LN Markets Alpha #2

In the Bitcoin market, caution meets optimism short-term amid active price and leverage. Imminent ETF approval seems likely with Binance's SEC development. A changing global order and US-China tensions underscore the need for a neutral currency. An unusual recession looms, possibly favoring Bitcoin.

Overview

- The current dynamics of price action and leverage in the Bitcoin market call for a prudent yet cautiously optimistic stance in the short term.

- Recent developments, including the Binance settlement and ongoing dialogues between ETF applicants and the SEC, strengthen our anticipation of ETF approval in the coming months.

- In the context of a shifting global order and a burgeoning Cold War between the US and China, the demand for a politically neutral reserve currency is intensifying.

- Current economic indicators suggest an impending recession, which we believe will have unique characteristics compared to traditional downturns, potentially benefiting Bitcoin's wider adoption.

Short-Term Outlook

In our previous edition, we highlighted the overbought condition of the market and the risks associated with momentum traders aggressively pushing prices higher using leverage, setting the stage for potential liquidation cascades.

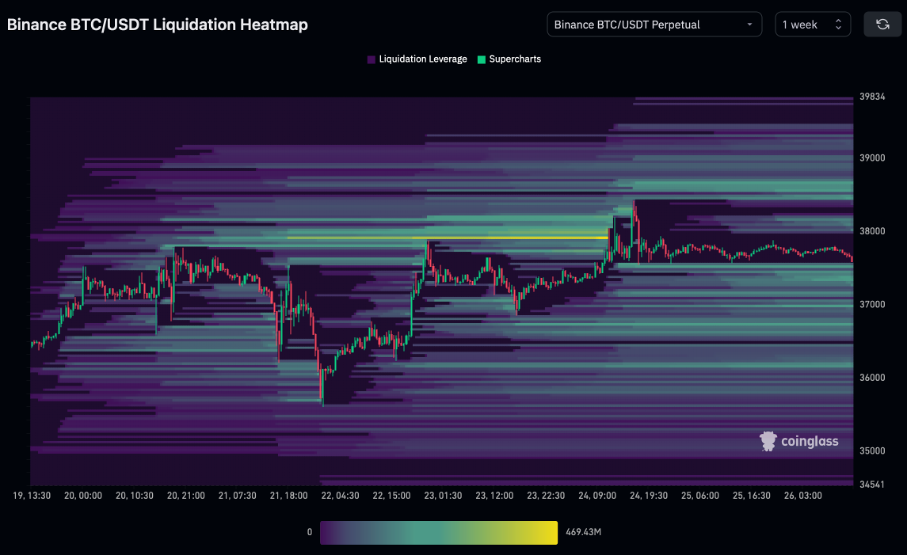

Indeed, over the following 10 days, we witnessed three significant dips, the first of which erased around $87M in long positions – see chart below. Typical of sharp deleveraging events in upward trends, Bitcoin found its footing after each dip and regained most of its lost ground. However, each recovery attempt faltered near the $37.5K - $38K range, a crucial zone congested with take-profit orders, stop losses, and short liquidations, until last Friday when the resistance at $38K was finally breached.

