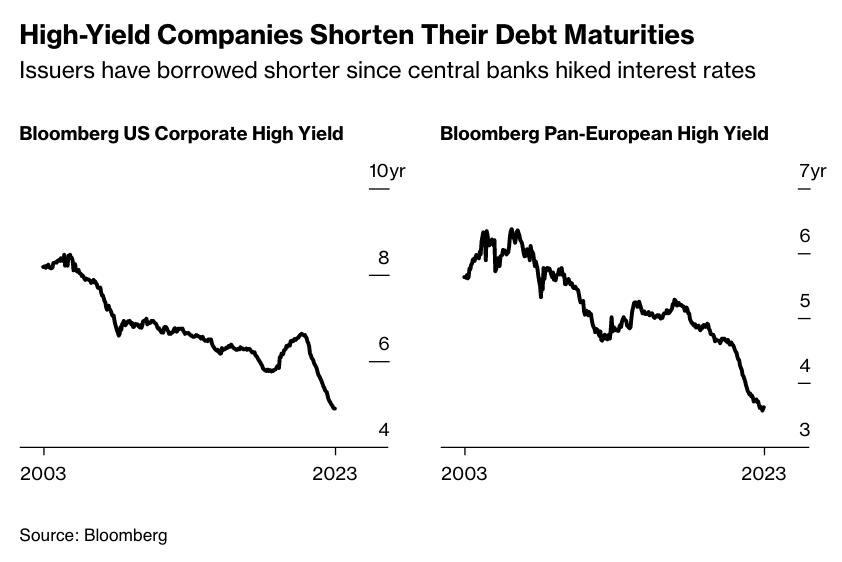

Due to recent rate hikes, refinancing costs have risen significantly, prompting borrowers to opt for shorter maturities.

This suggests that the global debt landscape will have to navigate a substantial rollover in the next two years, with record-low maturity in high-yield debt, as seen in the chart provided.

In our previous issue, we discussed the unique nature of the looming recession, influenced partly by under-capacity issues and current fiscal expansiveness. A crucial element of this forecast is the monetary aspect: we are skeptical that central banks and governments will allow a credit deflation spiral. Instead, they are more likely to step in to assist with refinancing the debt, though the specifics of such intervention are complex and beyond our current scope.

Here's the scenario: low demand and increasing financial costs will pressure businesses to reduce expenditures, including hiring and investments in productive capacity. Meanwhile, the monetization of private debt will likely inject more liquidity into the financial system rather than the real economy. This unusual combination might result in an odd economic landscape: a sluggish or recessionary economy coupled with a bull market in risk assets. While this macro regime might feel unfamiliar to many, it’s a scenario not uncommon in countries with structural high inflation, like Argentina or Turkey.

China and Japan: QE from Abroad

The Bank of Japan has been implementing a Yield Curve Control policy for about seven years, targeting the yield on 10-year government bonds primarily through purchasing government securities.

Since the Fed began raising rates, Japanese money managers have found an opportunity: selling domestic bonds to the Bank of Japan and purchasing higher-yielding US Treasuries or European Bonds, while hedging against the USDJPY through FX-swaps.

This is significant for the global financial landscape, as Japan holds the world’s largest net foreign asset position. Consequently, the Japanese yen has weakened against the USD as capital has shifted from Japan to other economies.

Brent Johnson, a fund manager and macro analyst, has repeatedly stated that the impact of QE depends on who benefits from it. In this case, Japan’s aggressive monetary policy is bolstering US markets.

Japan’s unique situation—low population growth, high debt levels, substantial current account surpluses, and unattractive domestic yields—enables this policy without triggering hyperinflation.

China, experiencing a similar economic trajectory - more on that here[i], is also stimulating its economy and is likely to intensify these efforts. Xi Jinping’s commitment to growth and the formation of a new sphere of influence independent of the US makes this a strategic imperative.

Though Chinese financial markets are less open than Japan's, similar economic conditions in China are leading to similar outcomes: stimulus measures are increasing global USD liquidity and risk assets, devaluing the CNY against the USD, and strategically aligning with Xi’s broader plans.

Recent market reactions to the expectation of rate hikes in Japan, which briefly strengthened the yen, have been corrected as the Bank of Japan maintains its accommodative stance[ii]. This confirms our view that Japan's monetary policy is unlikely to shift unless a significant crisis occurs.

