LN Markets Alpha #4

Bitcoin's current sideways trading suggests short-term consolidation, and perhaps a 15-20% drawdown, while the long-term outlook remains exceptionally bullish, especially considering the burgeoning role of emerging markets in Bitcoin adoption.

Published on the 29th of December 2023, at Block 823450, Bitcoin Price is $42,200

Short-Term View

As anticipated in our previous newsletter, the Bitcoin market has entered a crab formation - trading sideways. Since our last update, there have been no significant developments, and we maintain our stance that Bitcoin is likely to persist in this consolidation phase, with a potential downtrend in the coming weeks. If the market cools sufficiently, it could present an ideal opportunity to open long positions in anticipation of a resumption of the overall bullish trend.

The anticipated approval of a BTC Spot ETF at the beginning of January, while a consensus in the current market, does not alter our short-term perspective. Although the market might initially respond positively to the approval, potentially triggering a surge due to speculative trading, it's the actual investment flows, which are expected to start a few months later, that could sustain a long-term bullish trend.

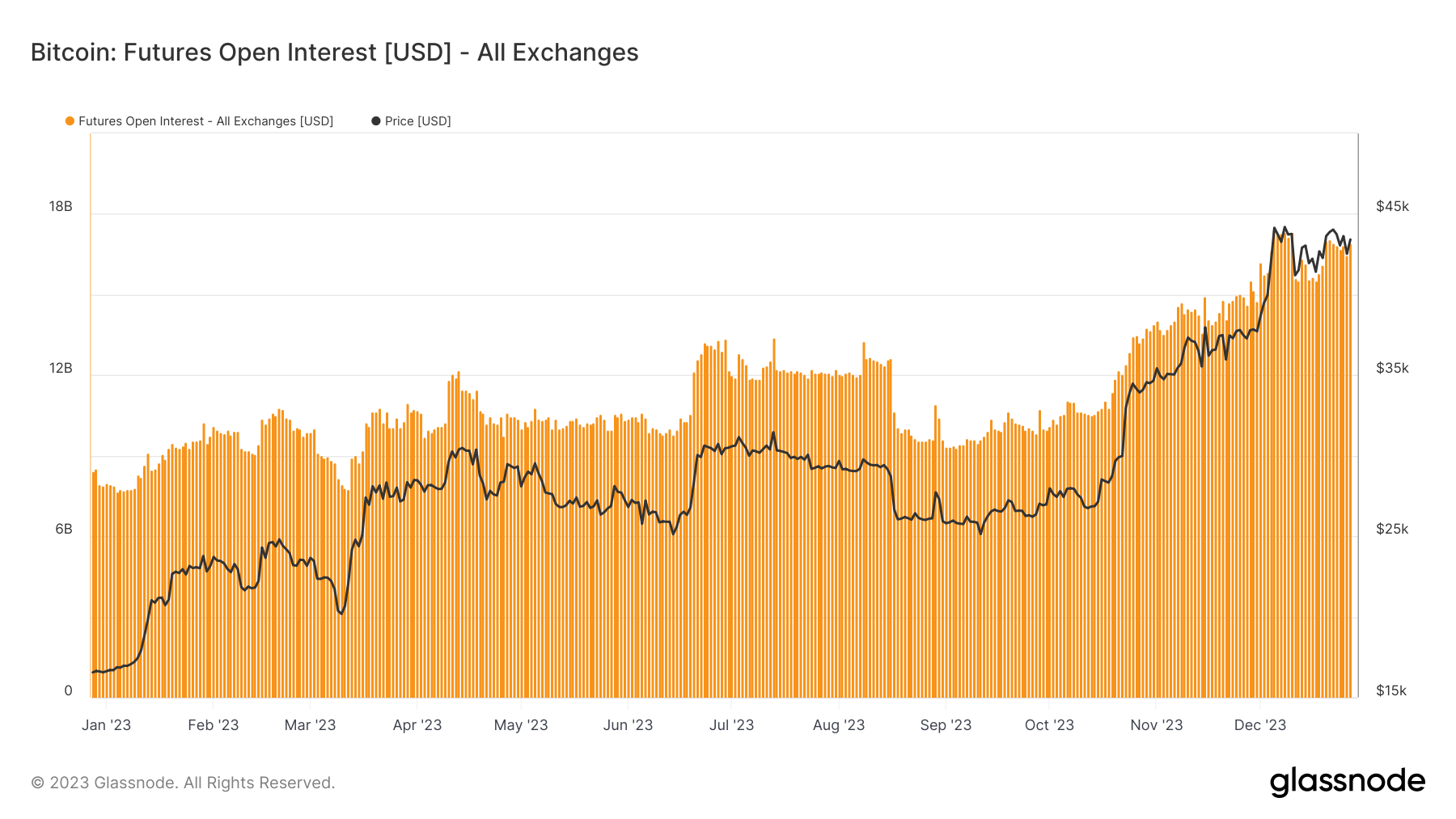

The Open Interest (OI) in options and futures has reached its peak for the year. This increase in OI contributed to the price surge in Q3 and Q4, but it also creates a delicate market structure. This setup is prone to sudden shifts in volatility and makes the continuation of the upward trend challenging without a corresponding increase in spot demand.