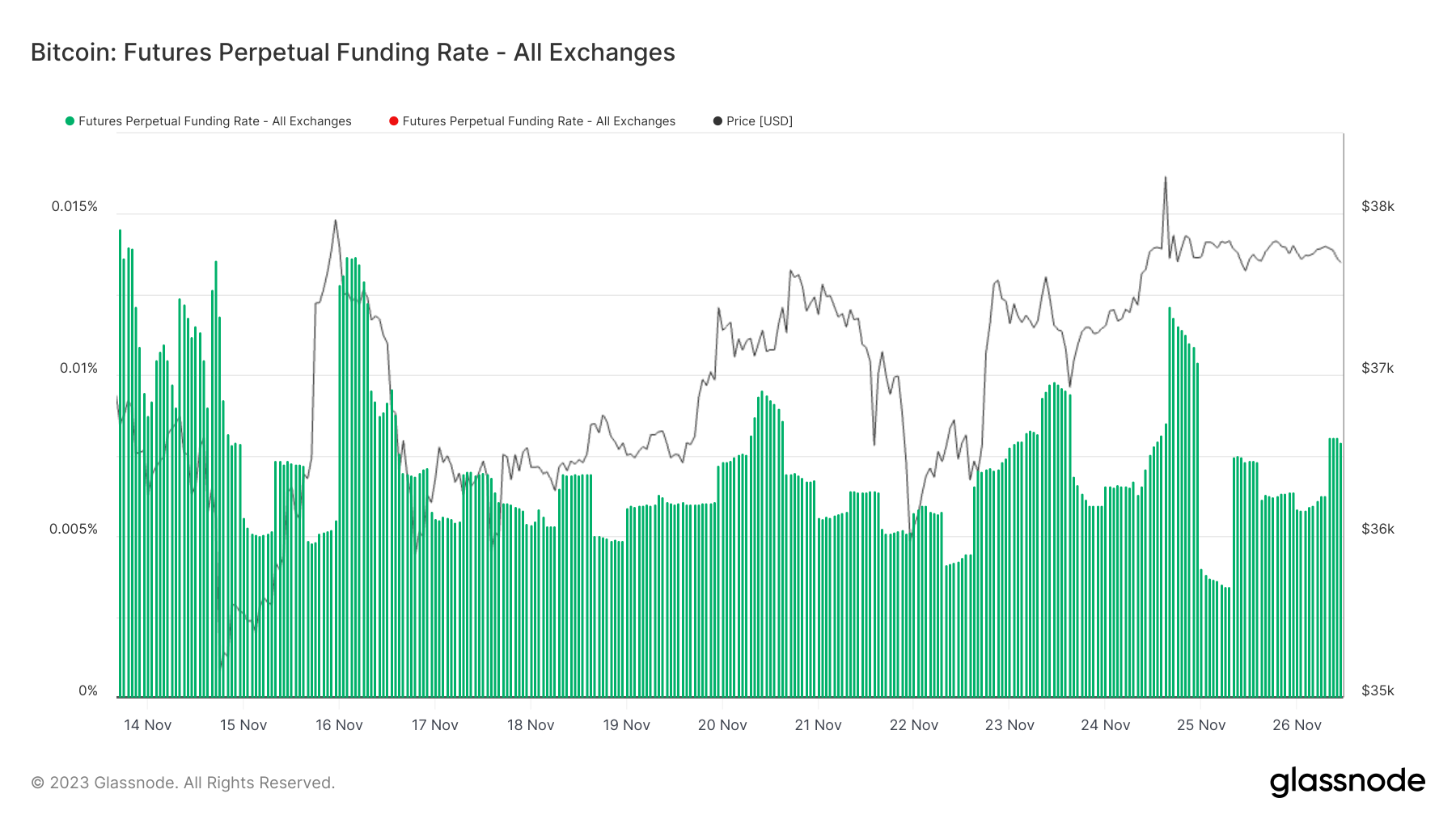

The funding rate dynamics suggest that this breakout led to a squeeze on short positions and encouraged leveraged buying, causing the funding rate to spike alongside the price. This created a fragile market structure that eventually gave way, pulling prices back to the mid $37K region.

Currently, while Bitcoin hasn't decidedly broken out of its trading range, it hovers at the lower boundary. The reduction in leverage sets a more stable foundation for a potential continuation of the upward trend.

From a technical analysis perspective, there's a possibility we're forming a bearish expanding triangle – see chart above. A revisit to the lower bound, around $36K, might trigger a sell-off towards the critical $32K support, echoing the market dynamics post the Silicon Valley Bank crisis – see chart below.

On the flip side, a push towards the higher bound could see us reaching our $40-42K target for profit-taking. While we don’t advocate for reliance solely on technical analysis to forecast trends, these levels appear suitable for setting stop-losses and take-profit orders.

This outlook aligns with insights from the Coinglass Liquidation Heatmap, which indicates a higher likelihood of long liquidations on a downward move and less potential for short squeezes around the $38K mark. In essence, a period of consolidation at $37K appears more probable than an immediate surge. If Bitcoin stabilizes here, forming higher lows, it could lay the groundwork for an ascent towards the $40K-$42K zone.

