LN Markets Alpha #7

For as long as fiat has existed, it has fuelled the most ridiculous bubbles and triggered the craziest speculative manias.

Short-Term Outlook: "Go with Flows"

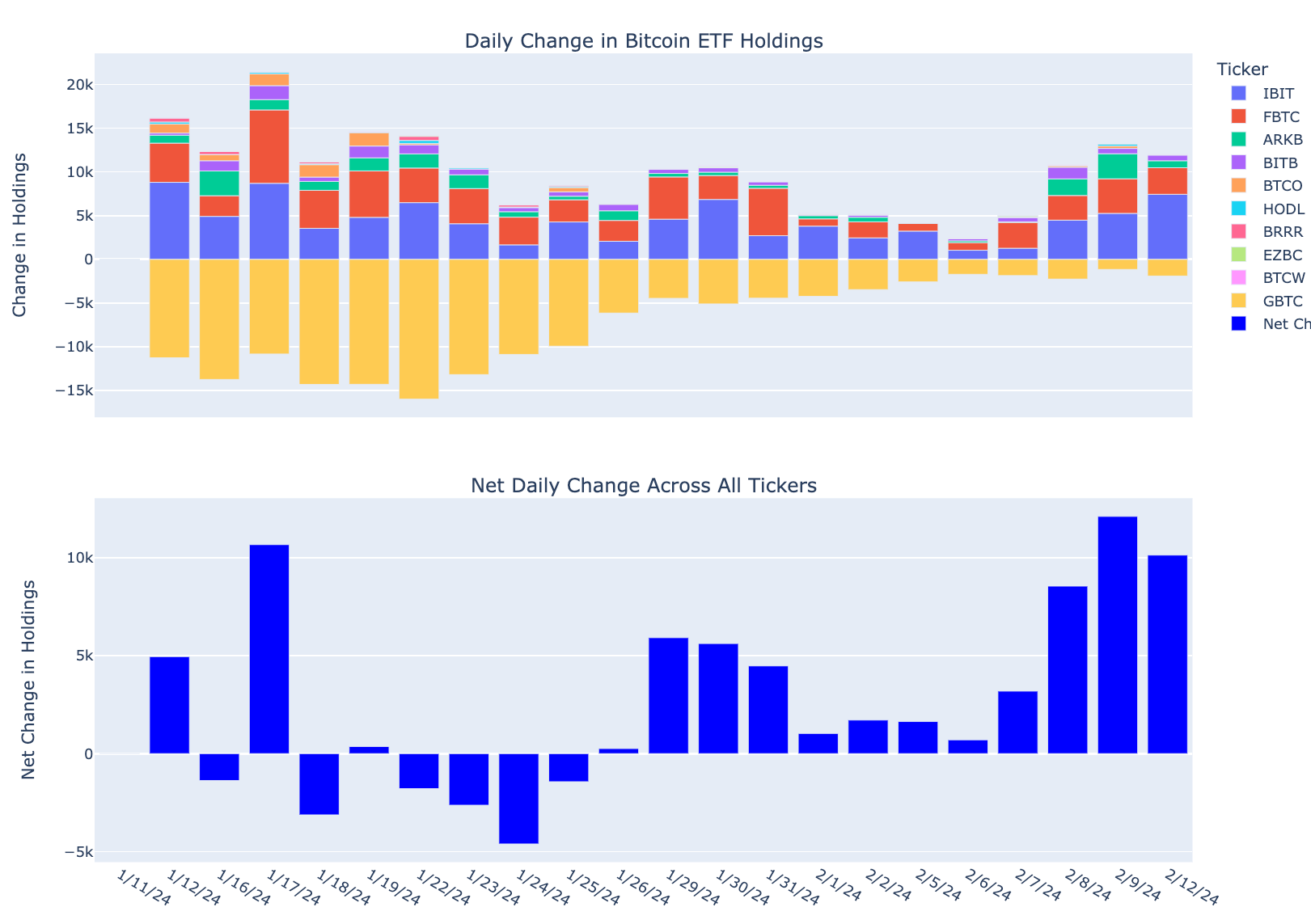

Well, our last forecast was embarrassingly off the mark... While we braced for a continuation of the consolidation phase, Bitcoin decided to throw us a curveball, soaring ~20-25% and shattering its previous local high to hit the $52K threshold, a pinnacle unseen since the tail end of 2021. Our misjudgment was twofold: we overestimated the impact of ongoing GBTC redemptions and underestimated the increasingly bullish trend in ETF flows. It turns out, trend dynamics often trump raw numbers.