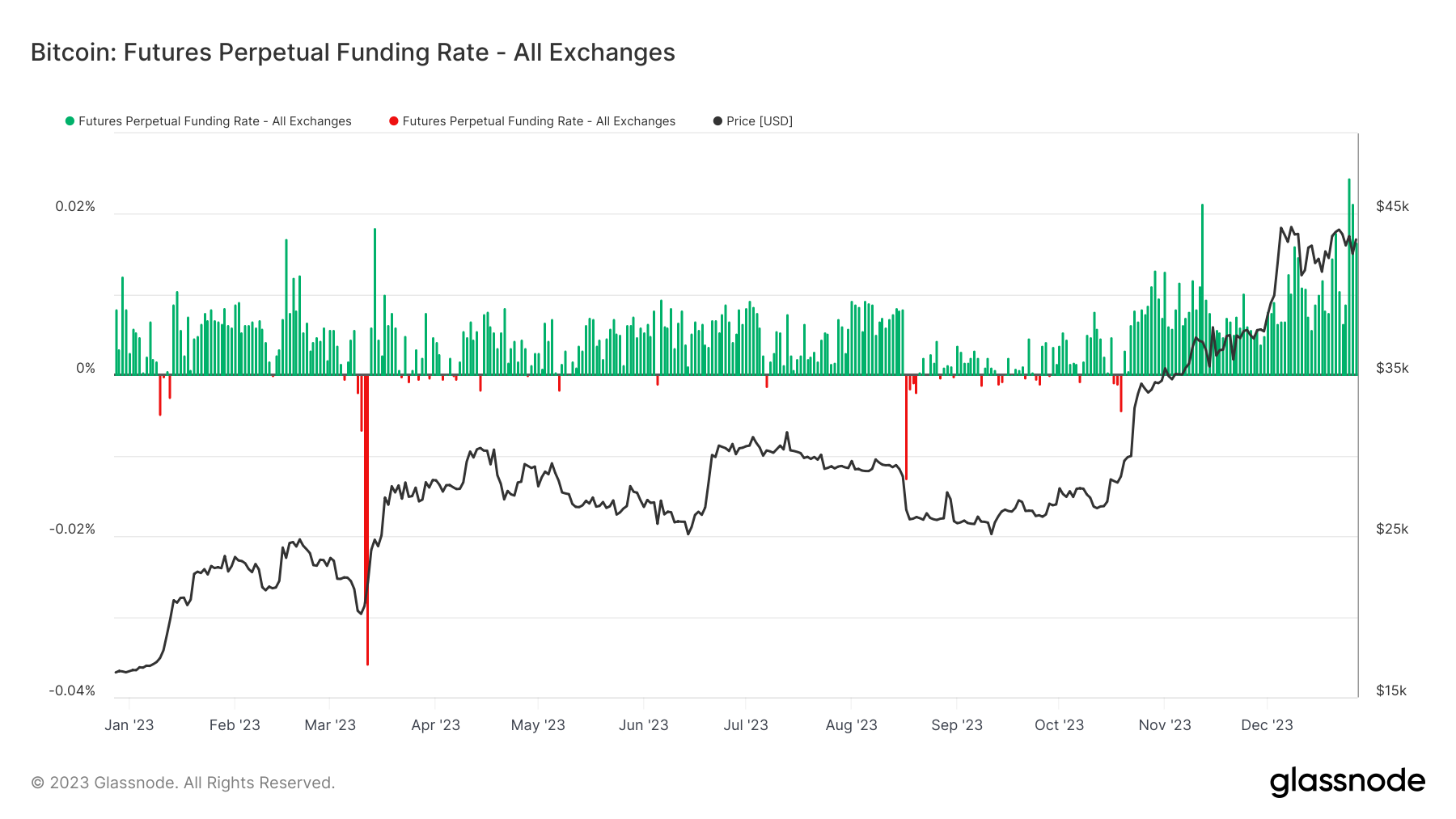

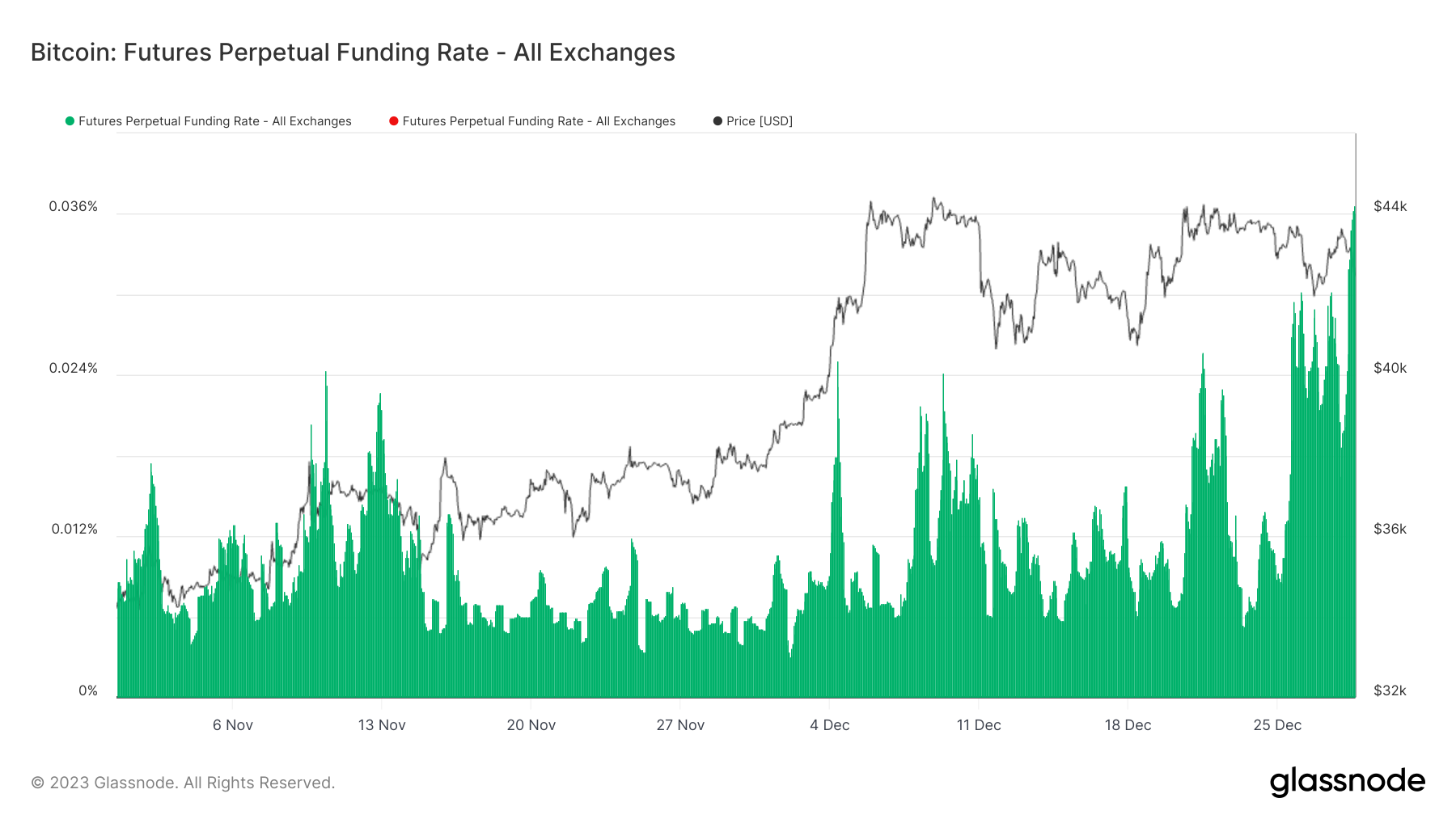

This derivative activity is rather skewed toward bullishness, as demonstrated by the funding rate sitting at its highest yearly level.

In the shorter time frame, the funding rate is rising sharply and is showing a divergence from the price. Such a discrepancy often signals an overleveraged market. Therefore, traders should be cautious of possible liquidation events that could rapidly push Bitcoin's price back down to the $40K range in the short term.

However, as stated in Kelly’s tweet below, a large chunk (~$7.5Bn) of the current option contracts will expire tomorrow. If most funds/traders roll their positions in new contracts, it could meaningfully change market positioning, so we will keep an eye on option data over the coming weeks.

Medium/Long-Term