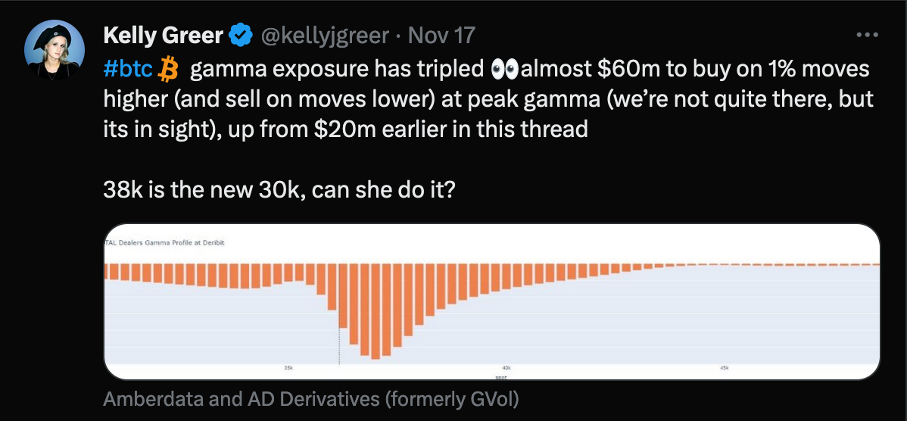

The role of option dealers at the $38K level is also noteworthy. As Kelly Greer notes, net gamma exposure for option dealers was significant at this price point, with a $60M adjustment needed for every 1% price change to maintain their hedge. However, it's important to be cautious with this data, especially since approximately $3 billion in options expired last Friday, potentially altering the gamma exposure landscape significantly.