As illustrated in the figure below, the pace of GBTC redemptions was decelerating while inflows into other ETFs were picking up speed, effectively gobbling up around ten thousand bitcoins daily last week.

At this juncture, barring specific cases like Gemini's holdings – as discussed in our previous edition, it seems reasonable to conclude that the majority of GBTC redemptions are now in the rearview mirror.

Can the influx into other spot ETFs maintain last week's momentum? If so, we're looking at $120 billion of net buying per year, a staggeringly high figure for a market of this magnitude. While this estimate may seem a bit exaggerated, it underscores the potential for significant price appreciation in Bitcoin if the current buying frenzy sustains even a fraction of its recent pace.

Contrary to our expectations for Bitcoin to catch its breath before reigniting its bullish trend, the timeline has accelerated, and it appears we're already stepping into the bull market's early stages.

In other words, we're approaching a phase where turning off your brain could prove to be a highly profitable tactic. During Bitcoin bull runs, seasoned traders often miss out on gains due to excessive caution. They lock in profits at high RSI levels, or when market euphoria peaks, and then wait for a re-entry point that never materializes. Don't be that person; learn to harness your inner maverick, my fellow degens.

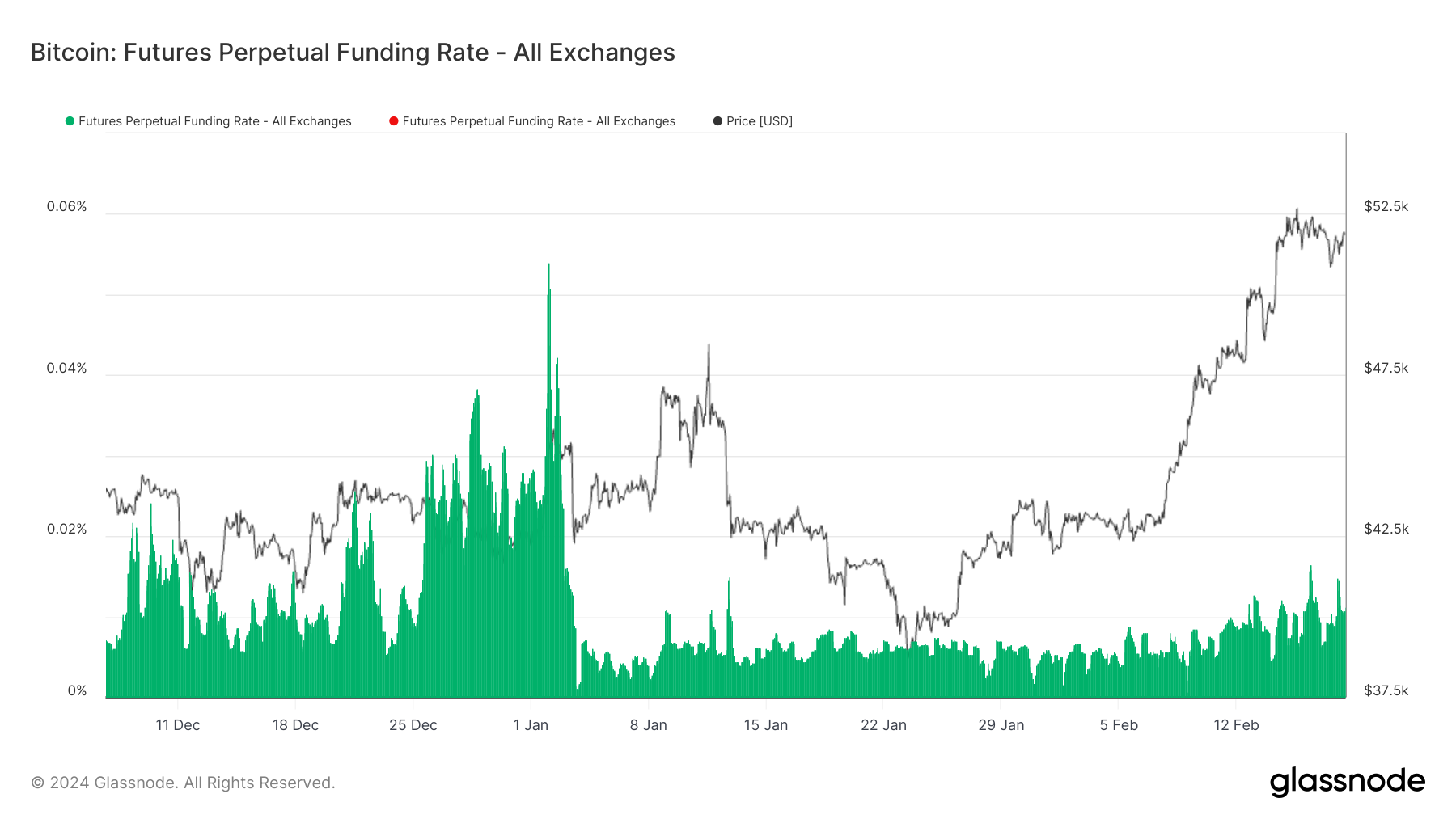

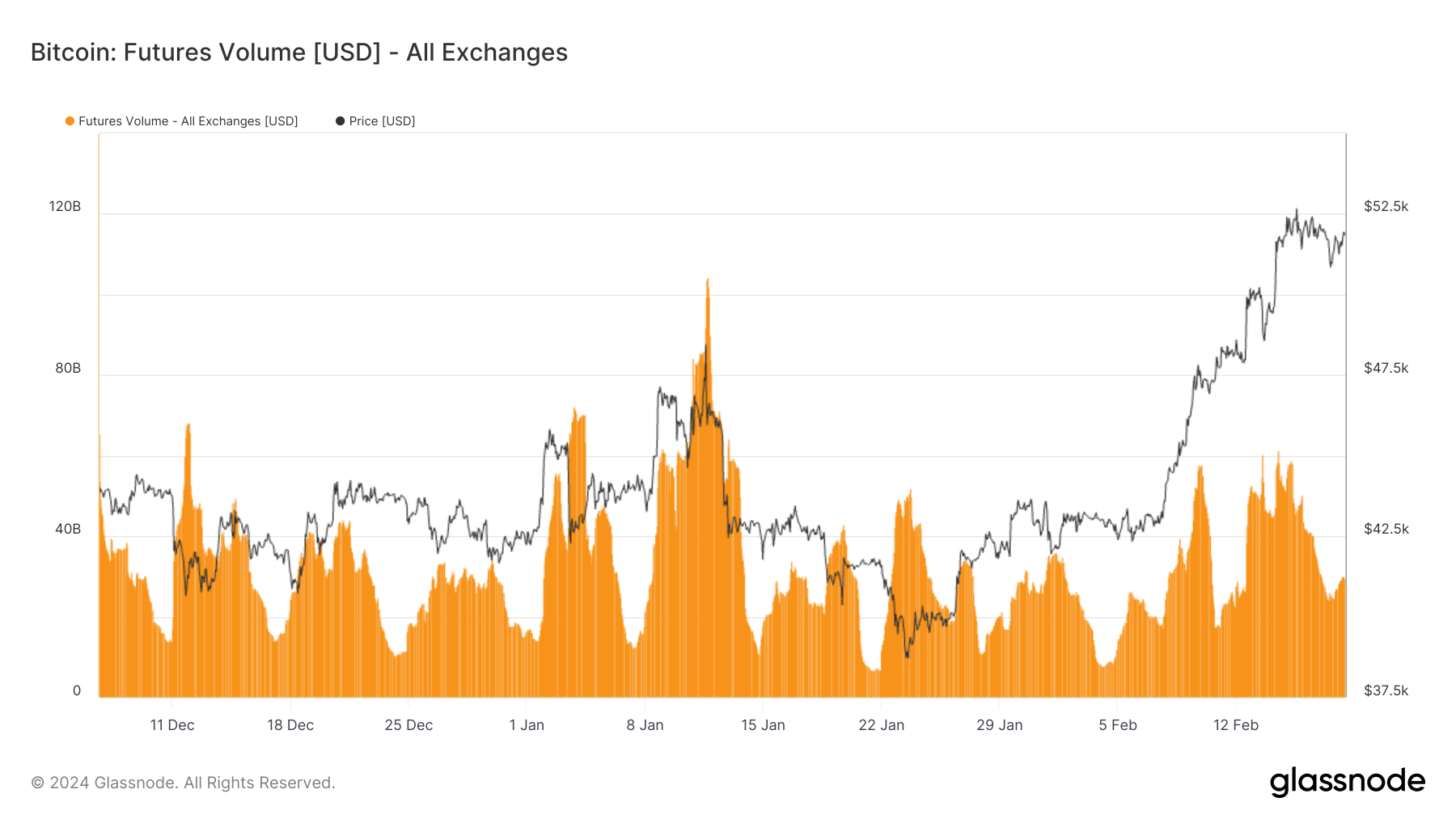

A peculiar aspect of the current market climate is the absence of typical signs of overheating, aside from the bullish price action itself.

Funding rates remain surprisingly low – as highlighted above, futures and options volumes are consistent with recent trend.

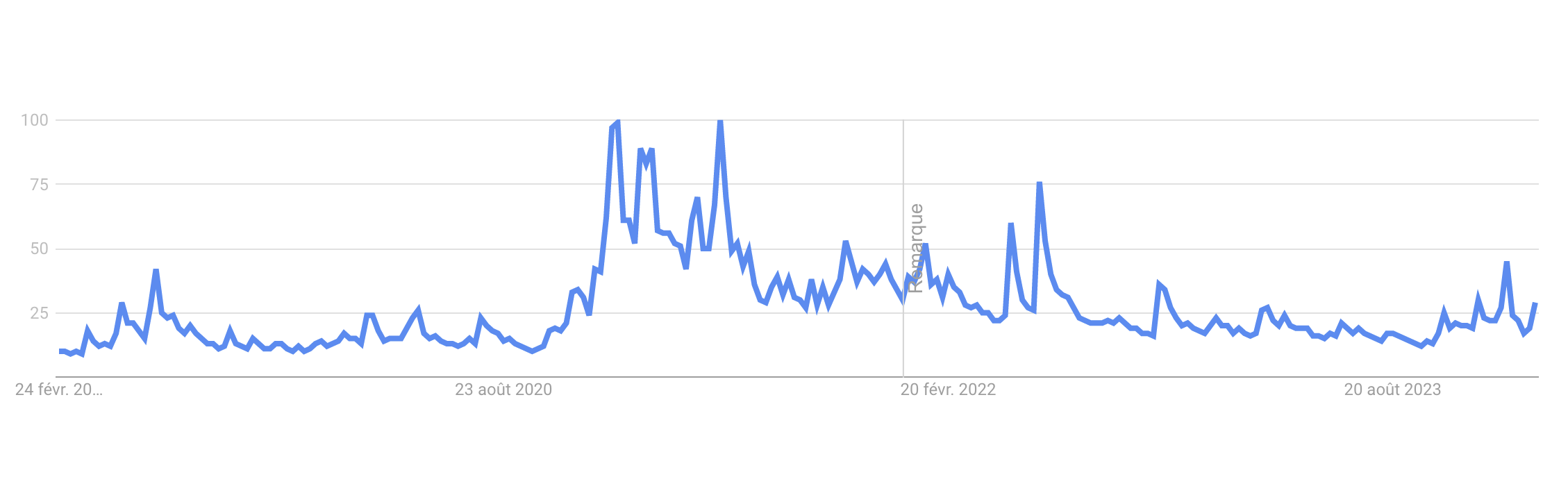

And public interest is far from peaking, as evidenced by Google Trends data for "Bitcoin" in the US - see below.

This suggests that the market's momentum is primarily fueled by heightened demand through ETFs and a scarcity of spot Bitcoin available at current prices, indicating that this rally could have legs in the short term.

Medium-Term Outlook: "Weimar Intensifies"

Yet, despite our previous misgivings, every piece of untainted data screams of an ailing economy, a commercial real estate sector in shambles threatening to bring down multiple banks in its fall, a Chinese economy mired in a severe credit crunch, and an inflation problem that's anything but resolved.

But as we've repeatedly hammered home in these pages: honeybadger doesn’t care. In fact, these calamities only signal the likely resurgence of the money printer, further diminishing the appeal of bonds and thereby hastening the shift of financial capital towards assets of true scarcity: stocks, gold, and Bitcoin. Indeed, the market vibe is eerily reminiscent of early 2021. Recall the days of GameStop, AMC, YOLO, "stonks", and Barstool Sports' random Scrabble-letter stock picks?