While Bitcoin may seem on the cusp of a new ascending trend, it's important to consider that for many people worldwide, Bitcoin has already reached new highs in their local currency. It has formed all-time highs (ATH) in currencies such as the Nigerian Naira (NGN), Egyptian Pound (EGP), Lebanese Pound (LBP), Turkish Lira (TRY), South African Rand (ZAR), Ukrainian Hryvnia (UAH), Iranian Rial (IRR, considering black-market rates), Pakistani Rupee (PKR), and Laotian Kip (LAK).

Below is the estimated population, population growth rate, and income growth rate, for countries where these currencies are legal tender:

· Nigeria (NGN - Nigerian Naira): 216 million

- Population Growth Rate: 2.6%

- Income Growth Rate: 2.5%

· Egypt (EGP - Egyptian Pound): 104 million

- Population Growth Rate: 1.9%

- Income Growth Rate: 3.0%

· Lebanon (LBP - Lebanese Pound): 6.8 million

- Population Growth Rate: 0.1%

- Income Growth Rate: -3.0%

· Turkey (TRY - Turkish Lira): 85 million

- Population Growth Rate: 1.0%

- Income Growth Rate: 3.5%

· South Africa (ZAR - South African Rand): 60 million

- Population Growth Rate: 1.3%

- Income Growth Rate: 1.5%

· Ukraine (UAH - Ukrainian Hryvnia): 41 million

- Population Growth Rate: -0.6% (negative)

- Income Growth Rate: -4.0% (negative)

· Iran (IRR - Iranian Rial): 86 million

- Population Growth Rate: 1.3%

- Income Growth Rate: 0.5%

· Pakistan (PKR - Pakistani Rupee): 225 million

- Population Growth Rate: 2.0%

- Income Growth Rate: 4.0%

· Laos (LAK - Laotian Kip): 7.4 million

- Population Growth Rate: 1.5%

- Income Growth Rate: 6.0%

The combined population of these countries, where Bitcoin has already surpassed its 2021 highs, totals approximately 831.2 million people. In several other currencies, the gap to reach the 2021 ATH is narrower than with the USD.