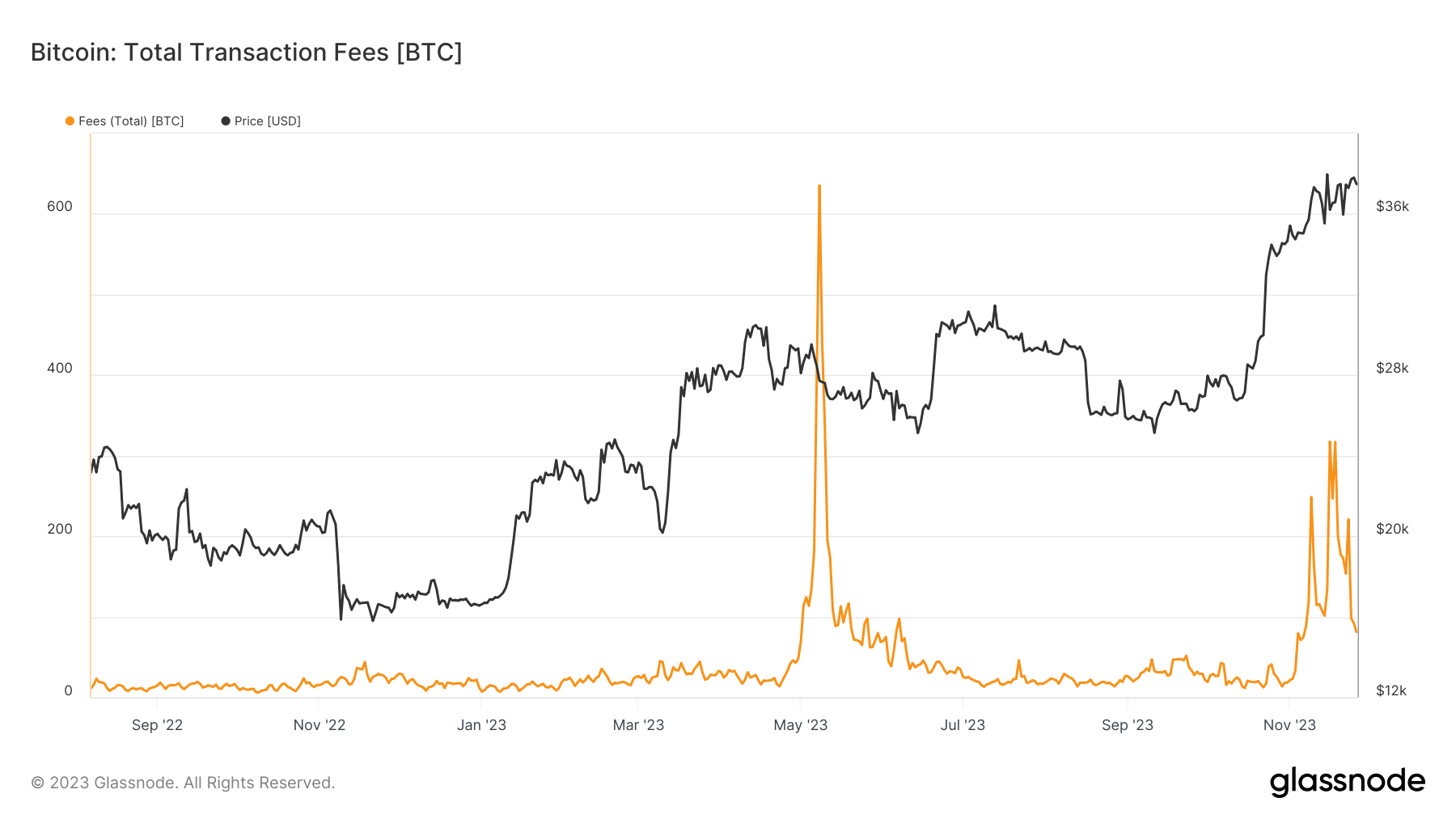

Lastly, it’s crucial to address the recent spike in transaction fees. Initially, this increase can be detrimental as it leads to more coins being sold by miners to cover expenses and does not necessarily indicate a heightened demand for Bitcoin as a currency. Instead, it's largely a byproduct of the recent market pump, fueling activity among JPEG traders and BRC-20 enthusiasts. High transaction fees can hinder Bitcoin’s price growth by deterring new entrants due to prohibitive costs, and it also gives critics ammunition to challenge Bitcoin's efficiency and relevance.

However, it's important to distinguish the short-term market reaction to fees from the medium and long-term outlook. In the longer term, the answer to high fees is paradoxically higher fees, which we're already seeing stabilize. Episodes like this dispel concerns about Bitcoin's security budget and likely hasten the adoption of Layer-2 solutions like the Lightning Network.

Medium/Long-Term Outlook

Binance vs. US Government

Regarding the ETF landscape, there have been significant developments hinting at a possible SEC approval of Bitcoin spot ETFs. A notable event is the resolution of the dispute between CZ/Binance and the Department of Justice. The settlement includes CZ stepping down as CEO, a hefty fine of $4.3 billion for Binance, and a commitment to a five-year monitoring period by an external observer. This development is pivotal, considering the SEC's concerns about potential market manipulation in the Bitcoin arena[I]. With Binance, a major player in Bitcoin spot and futures trading, now under closer scrutiny, this could ease Gensler’s apprehensions and pave the way for U.S. exchanges and financial institutions to dominate Bitcoin trading, especially post-ETF approval.

ETF Creations

Eric Balchunas, a renowned ETF analyst, reported that the SEC is in discussions with ETF applicants and broker-dealers about the possibility of cash creations instead of in-kind creations, which most Bitcoin spot ETF applications currently propose. In ETF terms, "creations" refer to how new ETF shares are generated by Authorized Participants. Typically, these participants, usually major financial institutions, provide either cash or the underlying asset to facilitate new share creation. The SEC's preference for cash dealings is understandable, given the complexities and regulatory challenges associated with handling Bitcoin directly.

There's ongoing resistance to this shift from applicants, mostly because in-kind creates will increase their operating costs, but the intense negotiation over such minutiae suggests that major disagreements are narrowing, hinting at potential imminent approvals.

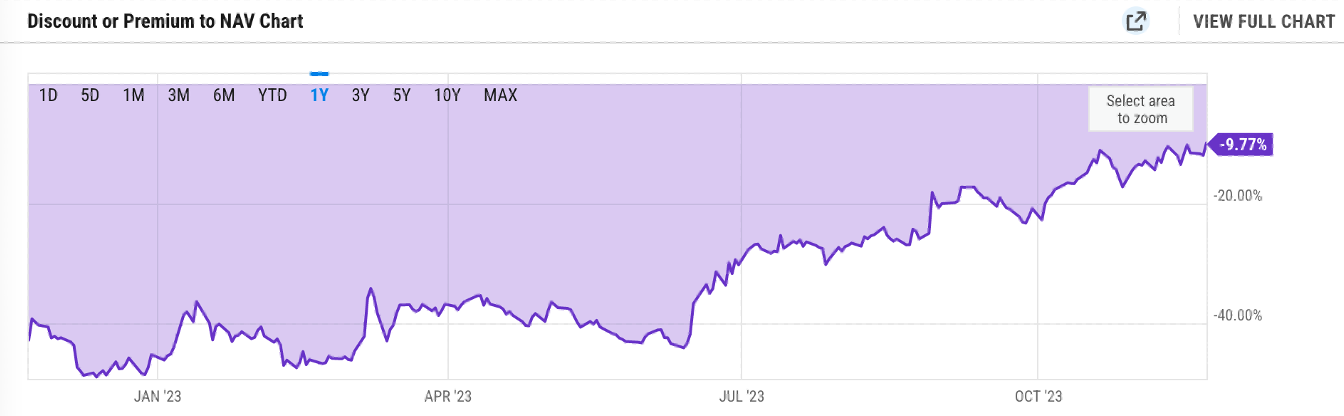

The GBTC premium's recent rise to its highest level since August 2021 also signals market anticipation of the trust's conversion into an ETF soon.

