Ln Markets Alpha #5

While the launch of the spot Bitcoin ETFs is definitely bullish in the long-term, the short-term impact of ETF inflows on the spot market is less straightforward than one might think. Let's unravel the anatomy of these products to better understand how they will impact bitcoin's price.

Published on the 16th of January 2024, a Block 826,053 & BTC price $43,000

While the launch of the spot Bitcoin ETFs is definitely bullish in the long-term, the short-term impact of ETF inflows on the spot market is less straightforward than one might think. Let's unravel the anatomy of these products to better understand how they will impact bitcoin's price.

Short-Term

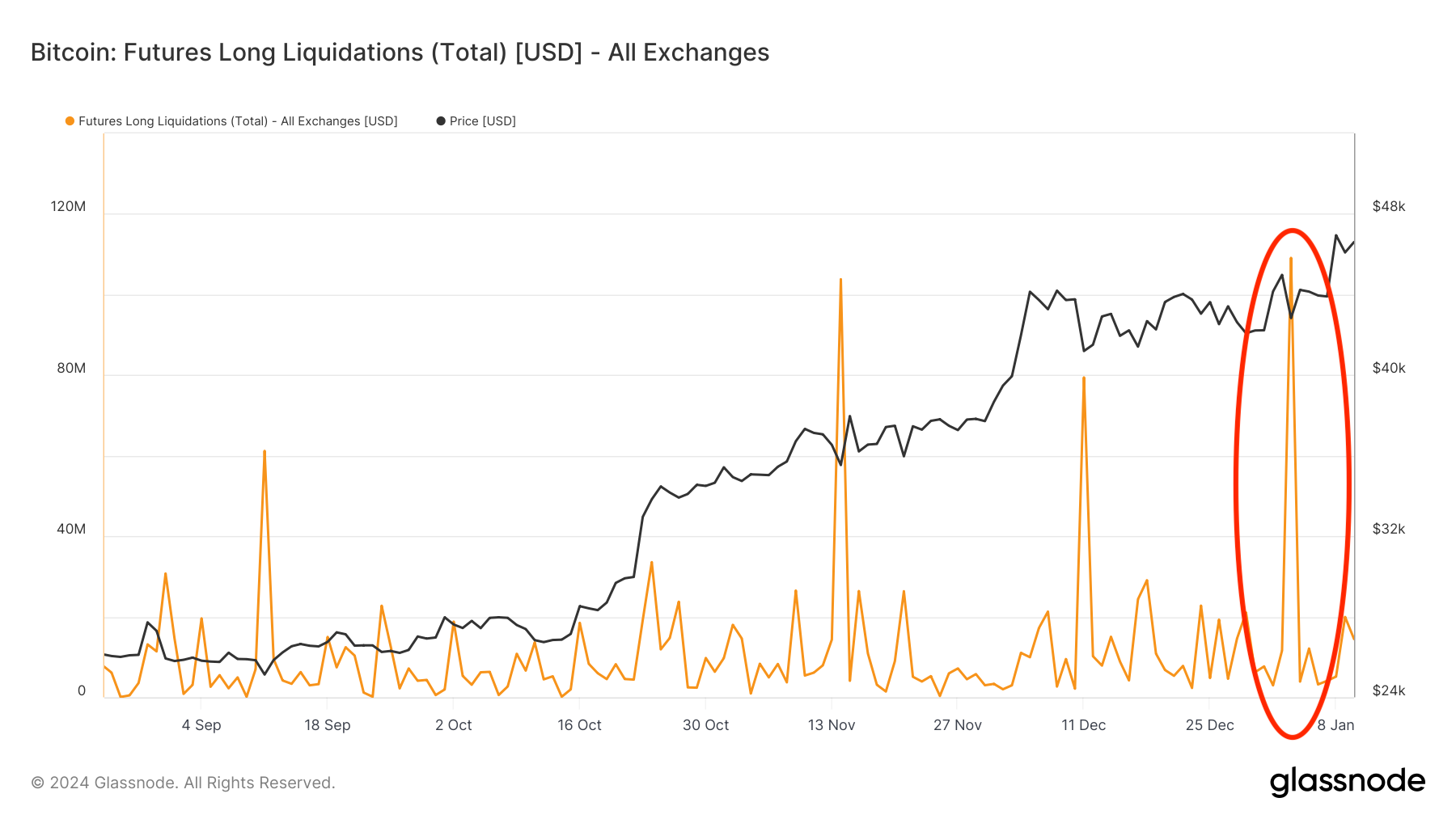

Our last forecast proved somewhat frustrating: we anticipated a significant liquidation cascade, which did materialize shortly after publication, with over $100M in long positions being wiped out – refer to the chart below. However, we also expected the market to trade weakly due to a fragile market structure. This view was disproven by the relatively bullish price action following the liquidation, with Bitcoin surging to $49K just before the ETFs began trading.

