LN Markets Alpha #6

This dual-phase outlook underscores the importance of navigating the current market with caution while preparing for the opportune moment to capitalize on the anticipated bullish wave in the Bitcoin market.

Published on the 7th of February 2024, at Block 829414, BTC sits at $43,800.

Short-Term

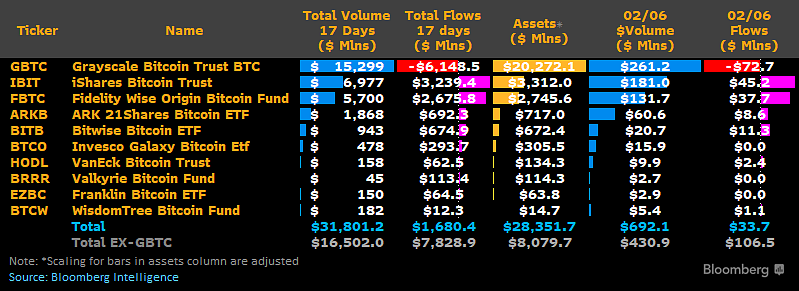

Our last issue dissected the intricacies of ETF creation and redemption and their potential ripple effects on Bitcoin's pricing. Revisiting this with the wisdom of hindsight, we reaffirm our belief that the tangible impacts of these mechanisms are on a slow burn to materialize. As of the 6th of February, net inflows are slightly above the $1.5 billion mark. This is largely due to the scenario we forecasted previously, where a significant number of GBTC shareholders jumped at the opportunity to offload their shares, with only a handful redirecting their capital into rival offerings.