Erosion of the USD's Global Status

In the previous edition we wrote that:

“[…] shifting geopolitical dynamics indicate that the current U.S.-led world order may be nearing its end. BRICS nations are working on alternatives to the U.S. dollar, and conflicts in Palestine and Ukraine could reshape alliances in resource-rich regions”

Hence, the recent announcement that China and the Kingdom of Saudi Arabia are opening a $7Bn currency swap line does not come as a surprise[ii]. Earlier this fall, China already unveiled a 27-year LNG supply deal with Qatar[iii].

Xi Jinping made clear through his speeches that it’s only a matter of time before China makes a move on Taiwan[iv], and since the US showed their playbook in early 2022 with the freeze of Russian foreign exchange reserve and trade sanctions[v], the communist leader knows how to prepare for war: reduce dependance on the USD and secure supply of critical commodities such as oil through bilateral trade agreements. The best US assets in this emerging cold war are its control over financial rails (SWIFT mostly) and oil routes (Ormuz and Malacca straight for instance), and China is currently working in circumventing those.

Besides, many southern nations have been unpleased with the weaponization of the USD by Uncle Sam, are holding underwater USG securities, and are sick of Americas hypocrisy, best exemplified by its propensity to enforce rules on the global stage it doesn’t itself follows. Therefore, commodity rich nations could become more receptive to China’s overtures and hoping for better deals than those struck with the US.

The Ugly Macro Picture

Since the Fed initiated interest rate hikes in early 2022, predictions of a looming recession have been widespread. While the timing of these forecasts may have been premature, the underlying analysis remains valid. The effects of monetary tightening often lag, and the impact of recent Federal Reserve policies has been somewhat offset by fiscal excesses [vi], the draining of the Reverse Repo facility[vii], and the Bank of Japan's substantial printing under its Yield-Curve Control policy[viii].