However, Bitcoin then swiftly sold off during the subsequent 36 hours of trading, returning to the $42K level. This move reinforces our original forecast that the rally, which began in early September 2023, is becoming overstretched and that a consolidation and/or correction is likely. Indeed, such price action, where the price reaches a new high and then quickly retreats below previous lows, is often indicative of a local top.

On a related note, this previous imperfect forecast highlights the importance of risk management: believing that the risk-reward ratio for opening either long or short positions was unattractive, we advised caution. Had you opened a short position, you might have suffered from the rally to $49K. Conversely, if you had opened long positions, you would likely have been stopped out or liquidated during one of the two significant drawdowns – see the chart below.

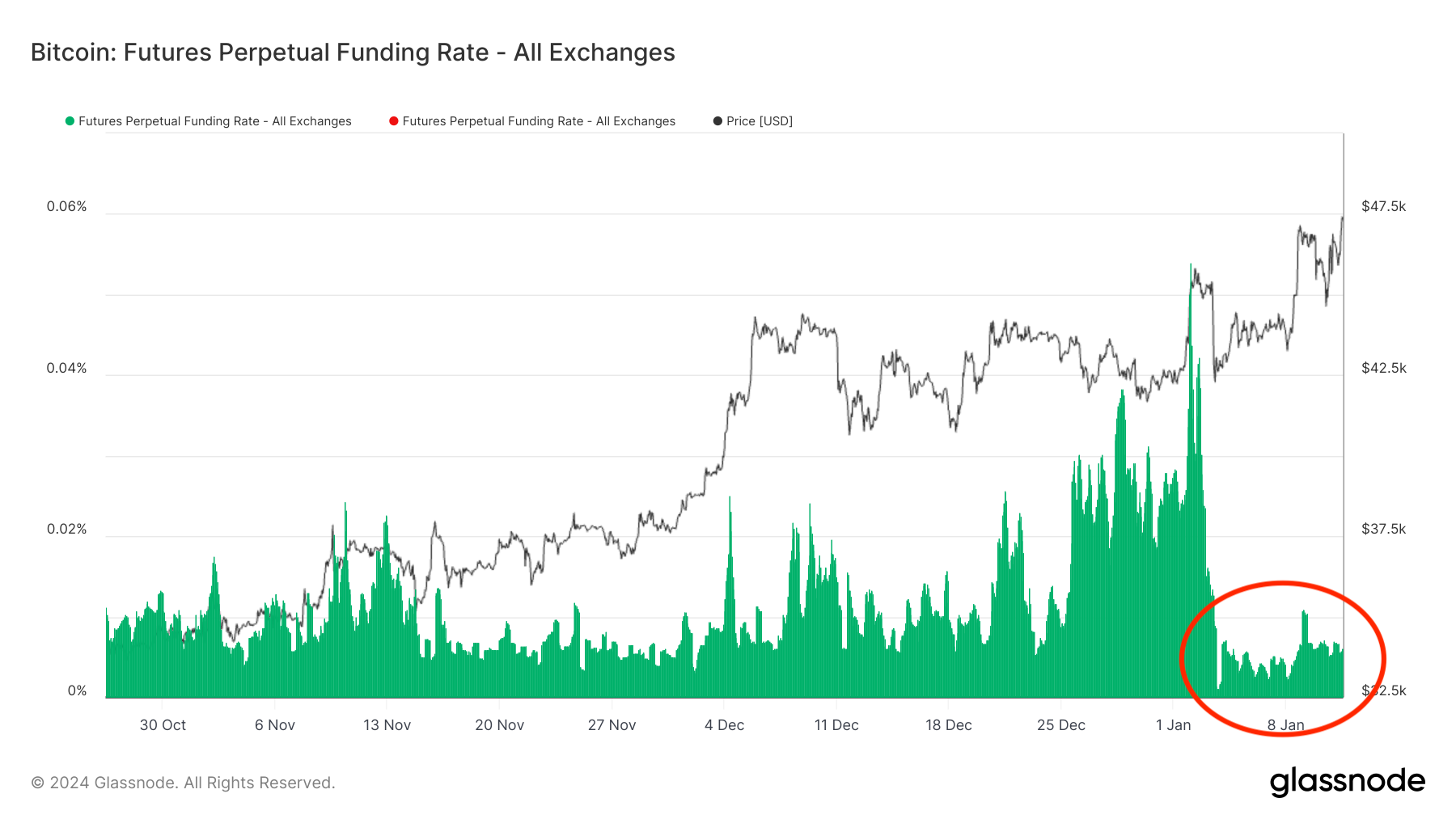

Moving forward, the funding rate picture appears neutral: the liquidation cascades have eliminated most of the excess leverage, potentially setting the stage for a healthier continuation of the bullish trend.

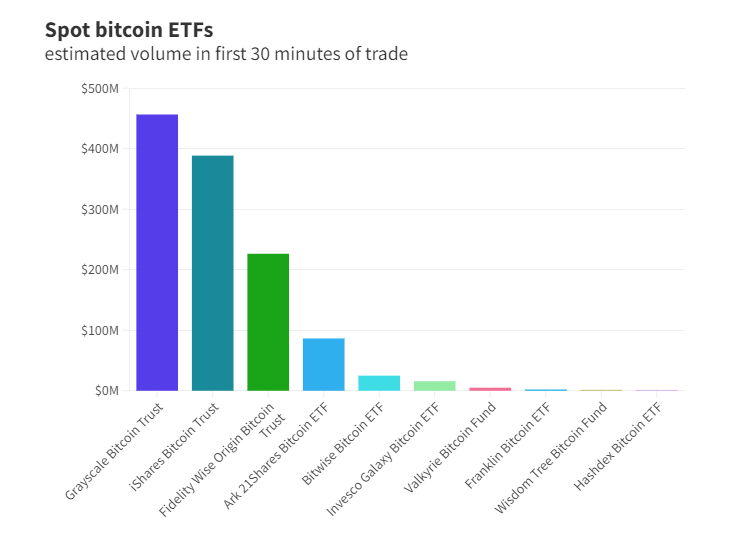

That said, the current bullish trend can only be sustained with robust spot buying volume. In this context, the launch of 11 ETFs on Thursday morning could boost the spot market, as evidenced by the impressive $1 billion in inflows in the first minute of trading – see below, and $4.5 billion over the day.

As the ETF news currently dominates the Bitcoin news cycle, and given the general misunderstanding on X (formerly Twitter) about ETF structure, fund management, and the impact of ETF inflows on spot prices, we will deviate from our usual newsletter format and dedicate the second part of this edition to this topic.