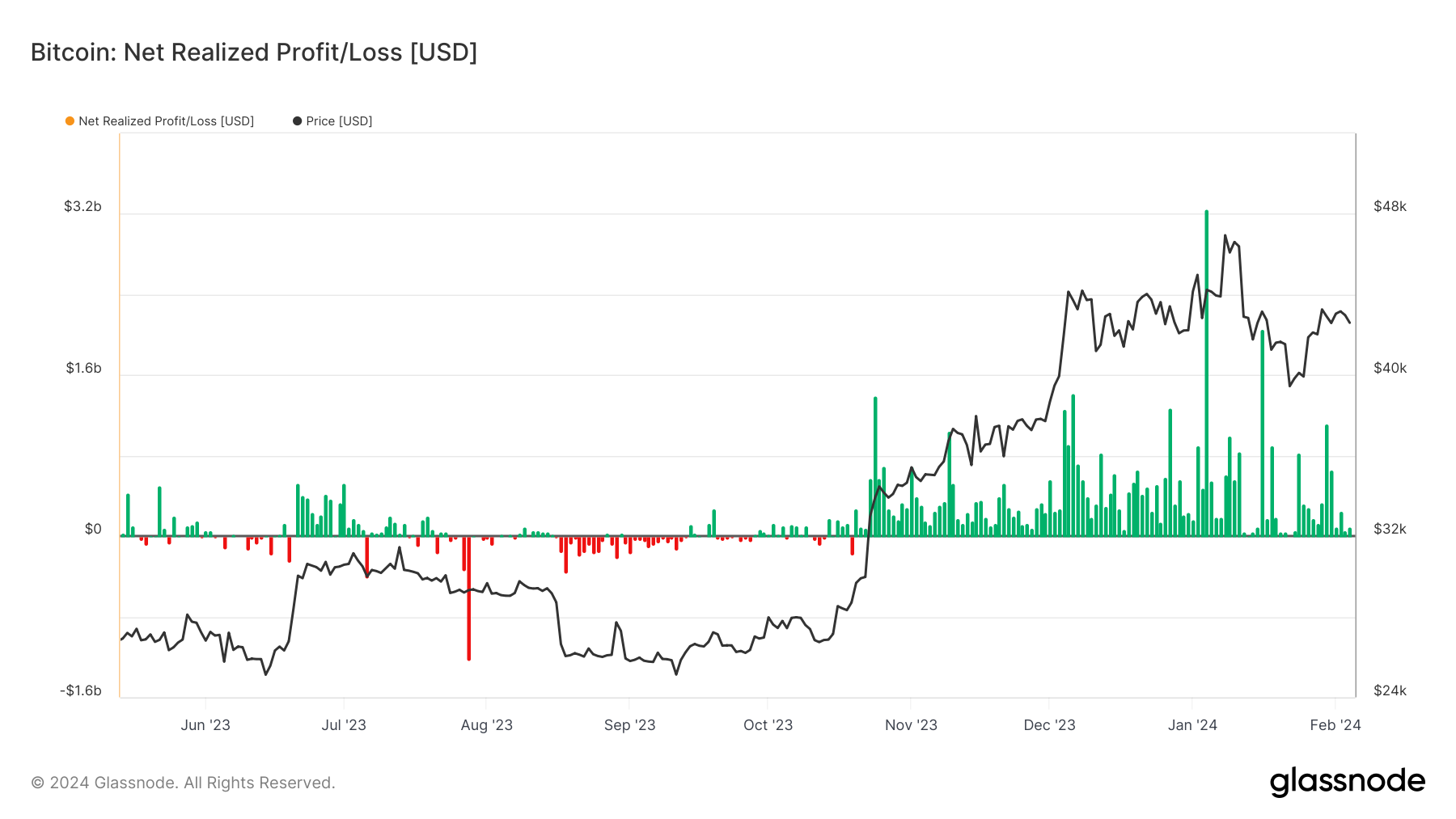

Yet, it's important to note that $1.5 billion in net spot Bitcoin purchases isn't trivial, but it's hardly enough to counterbalance the multi-billion dollar profit-taking spree seen in late December and early January. Glassnode's on-chain data reveal that on January 24th alone, the market saw a net profit taking of $3.25 billion, dwarfing the net inflows into ETFs to date. This pattern of profit extraction hasn't reversed, even though there's been a noticeable dip in the volume of profits cashed out.

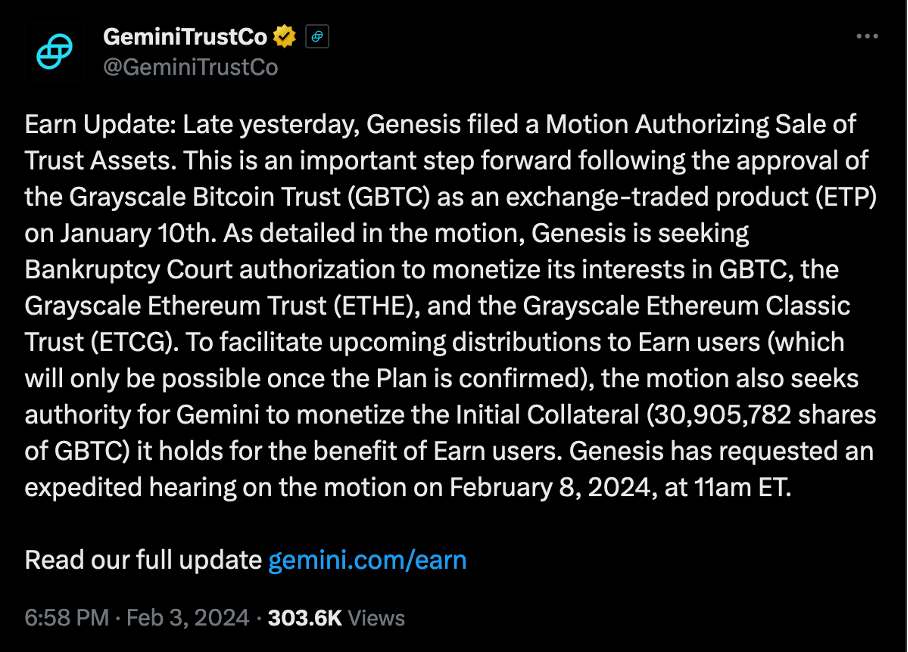

Moreover, Gemini's recent plea to liquidate its approx $1 billion worth of GBTC shares to pacify their rightfully irate earn-users, if granted, will only fuel the ongoing mass exodus from GBTC.

The current market consolidation phase might also be a reaction to the Federal Reserve's unexpectedly hawkish stance. In the latest FOMC meeting, Chair Powell decided to hold the Fed rates steady at 5.25%, likely spooked by a minor inflation uptick.

Despite the Fed's cautious approach, other "risk-assets" like the S&P 500, Nasdaq 100, and gold have been smashing records, setting new all-time highs in recent weeks. However, it's critical to remember that the performance of these major indices isn't a reliable barometer for the broader market health, especially when their gains are disproportionately driven by a select few, like NVIDIA, MSFT, TSLA, and now META, which recently soared like a cryptocurrency on steroids, adding over $200 billion in market cap in just a few sessions following its earnings blowout.