In summary, China and Japan’s structural challenges necessitate monetary policies that indirectly support risk assets in the US and others priced in USD. Until major changes occur, we expect this to enhance global USD liquidity and propel Bitcoin to new heights.

FED’s Policy

The final piece influencing future liquidity is the Federal Reserve's policy. The upcoming FOMC meeting is critical, and while we don’t anticipate immediate rate cuts, Chair Powell's comments could shape market expectations about future rate adjustments.

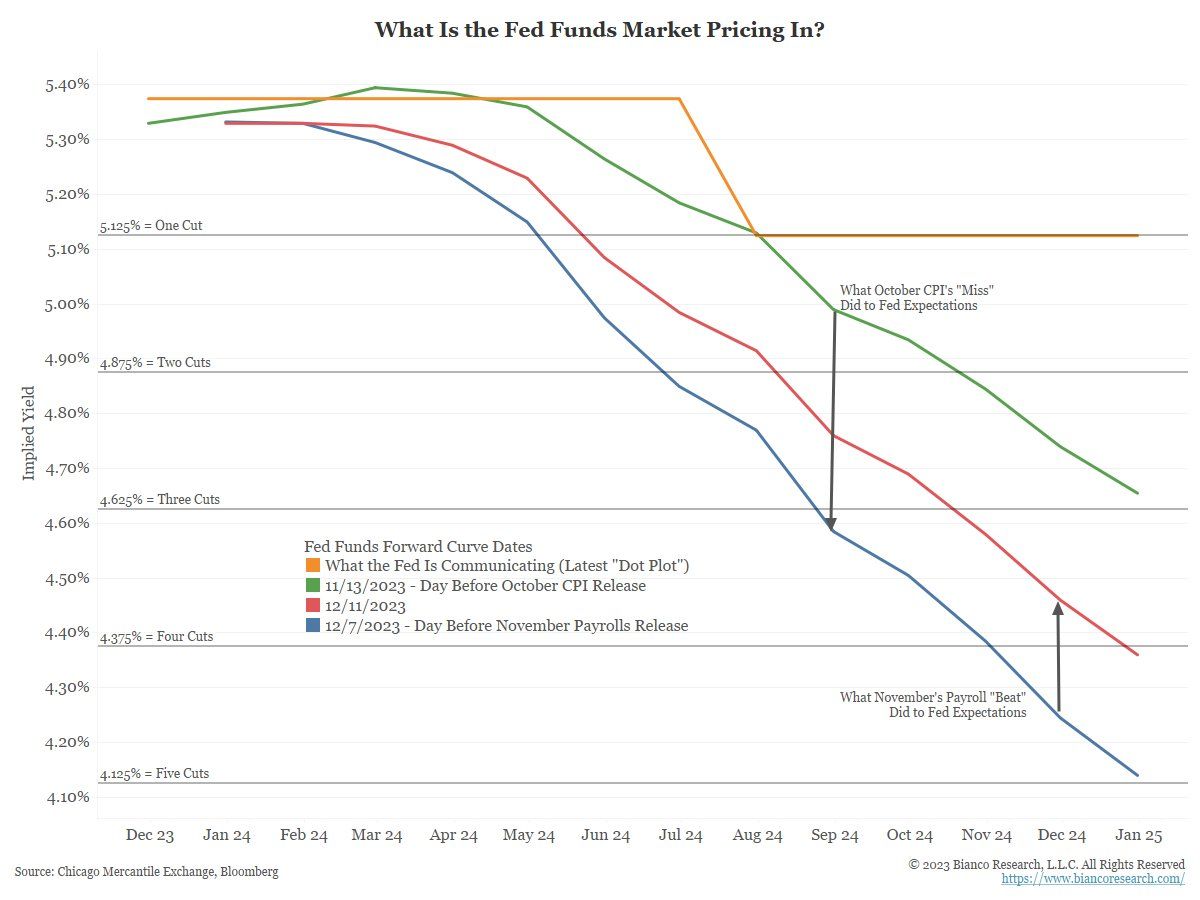

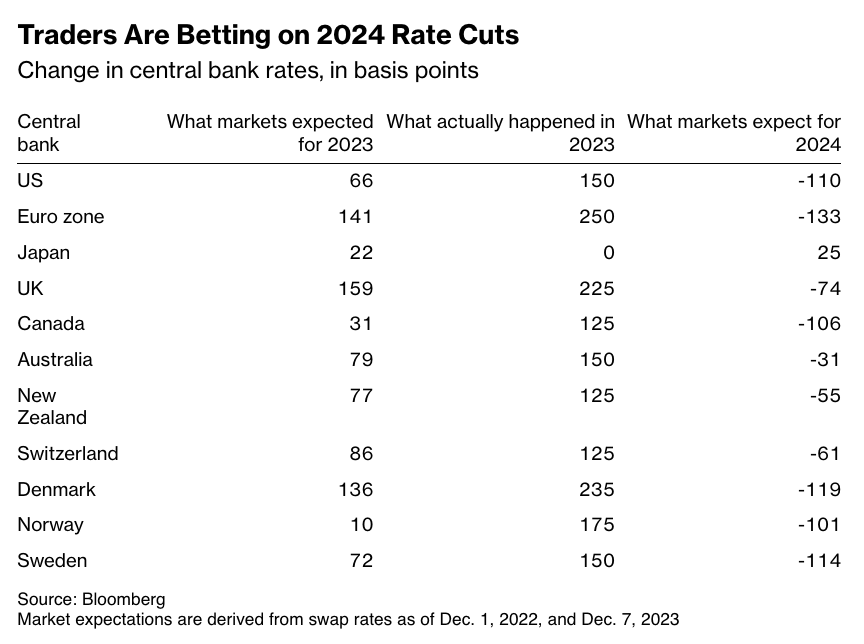

Market predictions, based on futures market implied yields, suggest at least three rate cuts next year, with easing expected to start in early Q2. However, given the rapidly worsening economic landscape, as highlighted in our previous edition, these market expectations might be underestimating the speed of the Fed’s pivot.

Historically, futures markets have been conservative in their forecasts, as seen last year when they underestimated the pace of rate hikes amid rising inflation.

Similarly, current predictions might be skewed by recent Federal Reserve communications and a recency bias, failing to account for the economic pressures that could compel the Fed to act more aggressively, especially in an election year. We’ll be watching closely to see how this unfolds!

Conclusion

In the near term, we anticipate Bitcoin entering a cooling phase, oscillating between $32K and $42K. The steep correction witnessed on Sunday night and Monday was largely driven by an overleveraged market. However, looking ahead, we expect a more gradual, sideways correction that could span about a month. Absent the impetus of a halving event, predicting a swift recovery and new highs seems optimistic. This timeline could align the formation of a local bottom with the anticipated ETF approval in early January.