Bitcoin is nearing its ATH in currencies like the Norwegian Krone NOK (Norwegian Krone, 15% from top), SEK (Swedish Krona, 19% from top), MNK (Myanmar Kyat, 21% from top), in INR (Indian Rupee, 24% from top), MYR (Malaysian Ringgit, 24% from top), JPY (Japanese Yen, 25% from top), IDR (Indonesian Rupee, 25% from top), CNY (Chinese Yuan, 25% from top), PHP (Philippine Peso, 25% from top), CLP (Chilean Peso, 26% from top), VND (Vietnamese Dong, 27,5% from top), DKK (Danish Krona, 28% from top), RUB (Russian Rubles, 30% from top), SAR (Saudi Real, 32%), AED (Dubai Dirham, 32% from top), PLN (Polish Zloty, 35% from top), KWR (Korean Won, 37% from top), AUD (Australian Dollar, 40% from top), MXN (Mexican Peso, 44% from top), CAD (Canadian Dollar, 45% from top), GBP (British Pound, 46% from top), THB (Thai Baht, 49% from top).

- Norway (NOK - Norwegian Krone): 5.4 million

- Sweden (SEK - Swedish Krona): 10.4 million

- Myanmar (MNK - Myanmar Kyat): 54.8 million

- India (INR - Indian Rupee): 1.393 billion

- Malaysia (MYR - Malaysian Ringgit): 33 million

- Japan (JPY - Japanese Yen): 125.5 million

- Indonesia (IDR - Indonesian Rupee): 273.5 million

- China (CNY - Chinese Yuan): 1.412 billion

- Philippines (PHP - Philippine Peso): 111 million

- Chile (CLP - Chilean Peso): 19.2 million

- Vietnam (VND - Vietnamese Dong): 98 million

- Denmark (DKK - Danish Krona): 5.8 million

- Russia (RUB - Russian Rubles): 146 million

- Saudi Arabia (SAR - Saudi Riyal): 35 million

- United Arab Emirates (AED - Dubai Dirham): 9.9 million

- Poland (PLN - Polish Zloty): 38 million

- South Korea (KWR - Korean Won): 51.7 million

- Australia (AUD - Australian Dollar): 26 million

- Mexico (MXN - Mexican Peso): 128.9 million

- Canada (CAD - Canadian Dollar): 38 million

- United Kingdom (GBP - British Pound): 67 million

- Thailand (THB - Thai Baht): 70 million

The aggregate population of these countries amounts to about 4.15 billion people. Adding those already at ATH in their local currency, almost 5 billion people are close to or have reached a Bitcoin ATH. Specifically, 3.68 billion are within 30% of a Bitcoin ATH in their local currency, combined with the aforementioned 831.2 million, totaling approximately 4.51 billion people.

These data highlight not just the proximity of Bitcoin to ATH for most of the world's population, but also the significant role emerging countries play in the future dynamics of Bitcoin adoption. Many of these countries have young, fast-growing populations with high income growth and limited banking services, often compounded by rapidly depreciating local currencies.