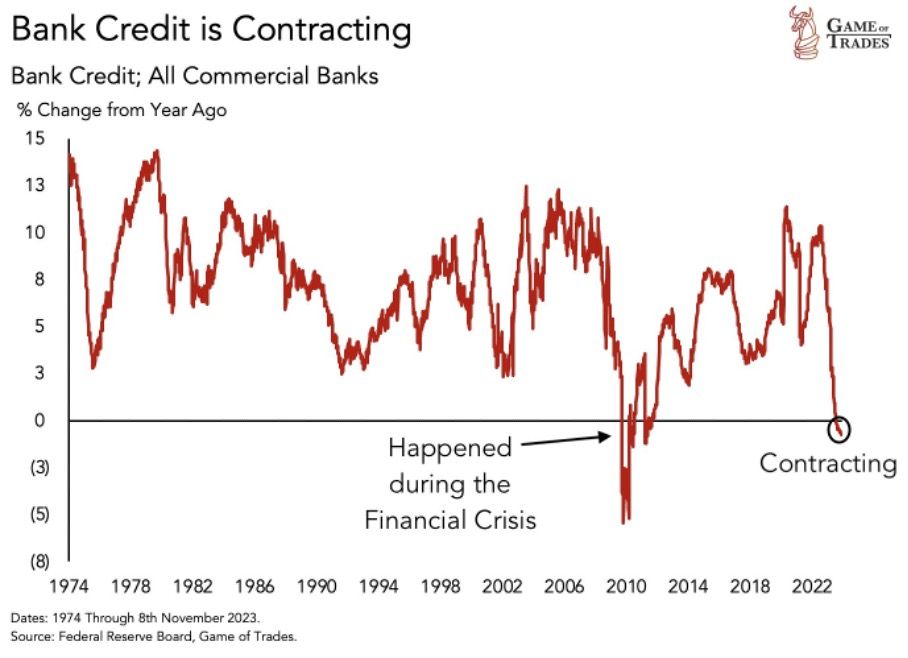

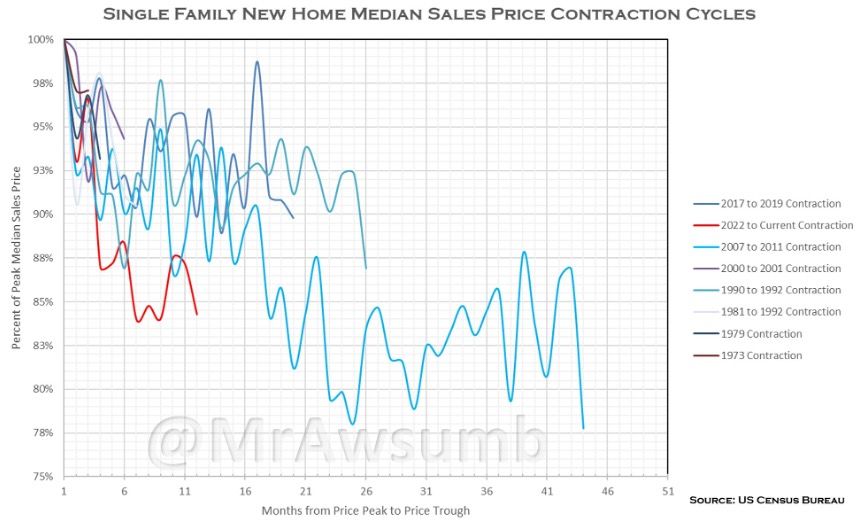

Recent economic indicators are now showing signs of strain: a significant drop in shipping volumes, record contraction in home sales – see below chart, shrinking bank credit – see above chart, declining non-farm payroll figures consistently revised downwards [ix], and global PMIs on the downturn [x].

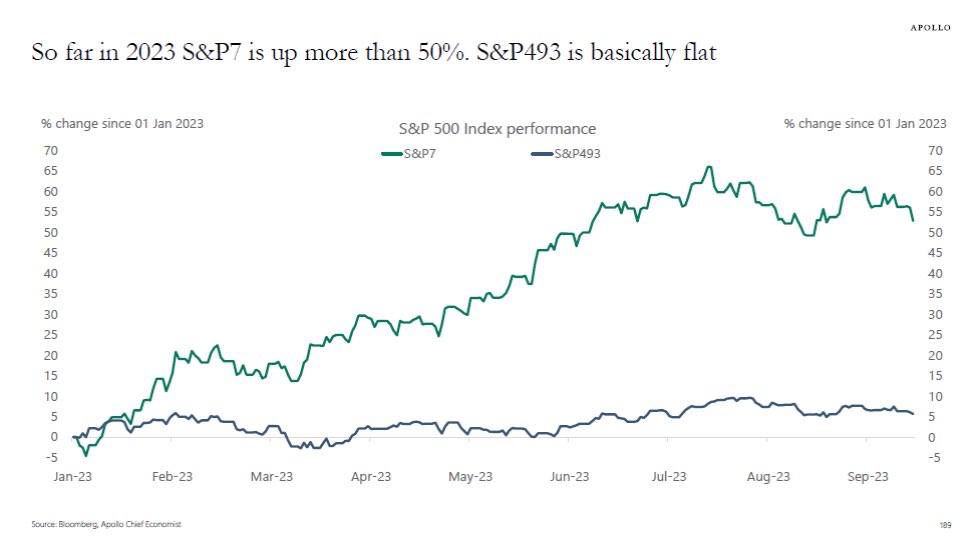

Despite these indicators, investor sentiment has remained somewhat optimistic, buoyed by the resilience of stock market indices. However, a closer look at the S&P 500, excluding the magnificent seven (Alphabet, Apple, Meta, Amazon, Microsoft, Nvidia, Tesla), reveals a less rosy picture.