Given this outlook, we advise against opening short positions unless you are a seasoned trader capable of navigating a choppy market that deviates from the general trend. For those who choose to venture into short selling, monitoring the funding rate and key liquidation thresholds will be vital to identify unstable directional shifts and set stop-losses appropriately. Nonetheless, we remain confident that the upward trend isn't over yet. If anything, a period of correction and consolidation could be beneficial, setting the stage for Bitcoin to achieve new heights in early 2024.

Our long-term analysis has centered on the USD liquidity landscape and its influences, highlighting its significance for Bitcoin’s medium-term pricing behavior. While we concur with the consensus that a recession may soon materialize, we diverge in our belief that it won't necessarily lead to a prolonged bear market in risk assets. Our view is that various long-standing structural issues will compel global political leaders to continue deferring tough decisions.

Certain aspects of our thesis, like a potential Fed pivot, are widely recognized. However, other elements, particularly the role of Japan and China in shaping global USD liquidity, receive less attention in Bitcoin discussions. We will continue to monitor developments in the East for insights that might validate or challenge our perspective.

In the meantime, a word of caution to traders: avoid overtrading. Missing a rally is common and not a catastrophe, but many fall victim to impatience. In the meantime, don’t overtrade folks. As Pascal aptly wrote: “all of a man’s problem stem from its inability to sit quietly in a room alone”[iii].

[i] Here is a complete report from yours truly, published early 2022, and explaining China’s predicament and also forecasting a CNY devaluation: https://theomogenet.substack.com/p/the-road-to-financial-repression-181

[ii] https://www.zerohedge.com/markets/yen-plummets-report-boj-will-not-hike-rates-any-time-soon

[iii] The exact quote from Les Pensées, is « all of humanity’s problems stem from man’s inability …” but I personally fancy this paraphrasing from Arnold Rothstein in the HBO show “Boardwalk Empire”