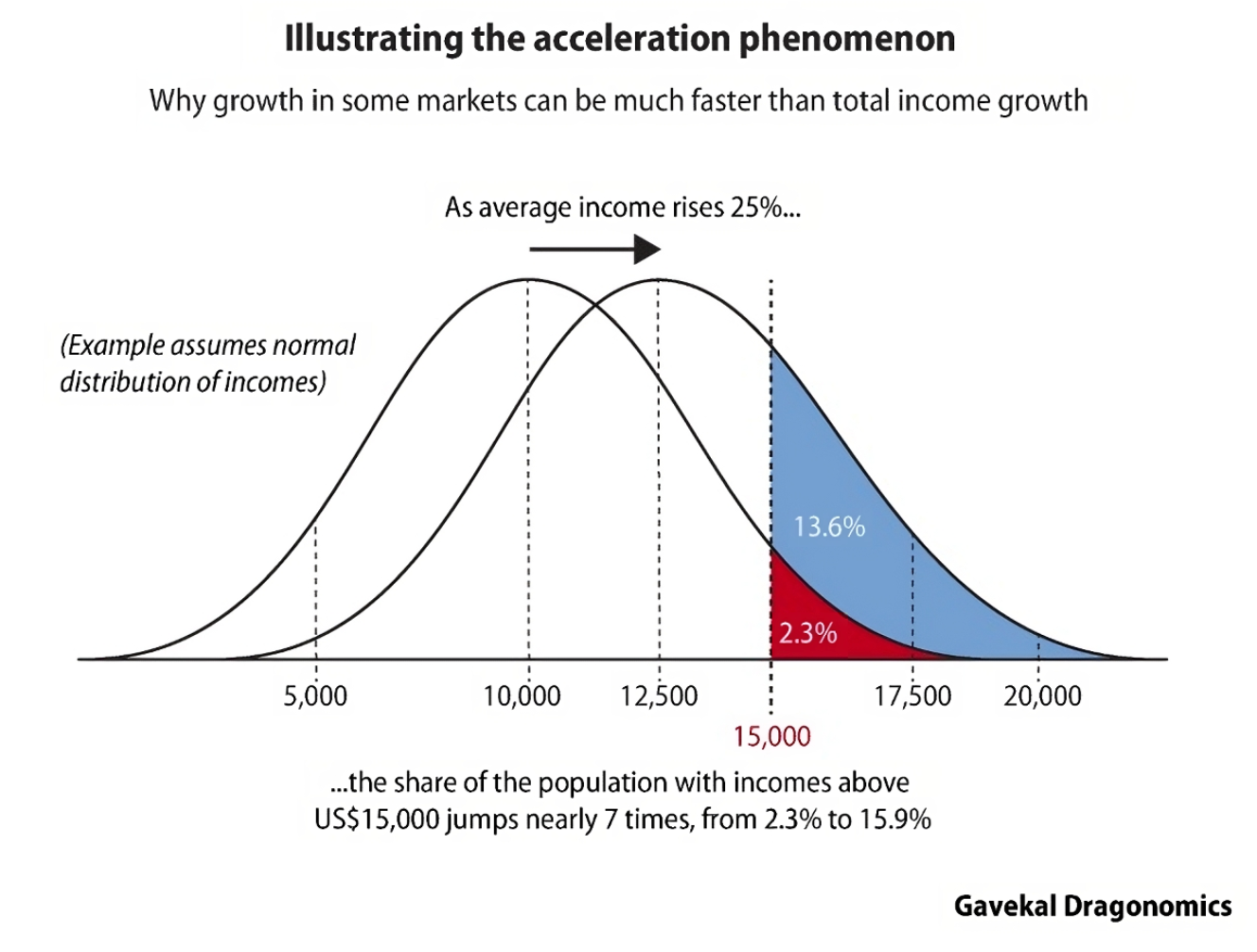

This scenario is particularly conducive to Bitcoin adoption, especially considering the acceleration effect in economics, a concept first introduced by Albert Aftalion, an economist of the interwar period. This concept states that socioeconomic variables, including incomes, typically distribute according to a Gaussian bell-shaped curve. As incomes grow, the right side of the curve accelerates faster than income growth, leading to exponential increases in the number of people earning certain amounts – see picture below.

The implications are clear: a rapidly expanding population with high income growth, mostly comprising smartphone owners with internet access, will increasingly require financial services such as savings and retirement plans, and global payment methods. This need is amplified in countries with inflating currencies and subpar banking systems, making Bitcoin an attractive solution.