Allow me to introduce Super Micro Computer (SMCI), a Nasdaq-listed firm specializing in Cloud & Big Data infrastructure, which recently unveiled a product designed for AI, leading to a tenfold stock price surge in about 300 days – see below.

Its daily RSI hit 97, setting a new record for US-listed companies, with the market valuing it at 60-70 times earnings.

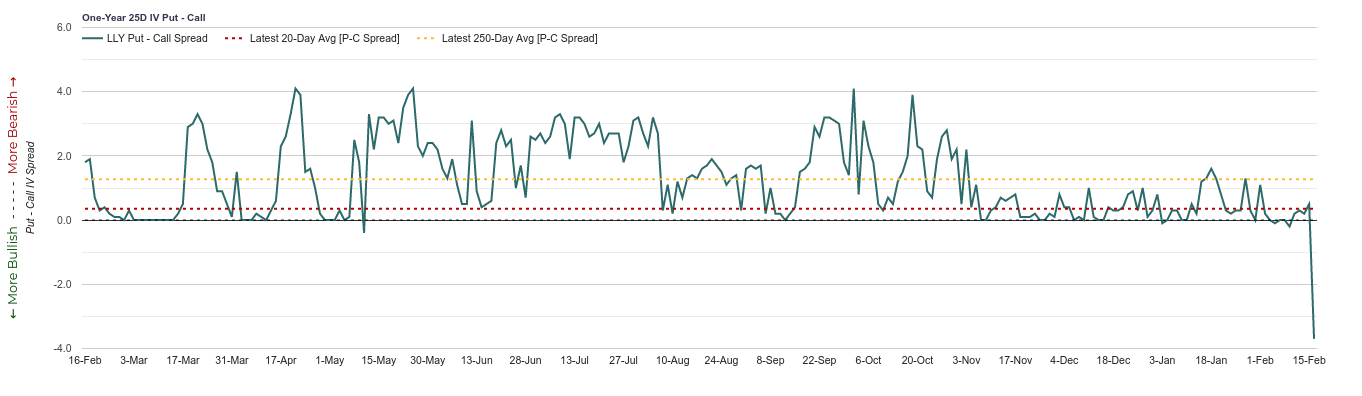

Then there's US-based Eli Lilly (LLY) and Denmark's Novo Nordisk (NOVO), collaborating on an anti-obesity drug, both smashing records, respectively ranking 9th in market cap size in the US Stock Market and 1st in the European Stock Market, the latter outranking even LVMH[i]. Eli Lilly's options market is overwhelmingly one-sided, with its stock price trajectory going parabolic - see below.

NOVO's performance is equally staggering, with a tenfold increase in roughly 5 years, all while maintaining a steady ascent without significant corrections.

Both companies have respective P/E ratio of ~56 and ~36, whereas the average for pharmaceuticals is approximately 18.

Both companies boast P/E ratios of ~56 and ~36, dwarfing the pharmaceutical average of about 18. For context, LLY's P/E ratio rivals that of Tesla, and NOVO's is on par with NVIDIA's, both darlings of the growth tech stock enthusiasts.

Hopium peddlers will tell you we're on the cusp of a new era, where AI and gene therapy will revolutionize society, suggesting these astronomical valuations barely scratch the surface of these technologies' potential.

Yet, remember the tales of Netscape and AOL? Pioneers of the "Internet" era, yet ill-positioned to harness the transformative power of the web, unlike the later successes of Amazon, Google, and Apple, which largely flew under the radar during the dotcom bubble.

Is it rational to pretend the market is accurately pricing in the future, assigning record valuations to companies whose existence could be upended by various events, such as a single missile strike on Taiwan, or an FDA ruling?

Investing 30 to 50 times earnings in a company that may (or may not) lead a technological revolution is far from prudent. It smacks of bubble territory.

Does this mean a crash is imminent? Not necessarily. We might just be witnessing the beginning of Western economies' Weimarization.