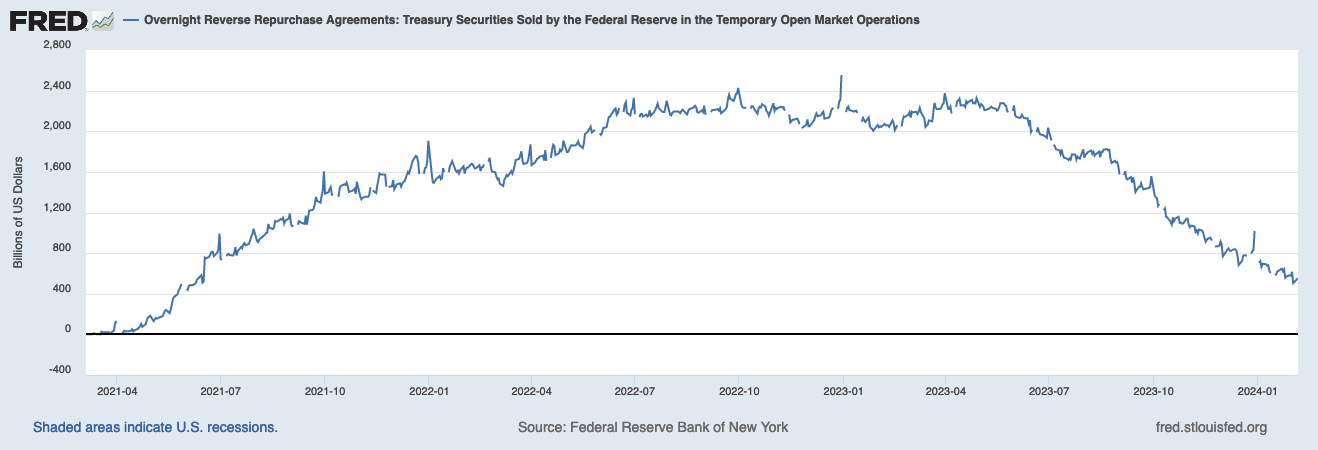

So, the Bitcoin market's demeanor isn't exactly brimming with confidence, and we're skeptical about a bull run kick-off anytime soon. Traditional risk assets and gold are surfing on a wave of liquidity from the Fed's Reserve Repo Facility and stimulus packages in South-East Asia, particularly from Japan and China[i], while Bitcoin seems stuck in a new consolidation zone. This relative performance often signals Bitcoin market weakness, leading us to brace for ongoing consolidation or even a further slide down—though we peg $32k as our firm floor.

This bearish short-term forecast is fueled by the swift degradation of banks' balance sheets, signs of liquidity evaporation, among other macro themes we're diving into next.

Medium-Term

A Teetering US Banking Sector

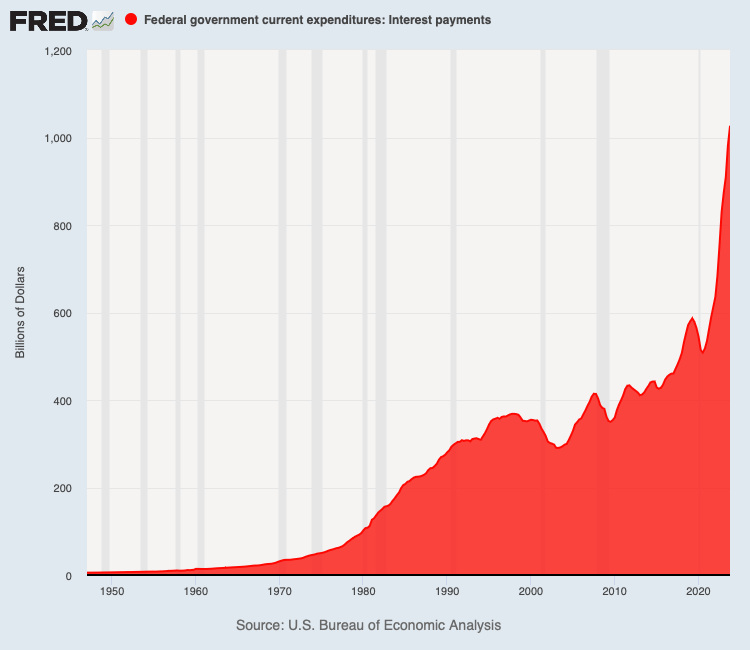

First off, hats off to the US fiscal and monetary policymakers for their stellar track record of mismanagement, culminating in the budget's interest expenses vaulting over the $1 trillion/year mark.

Then there's the Fed, whose decisions have nudged US regional banks to the edge of the abyss. Their prolonged zero-interest rate policy has eroded bank profitability, pushing them to bulk up their books hastily to recoup lost margins. The big fish on Wall Street loaded up on fixed-income, doubled down on mergers, acquisitions, private equity, and other financial ventures artificially buoyed by the Fed's largesse, while the small fry—regional banks—had no choice but to lean heavily into real estate loans, the only sizable and low-risk market available in such an interest rate climate.