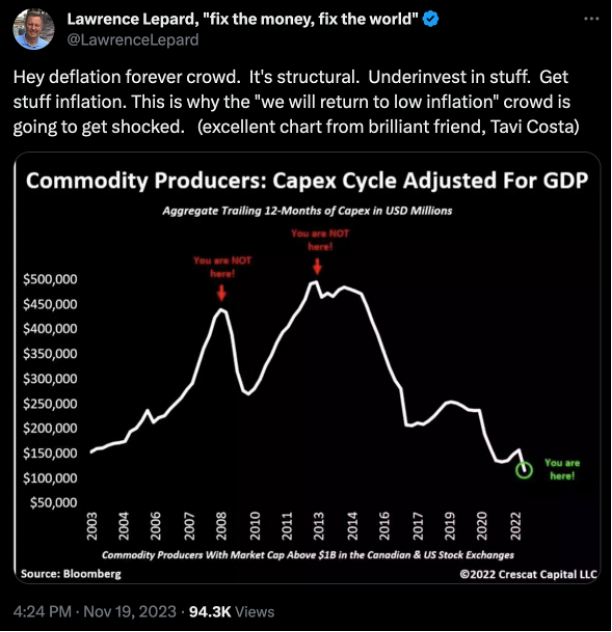

Yet, the current economic challenges differ from past recessions. The central issue is not credit deflation but a combination of sovereign debt crises, a shifting global order, and a lack of productive capacity due to price distortions discouraging savings and real economic investment.

In these conditions investors, needing to park their assets somewhere, may find equities more appealing despite absurdly high P/E ratios.

Indeed, investors can buy short-term debt or money market fund shares as it is currently a good bargain, but in a recession the FED will ease rate, thereby collapsing the front-end of the curve, while inflation will stay elevated long-term as easing monetary policy won’t solve the under-capacity problem, thus making long-term bonds unappealing and possibly forcing investors toward equity overallocation.

In this scenario, we could see investors buying overpriced equities, not so much because of “absolute value”, but rather because it could be a relatively better risk reward arbitrage to own Microsoft at 40x earnings than owning a claim against a government swamped in a debt trap. The recent performance of the largest caps in the Nasdaq and S&P500 might well indicate that this trend has already started.

This framing is also very bullish for Bitcoin in the long-term, and we believe it partly explains the renewed institutional interest for the orange coin. Indeed, if governments bonds are a no-go, equities are relatively better but still highly overbought, and commodities are riddled with political and geopolitical risks, all the while we enter secular stagflation, investors could consider rebalancing their portfolio towards gold, bitcoin & energy.

Conclusion:

In the short term, our outlook for the Bitcoin market remains relatively unchanged. Significant movement is unlikely unless there's progress on the ETF front or a breach of either the $38K resistance or the $36K support level of the expanding triangle. Given Bitcoin’s tendency to trend strongly at the onset of bull markets and a more sustainable leverage structure, we lean slightly bullish.

The medium-term scenario is more complex. ETF approval appears imminent, but signs of an impending recession are increasingly evident. Bitcoin's performance in a recession is unknown territory, and it could initially suffer from a slowdown in demand. However, it may later excel as fiscal and monetary responses to a recession or disruptions in key financial systems like the bond market create a favorable environment for Bitcoin.

Looking long-term, the outlook is decidedly bullish. The macro environment, marked by a changing global order, fiscal recklessness in the West, China and Japan's stimulus measures, and the weakening status of the USD as the reserve currency, seems ripe for further Bitcoin adoption. With the fourth Bitcoin halving approaching in six months, reducing supply even further, the stage is set for significant appreciation.

As the adage goes, "time in the market beats timing the market." Therefore, don’t abuse leverage and place your stop losses wisely as the most important thing is to live another day and benefit from future price appreciation.

[i] https://news.bitcoin.com/sec-postpones-verdict-on-global-x-spot-bitcoin-etf-cites-market-manipulation-concerns-and-need-for-public-insight/

[ii] https://www.zerohedge.com/geopolitical/what-are-saudis-really-preparing

[iii] https://www.bloomberg.com/news/articles/2023-11-04/china-s-sinopec-qatarenergy-sign-27-year-lng-supply-deal

[iv] https://www.youtube.com/watch?v=98kMSEkPiLo

[v] https://www.coindesk.com/layer2/2022/03/09/americas-quiet-default/

[vi] https://fred.stlouisfed.org/series/FYFSD

[vii] https://www.reddit.com/r/Superstonk/comments/17xhupy/jp_morgan_13t_rundown_in_reverse_repo_has_been_a/?share_id=3vAE54BIPaABjZ5qVbo3-&utm_content=1&utm_medium=ios_app&utm_name=ioscss&utm_source=share&utm_term=1 & https://x.com/heresyfinancial/status/1698001981628096578?s=20

[viii] https://www.reuters.com/markets/asia/how-does-japans-yield-curve-control-work-2023-07-28/

[ix] https://www.investing.com/economic-calendar/nonfarm-payrolls-227