Anatomy of the Spot Bitcoin ETFs

Fundamentally, an Exchange-Traded Fund (ETF) is a vehicle that facilitates access to a specific financial exposure, aiming to track the price of an index. Typically, ETFs trade during market hours, and the issuer then buys or sells the underlying asset to align the fund’s NAV with its market cap – a process known as “rebalancing”. Consequently, inflows into spot BTC ETFs don’t necessarily immediately impact the Bitcoin spot market. This depends on the timing and method of rebalancing. To fully understand this, we need to examine the funds’ structure and operations in more detail.

Breakdown of ETF flows

Firstly, we must clarify the role of Authorized Participants (APs). Fund managers don't directly create or redeem shares; instead, this is done at the behest of APs, who facilitate the trading of shares on secondary markets (NASDAQ, NYSE, etc.) and manage their exposure by trading the underlying assets and shares with the ETF issuer. APs don’t speculate; their role is purely to provide liquidity to the market, aiming to remain market neutral.

APs are typically banks and other large financial institutions with broker-dealer activities and sufficient balance sheet capacity to act as market makers. They have contractual agreements with each ETF issuer, outlining the terms of their collaboration. For example, APs in this scenario include traditional banks with minimal digital asset activities, like Goldman Sachs or JP Morgan, as well as hybrid entities like Jane Street.