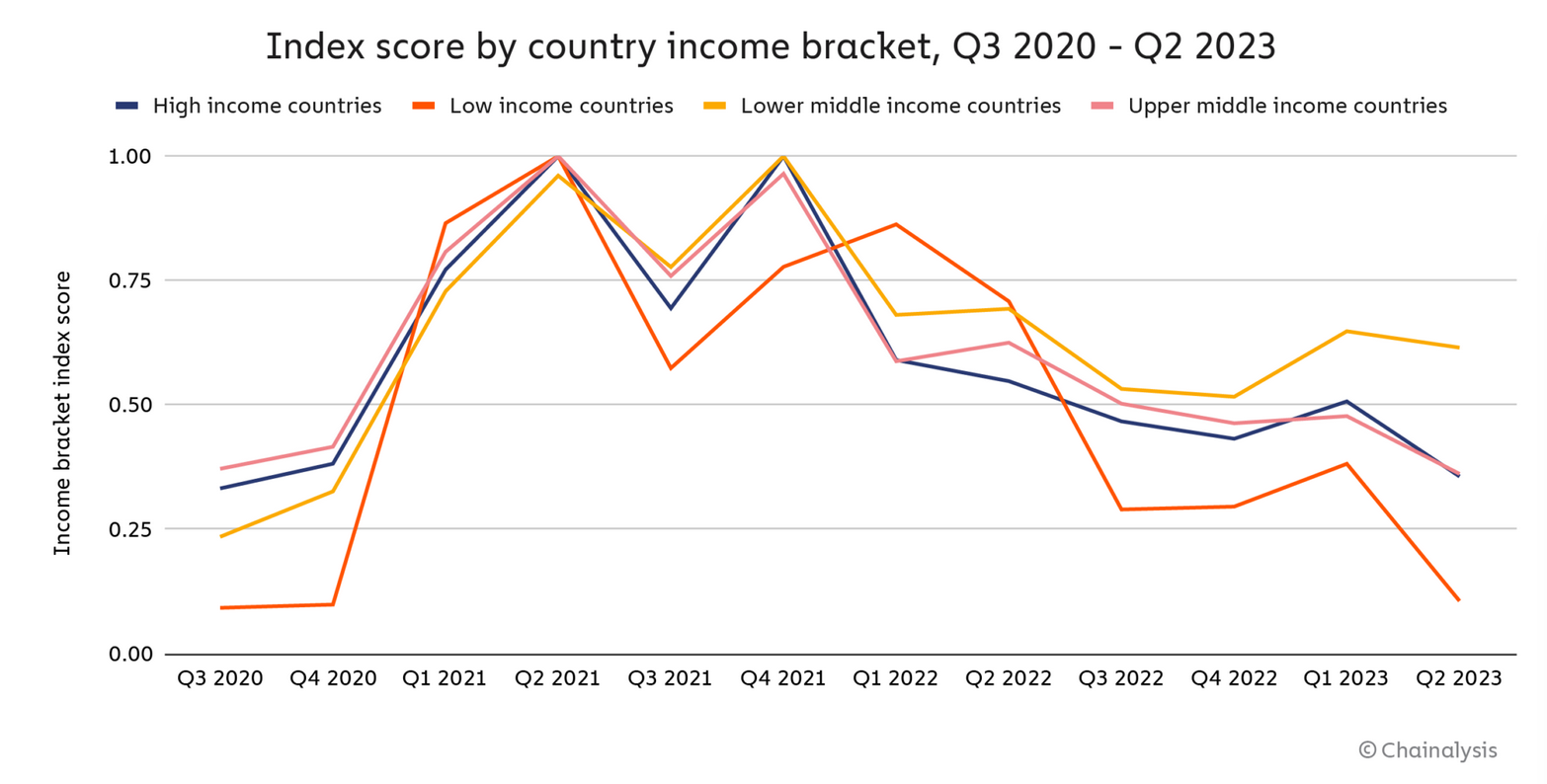

Supporting this hypothesis, data from Chainalysis's latest geographical report shows that Low-to-Middle-Income (LMI) countries are leading in grassroots adoption of Bitcoin[i]. The Chainalysis Index score for LMI countries, measuring grassroots adoption, is higher than at the start of the previous bull market in Q3 2020 and is mostly comprised of countries mentioned before, where bitcoin performance in local currency stands out.

We’re looking at billions of people who, over the next decade, could potentially invest hundreds or thousands of dollars in Bitcoin annually for long-term savings and to circumvent foreign exchange controls.