As practically everyone but central bankers predicted, this inevitably led to inflation spiking, forcing the Fed to enact the swiftest rate hikes in its history—right after assuring banks they wouldn't do exactly that. This left many banks nursing historic losses across their loan, MBS, and fixed-income portfolios, prompting Jerome Powell and company to concoct the Bank Term Funding Program (BTFP)—essentially a banking sector 'god mode' cheat, lending against assets at book rather than market value.

Predictably, when Wall Street smells free money, it pounces. Though the BTFP was initially rolled out post-SVB collapse to stem credit contagion among regional banks, it ended up being a lifeline for Wall Street giants to snag cheap liquidity, only to park it right back at the Fed for a tidy profit. A classic case of a government program backfiring and fattening the wallets of the already wealthy. Upon realizing they'd inadvertently handed Wall Street a golden goose, Fed officials scrambled to hike the BTFP's borrowing costs, further squeezing the already thin margins of regional banks.

Adding insult to injury, NY Community Bank's recent 71% dividend slash—post Signature Bank acquisition—and its stock plummet nearly 40%, exemplify the dire straits facing regional banks. These banks, now squeezed between soaring financing costs and an imploding US commercial real estate market, render the Fed's "sound and resilient" banking system assertion rather hollow.

International banks are also feeling the strain, as evidenced by Aozora Bank's 20% market cap loss following additional provisioning announcements, and Deutsche Bank's quadrupled loss projections in US real estate[ii].

Global Liquidity Crunch

With the Fed's interest rate hikes, the financial markets have been propped up by drawing close to $2 trillion from the Federal Reserve's Reverse Repo Facility (RRP). However, with the RRP's balance now reduced to approximately $500 billion, the financial markets are on the brink of a liquidity crisis. The looming question is: where will the next influx of cash come from if not from the depleted reserves of the RRP?

China's Economic Downturn

The prospect of liquidity coming from China is on the horizon, yet it remains a distant hope. After a fleeting uplift from the CCP's announced stimulus measures, the Chinese stock market has resumed its downward trajectory. The situation suggests that Beijing will need to unleash additional monetary stimulus and fiscal incentives to buoy its stock market and the broader economy, crucial for the wealth of its populace.

When the Chinese government eventually succumbs to Keynesian temptations, a portion of this fresh liquidity is expected to flow into U.S. markets and Bitcoin. However, until then, the current market dynamics signal a stark liquidity shortage in China. Considering the significant holdings of U.S. dollar-denominated debt by Chinese companies, a faltering Chinese economy could exacerbate the liquidity squeeze by drawing USD out of the global system.

The DXY's (U.S. Dollar Index) ascent since the year's start, accelerating recently, is a testament to the growing scramble for dollars. This dynamic is crucial because if the chase for USD intensifies while liquidity reserves like the RRP are depleted, and monetary conditions stay stringent, the financial markets could face significant disruptions.

Data Discrepancies

Going forward, forecasting their policy might prove tricky though. Indeed, inflation is slowly rising again in most G7 economies, rendering accelerated rate cuts politically difficult. However, as the introduction of the BTFD demonstrated, the Fed is not afraid to shower the financial system in liquidity and at the same time keep monetary policy tight to save the face. So, we might get another set of acronyms effectively implementing a new round of “QE but not QE”.