On Tuesday the 11th, when the ETFs launched, most trading was internalized within these institutions' books. At 2pm NYT, they settled their net exposure with the ETF issuer by initiating a creation/redemption unit – that is, requesting the creation or redemption of a specific number of shares in exchange for payment. Since the ETFs operate on a cash-creates basis, APs send cash to the ETF issuer at cut-off to settle their exposure, and the issuer then uses this cash to purchase Bitcoin through various channels like OTC desks, Market Makers, Exchanges, etc.

Cash-Creates

The discussion between ETF issuers and the SEC about cash versus in-kind creations, while obscure to many, was significant due to the inherent costs involved in cash-creates. APs settle their exposure with ETF issuers at the end of the trading session, but trades in the secondary markets settle only two days later. Consequently, when APs create shares, they effectively hold two short USD positions for multiple days. This situation is burdensome for two reasons: it reduces their balance sheet capacity, particularly for transactions involving hundreds of millions of dollars in shares, and it incurs funding costs for both positions, roughly 3 basis points per day – though this could decrease if short-term rates fall.

Given that Monday was a market holiday in the US, to avoid incurring funding costs over 3-4 days, APs likely only requested the creation of a fraction of the actual $4.5 billion in shares traded last week. Essentially, most of the 11th's flows were APs short-selling ETF shares to meet buyer demand. However, as Bitcoin trades 24/7, the APs had to hedge their Bitcoin exposure until settlement, primarily through the regulated futures market at the Chicago Mercantile Exchange.

Therefore, the impact on the Bitcoin spot market will be delayed by a few days, when APs cover their positions by requesting ETF issuers to create the shares they're short, using the proceeds to purchase Bitcoin. This will likely involve exchanges, OTC desks, or large-scale individual sellers. Thus, the bulk of the $4.5 billion traded last Thursday will likely hit the market on Tuesday or Wednesday, presenting a tactical opportunity for long positions.

Inventory

Another key aspect is that ETF issuers will predominantly acquire BTC through OTC desks and market makers. Assuming these entities are well-organized and have prepared by purchasing inventory in advance, anticipating demand from ETF issuers, the impact on the market might be limited. Given that the ETF traded volume matched expectations, we can infer that the settlements will primarily involve transferring inventory from OTC Desks/MMs to ETF issuers. This reasoning suggests that part of the recent bullish price action can be attributed to these entities building inventory in anticipation of the ETFs – as hinted at in our cryptic tweet.

However, this dynamic merely postpones the market impact rather than altering it: the more ETF shares sold, the more Bitcoin is withdrawn from the circulating supply.

Outflows from GBTC & MSTR

Another factor potentially contributing to the bearish market behavior at the end of last week may be the shift away from Grayscale's Bitcoin Trust (GBTC). GBTC, which had assets worth $28.6 billion and had been trading at a discount for years, is now less attractive due to the launch of spot Bitcoin ETFs. This is primarily because of its high annual fees of 1.5%, compared to 20 to 39 basis points for competing ETFs[i]. Consequently, investors likely seized the opportunity to switch their GBTC shares for more attractive ETF options, which offer better structures, should garner higher liquidity, and present with lower fees.

However, the trend's continuation is uncertain. Despite the high fees, some investors may choose to stay with GBTC to avoid triggering a taxable event by selling their shares. Moreover, GBTC was not the only securitized vehicle available for investors seeking Bitcoin exposure. MicroStrategy (MSTR, NASDAQ), often trading at a premium to its Net Asset Value (NAV), served as another proxy. Now, with better investment vehicles available, this premium is expected to diminish.

ETF Distribution

The extent of ETFs' distribution will also influence inflows. Key distributors, primarily banks, may be hesitant to allow their clients to invest in the most disruptive financial innovation ever invented. For instance, last week, major firms like Vanguard, Citi, Edward Jones, Merrill, UBS, and Morgan Stanley refrained from offering spot Bitcoin ETFs to their clients[ii]. This decision, while not necessarily stemming from a negative stance towards Bitcoin, could be influenced by various factors, such as ongoing negotiations or due diligence processes.

Nevertheless, client reactions, including account closures and boycotts, may prompt these institutions to reconsider their stance. History shows that if client demand exists, brokers will eventually offer the product. This fact underscores our view that the positive impact of ETF launches on Bitcoin's price will be gradual.