The past 15 years have seen the emergence of High Net-Worth Individuals (HNWIs) in Arab, Russian, Indonesian, Indian, Chinese, and Brazilian societies. Their dream was to acquire European and North American real estate and financial securities in the west where the rule of law offered them a guarantee against seizure, they would never get in their home countries. However, the seizure of Russian assets by western authorities in response to the Ukraine war in early 2022, signaled that our governments were in fact no more reliable than theirs. Hence, we believe the middle-class in these countries will similarly turn to Bitcoin stored in cold wallets as their strategy for financial sovereignty.

The notion that "Bitcoin is for the Global South" is often heard but not always evident in practice, leading to its dismissal as a fanciful idea. This discrepancy between expectations and empirical observation stems from underreporting of developing country news by Western media and the lesser financial wealth of people in these regions, making them less of a focus for Bitcoin companies.

However, this gap is likely to narrow over the next decade. As we noted in LN Market Alpha #2, emerging countries are forming new alliances and reshaping supply chains, energy markets, and monetary agreements in their favor. Western countries, constrained by green policies and a lack of investment following years of Zero Interest Rate Policies (ZIRP), are now facing their lowest energy security in decades. The U.S. relies on its shale oil industry but also contends with fragile energy infrastructure [ii]. Europe, lacking sufficient LNG terminals, is increasingly dependent on LMI countries for its energy supply, which are eager to renegotiate their terms with the West. These countries also control the supply of many vital commodities, essential for Western capital expenditure needs in the coming years - iron ore, aluminum, copper, cobalt, zinc, nickel, rare earth metals, coal, natural gas, etc.

All signs point to a shift in income and power balance from the West to emerging countries, particularly those along the diagonal line from Istanbul to Jakarta. This shift favors the rise of a large, digitally-native middle class likely to embrace Bitcoin.

Lastly, the adoption of network technologies in these countries is worth noting. For example, in telecommunications, many countries in Africa, Southeast Asia, the Middle East, and South America bypassed landlines entirely, jumping straight to cellular networks and smartphones for economic reasons. When it comes to global financial networks, it's plausible that these countries might skip traditional banking infrastructure development, opting instead for a free, open, neutral, and global financial network like Bitcoin. This approach allows minimal upfront costs (a smartphone and paper wallets or fedimint communities) for saving and sending money globally.

While developments like U.S. spot Bitcoin ETFs, new financial products based on Bitcoin[iii], and Western demand for non-Orwellian payment methods will drive adoption and inflows, the potential in emerging markets is far greater. For people in developed Western countries, Bitcoin is one of many options for storing and exchanging value. In contrast, for the emerging tech-native middle class of the Global South, Bitcoin represents a unique solution for financial sovereignty.

Conclusion

In essence, while Bitcoin's current sideways trading suggests short-term consolidation, and perhaps a 15-20% drawdown, the long-term outlook remains exceptionally bullish, especially considering the burgeoning role of emerging markets in Bitcoin adoption.

The potential for Bitcoin to reach new all-time highs in various local currencies signifies its growing global relevance, transcending traditional financial systems. As billions of people in these emerging economies seek financial services suited to their rapidly changing needs, Bitcoin stands out as a compelling solution. Our analysis indicates that the increasing financial autonomy of these regions, coupled with the unique advantages Bitcoin offers, will likely catalyze a significant shift in the global financial landscape. This shift could redefine Bitcoin's role, not just as an alternative investment in the West but as a foundational financial asset for the emerging tech-savvy middle class of the Global South.

Benefiting from such broad adoption will require patience. Bitcoin, as an investment, remains a long-term play with an incredibly positively skewed risk-reward ratio and one ought not to miss on the opportunity by squandering its stack trading short-term moves.

As J. Maynard Keynes once said, “the market can remain irrational longer than I can remain solvent”. The current Bitcoin price in USD doesn’t reflect bitcoin’s transformational potential, so make sure to remain solvent in waiting for the market to revert to rationality.

[i] https://www.chainalysis.com/blog/2023-global-crypto-adoption-index/

[ii] https://doomberg.substack.com/p/new-england-is-an-energy-crisis-waiting