Indeed, paying such prices for these companies is crazy, but it might be less so than holding western government bonds, or even worse, western fiat. As we wrote in LN Markets Alpha #2:

We could see investors paying absurd PE ratios to own equities, not so much because of “absolute value”, but rather because it will be relatively better in terms of risk reward to own Microsoft at 40x earnings than to own a debt claim against a government swamped in a debt trap

In the early 2000s, the bubble was distinctly tech-centric, inflated by Greenspan's rate cuts. Now, the bubble permeates everything: real estate, art, luxury goods, pharma, AI stocks, BRC-20 tokens, shitcoins, with money printers running full tilt to prop up OECD bond markets. This has led to an absurd bidding frenzy for society's most dubious assets, powered by endless money printing.

As many authors, from Stefan Zweig to Adam Fergusson and Charles Kindleberger, have shown in their writings, hyperinflationary episodes often start with financial bubbles popping left and right. In such periods, astute investors often recognize the bubbles and sit on the sidelines, only to later succumb to the FOMO and join the merry speculative crowd at even more ludicrous prices.

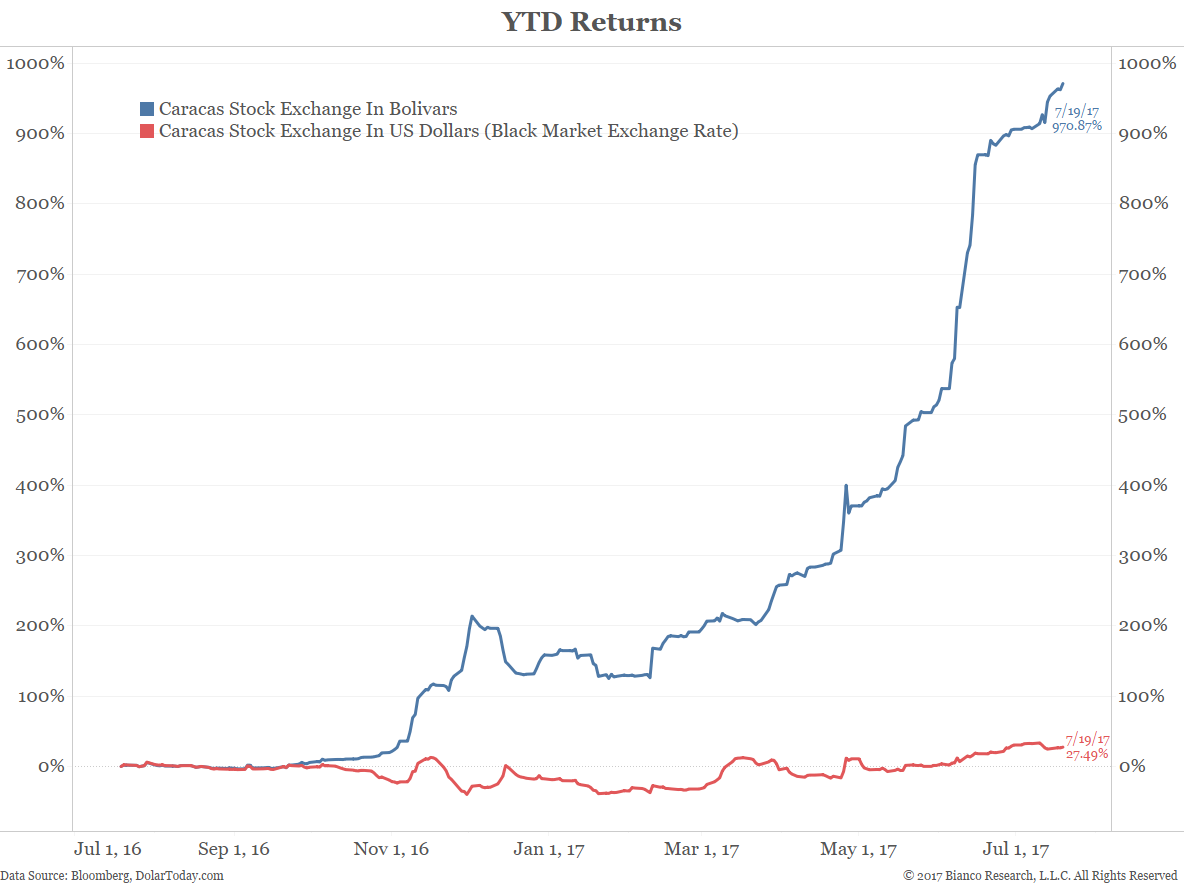

Below are other instances of the [Insert Hype Concept] revolution:

Just kidding! The first chart is the main Turkish stock market index (TUR) in Turkish Lira (TRY), and the second is the Venezuelan stock market during the recent Bolivar hyperinflation, in Bolivar terms (blue) and USD terms (red).