Custodianship

Lastly, we should consider the custody model for these ETFs. Although the specifics are not public information, it seems that there 3 different custody model out there: fully custodian (Coinbase), hybrid, self-custody by the ETF Manager.

IBIT, the product of Blackrock falls in the first category. As they don’t have any experience in managing crypto, and since the KYC process to realize transactions involves top-management hoping on a KYC call – Larry Fink has likely other fish to fry, it makes sense they went for a fully custodian model.

The Hybrid model is predominant in issuers accustomed to handling private keys, e.g. Ark/21S. In practice it means they can unilaterally sign and broadcast transactions to whitelisted addresses but need Coinbase’s signature to transact with other addresses. This allows them to easily transact with OTC desks and Market Makers (whitelisted addresses) to manage their fund, but at the risk of internal errors/attacks.

To our knowledge, the last model only concerns Fidelity. Fidelity is an early comer in the bitcoin space and already has experience in bitcoin custody, hence their choosing of handling their keys themselves. However, it seems they use an omnibus account, i.e. store all their bitcoin in the same set of addresses, which could be a problem in the case of bankruptcy since getting back the bitcoin will ultimately depend on the seniority of the claims…

Whatever the model considered – apart from Fidelity, it creates an unhealthy concentration of coins in the hands of Coinbase, therefore putting one big Damocles Sword above the whole bitcoin ecosystem.

Conclusion

The boomers and fiat overlords are joining the party. They now have an ad hoc vehicle to gain bitcoin exposure, and this could help further bitcoin adoption in many regards. First, having the lobbying department of BlackRock, Fidelity, ARK, and Co. on your team might prove helpful, especially so at a time when diehard socialists such as Elisabeth Warren resume their crusade against the exchange of elliptic keys over telecommunication channels. Second, as your dad’s pension fund buys some IBIT, BlackRock will scoop off coins from the circulating supply, thus helping bitcoin further grow in price and liquidity.

Yet, these folks will own a conduit, nothing more. Redemptions in bitcoin are not possible and these assets are everything but censorship-resistant. It’s an ersatz of the right stuff. From a technical standpoint bitcoin is a marvelous technology offering anyone in the world financial self-sovereignty whilst, as Theo Pantamis, our cryptographic mastermind, explained on a French speaking Twitter space last Friday, “ETFs are basically WBTC on an AWS server administered by the NYSE”.

Therefore, the ETFs are about NGU, nothing more; but bitcoin is much more than that. What makes honeybadger what it is, is not only the scarcity of the supply, but more importantly the censorship-resistance aspect of bitcoin, which can only be enjoyed when one holds his own keys. As Allen Farrington recently wrote, “Wrapping bitcoin in an ETF is rather like marveling at the internal combustion engine so much that you parade one around in your horse and carriage”[iii].

I want to make sure the distinction is clear in the mind of the reader, but I am not here to ruin the party. ETF holders will be the useful idiots of hyperbitcoinization, and we will like it. As we explained in this piece, the road from buying ETF shares to bitcoin pumping is rather convoluted, so don’t scream market manipulation too hastily when you see ETF inflows and bitcoin dumping.

These bitcoin ETFs offer some of the most well capitalized investors in the world a gateway to bitcoin exposure, but it ain’t Internet Magic Money. Shall we hope they serve as a gateway drug? That, once hooked-up on NGU, their holders will want the right stuff?

Difficult to say. After all, many will prefer the ETF over bitcoin for fiscal, legal, and practical reasons. However, if you have the choice anon, don’t purchase 21st century technology packaged in a 20th century envelope.

New wine in an old bottle is too cheap a trick to fall for.

[i] https://www.forbes.com/sites/digital-assets/2024/01/11/bitcoin-etf-scorecard-grayscale-tops-trading-volume-but-how-much-were-redemptions/?sh=c116b4f20929

[ii] https://www.cryptoglobe.com/latest/2024/01/bloomberg-etf-analyst-explains-why-crypto-community-should-not-be-hating-on-vanguard-and-predicting-its-demise/

[iii] https://www.linkedin.com/pulse/open-letter-prospective-buyers-bitcoin-etf-allen-farrington-mvore/