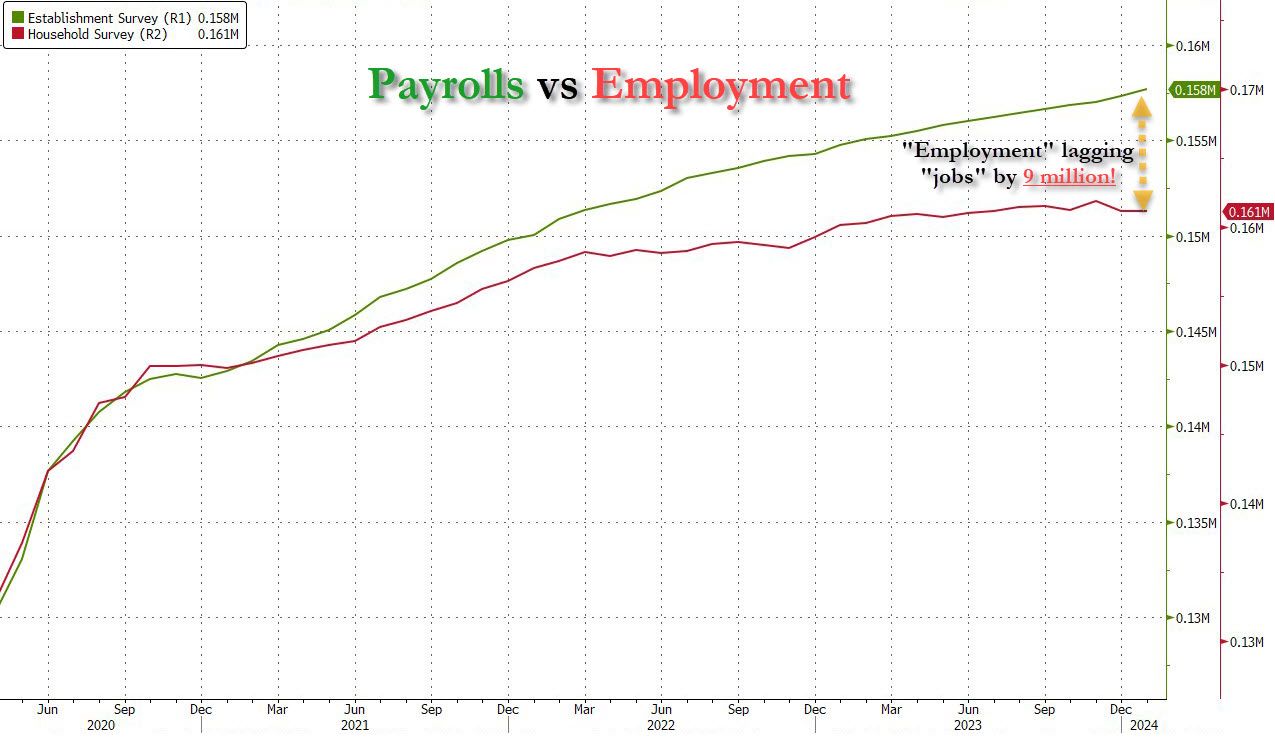

Alternatively, they could resort to bogus statistics and stupid metrics to make us believe inflation is our collective hallucination while they dust the printer. This kind of USSR tactics seem to take root in the US Government. After being fed the CORE inflation, which doesn’t include food and energy, as main proxy for increased living costs and the SUPERCORE, which also exclude housing costs, we now observe large discrepancy in the jobs data – see below. Would they dare to create the illusion of a booming economy to help their friends win the election? Not sure, but if they can create 9 million jobs on paper, they could also further tweak inflation metrics into absolute meaninglessness.

Conclusion

In the short term, the outlook for Bitcoin is neutral to bearish. The market is currently grappling with liquidity concerns and the dynamics of profit-taking, which have put pressure on Bitcoin's price. The recent sell-off in GBTC shares, coupled with a hawkish Federal Reserve stance, has not been conducive to a bullish dynamic. Additionally, the consolidation phase that Bitcoin is experiencing signals caution, suggesting that we might not be out of the woods yet in terms of further price declines.

However, looking beyond the immediate turbulence, there is a bullish horizon for Bitcoin. The anticipated stimulus from China, a potential introduction of new liquidity programs by the Fed, all poised around the Bitcoin halving in April, provide a robust backdrop for a bullish Bitcoin market. The existence of ETFs, facilitating easier access to Bitcoin for institutional and retail investors alike, adds another layer of support to the bullish case.

Let's also not forget that a crisis is brewing within the US banking system and that bitcoin acted as a safe heaven during the last one in march 2023. On top of bitcoin, the asset, being a safe-heaven amidst banking turmoil, Bitcoin, the network, is slowly developing the capabilities of serving as the backbone of a new and much healthier financial system. Check for exemple our latest product, DLC Markets pioneering the p2p settlement of derivatives contracts in bitcoin and on Bitcoin [iii].

Nevertheless, as these macroeconomic and regulatory developments unfold, they are expected to catalyze a significant uplift in Bitcoin's price, ushering in a new bull market phase post the liquidity storm. This dual-phase outlook underscores the importance of navigating the current market with caution while preparing for the opportune moment to capitalize on the anticipated bullish wave in the Bitcoin market.

[i] See LN Markets Alpha #3: https://blog.lnmarkets.com/ghost/#/editor/post/65785a1c4e9cc0000115a1bb

[ii] https://www.bloomberg.com/news/articles/2024-01-31/nycb-plunge-flashes-a-560-billion-real-estate-warning-for-banks?srnd=premium

[iii] https://bitcoinmagazine.com/technical/ln-markets-upgrades-bitcoin-trading-with-dlcs