Nothing new under the sun. For as long as fiat has existed, it has fuelled the most ridiculous bubbles and triggered the craziest speculative manias.

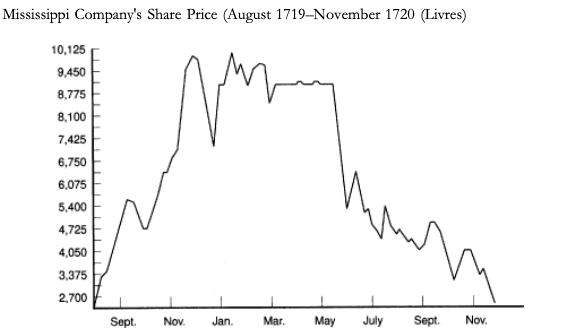

Already in 18th century France, when the royal treasury was swamped in debt, John Law Lauriston managed to convince the Duke of Orleans to introduce fiat money, therefore creating a stock market miracle. The Mississippi Company’s stock, whose principal shareholder was Law himself, and which had a monopoly on the exploitation of French colonies in America, skyrocketed in a few years thanks to an unbridled monetary inflation brought by Law’s system. Law’s policy of monetary devaluation combined with programs to buy back the company’s stock with newly printed money – yeah QE is 3-century old, sent the share price to the moon, even though the company didn’t really have meaningful revenues, productive capital, or economic activity yet.

In this instance also, it fueled a speculative mania with nobles and low-born alike coming to the open-air exchange rue Quimcampoix in the center of Paris to trade its shares. In its account of the event, a clerk of the British Embassy, Pyot, wrote that:

“The rue de Quinquempoix, which is their Exchange Alley, is crowded from early in the morning to late at night with princes and princesses, dukes and peers and duchesses etc. in a word all that is great in France. They sell estates and pawn jewels to purchase Mississippi.”

Barely a week later he commented that:

“All the news of this town is of stock jobbing. The French heads seem turned to nothing else at present.”[ii]

Conclusion

As Ernest Hemingway once wrote, when describing the process of going bankrupt, it happens “Gradually, then Suddenly”. As Parker Lewis did, by using it as the title of his (awesome) article series[iii] – recently turned into a book, we would convene that the demise of fiat and the ascent of Bitcoin will also happen “gradually, then suddenly”.

For now, we remain in the “gradually” phase, but many of the anecdotal fact incorporated in the present newsletter hint at an acceleration of this first act of the inflation story. In 2021, speculative mania was fueled by lockdown boredom and enough money printing to give Augustin Carstens his weight in $100 bills. Now, we're witnessing a similar frenzy in the stock market, albeit against a different backdrop. Investors anticipate rate cuts, new bank bailouts, and Chinese stimulus, yet we're far from the liquidity deluge of 2020-2021.

The market seems convinced that fiat currencies and bond markets are doomed, preferring to own anything at any price in anticipation of the money printer's return. It could well mean, that “it’s not the end, not even the beginning of the end, but perhaps, the end of the beginning”[iv] of the demise of the current fiat system.

In such environments, everything will entice you to partake in the global speculative orgy; FOMO is a powerful driver. Yet the wisest course might be to stack (as hard as you can) units of the next global currency, because when the “suddenly” part of the story will unfold, all the “up and right” charts included in this edition will invert when priced in sats.

[i] https://www.reuters.com/business/healthcare-pharmaceuticals/eli-lilly-novo-nordisk-get-growth-stock-status-weight-loss-drug-boost-2024-02-16/

[ii] « John Law, Economic Theorist and Policy-Maker », Antoin E. Murhpy, https://dl.abcbourse.ir/dl/Library/book/%5BAntoin_E._Murphy%5D_John_Law_Economic_Theorist_and.pdf

[iii] https://graduallythensuddenly.xyz/

[iv] Excerpt from a speech delivered by Sir Winston Churchill on November 10th 1942 in reference to WWII.